AISH Payment Dates 2026: Official Alberta Schedule & New ADAP Rules

For over 77,000 Albertans, the Assured Income for the Severely Handicapped (AISH) is the foundation of their financial stability. However, 2026 is a year of massive transition for the program. Not only has the monthly living allowance been adjusted for inflation, but a brand-new program—the Alberta Disability Assistance Program (ADAP)—is scheduled to launch on July 1, 2026, fundamentally changing how benefits are structured for those deemed "able to work."

Whether you are a long-term recipient or a new applicant, knowing exactly when your funds will arrive is essential for managing your rent and bills. This guide provides the official 2026 AISH payment calendar, the updated 2026 benefit amounts, and a deep dive into the new "clawback" rules that could affect your monthly check.

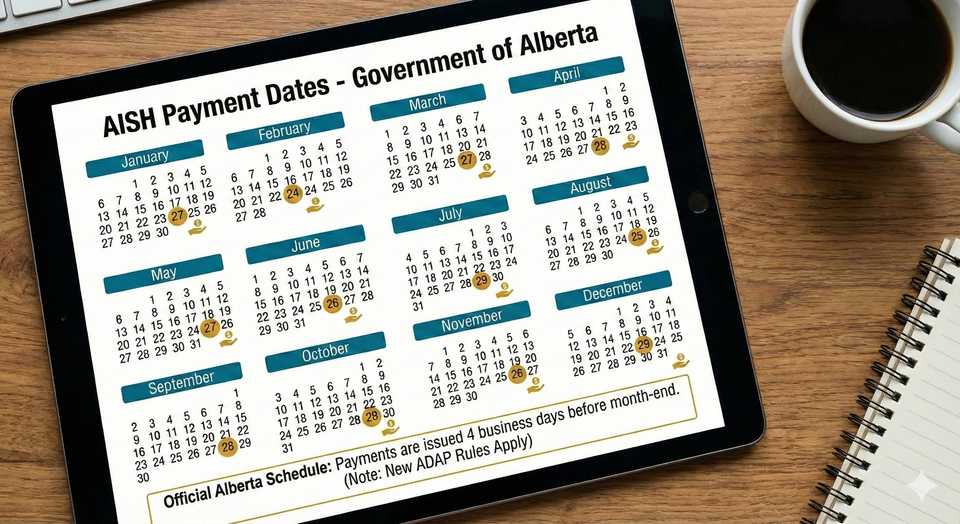

Official Alberta AISH Payment Schedule 2026

In Alberta, AISH payments are issued four business days before the first day of the next month. This ensures you have your funds available to pay rent on the 1st. If you receive your benefits via cheque, they are mailed six business days early, but direct deposit is the fastest way to get your money.

| Benefit Month | Official Payment Date | Day of the Week |

| January 2026 | December 22, 2025 | Monday |

| February 2026 | January 27, 2026 | Tuesday |

| March 2026 | February 24, 2026 | Tuesday |

| April 2026 | March 26, 2026 | Thursday |

| May 2026 | April 27, 2026 | Monday |

| June 2026 | May 26, 2026 | Tuesday |

| July 2026 | June 25, 2026 | Thursday |

| August 2026 | July 28, 2026 | Tuesday |

| September 2026 | August 26, 2026 | Wednesday |

| October 2026 | September 25, 2026 | Friday |

| November 2026 | October 27, 2026 | Tuesday |

| December 2026 | November 25, 2026 | Wednesday |

| January 2027 | December 22, 2026 | Tuesday |

Note: The July 2026 payment marks the start of the ADAP transition period. If your payment amount changes unexpectedly in July, check your MyBenefits portal immediately.

1. AISH vs. ADAP: The New 2026 Split

Starting July 1, 2026, the Alberta government is splitting disability supports based on "medical eligibility for work":

- AISH (Ongoing): For those assessed as permanently unable to work. The maximum living allowance for 2026 is $1,940/month.

- ADAP (New): For those assessed as having some capacity for work. The maximum allowance is $1,740/month—a $200 decrease compared to AISH.

The "Transition Guarantee": If you were on AISH before July 2026 and are moved to ADAP, the government has promised a Transition Benefit to keep your income at $1,940 until December 31, 2027. This gives you 18 months to either find work via BetterPayJobs.ca or request a medical reassessment for AISH.

2. The New Clawback Rules: A "Double-Edged Sword"

In 2026, the rules for working while on benefits are becoming much stricter for some and more flexible for others.

- The AISH Clawback (Pre-July): Currently, the first $1,072 of employment income is fully exempt.

- The New 2026 Standard: Starting in July, the Fully Exempt amount for both AISH and ADAP is expected to drop to $350/month.

- The Math: If you earn $1,000/month today, you keep it all. After July 2026, you may see a deduction of 50 cents on every dollar over $350. This "clawback" is designed to push ADAP recipients toward full-time employment, but it requires careful budgeting.

Part 1: How Much is AISH in 2026?

Effective January 1, 2026, AISH rates were indexed by 2% to help with the rising cost of living in Calgary and Edmonton.

| Benefit Type | Maximum Monthly Amount |

| Standard Living Allowance | $1,940 |

| Modified Living Allowance (Personal) | $339 |

| Child Benefit (First Child) | $212 |

| Child Benefit (Each Addl. Child) | $106 |

The "CDB" Conflict

Alberta is currently the only province that claws back the Canada Disability Benefit (CDB). If you receive $200 from the federal government, Alberta may reduce your AISH check by exactly $200. Ensure you report any federal changes to your AISH worker to avoid an "Overpayment" debt.

Part 2: 2026 Asset Limits (The $100,000 Rule)

To remain eligible for AISH or ADAP in 2026, you must not exceed the non-exempt asset limit.

- Non-Exempt Limit: $100,000 (Includes cash, TFSAs, RRSPs, and secondary properties).

- Exempt Assets (Do Not Count): * Your primary home.

- Your primary vehicle (and a second vehicle if specially adapted).

- Registered Disability Savings Plans (RDSPs).

- Clothing and reasonable household items.

The "Inheritance" Hack: If you receive a gift or inheritance that puts you over $100,000, AISH gives you a 365-day grace period to invest that money into an exempt asset (like an RDSP or home repairs) before you lose eligibility.

AISH Payment Dates 2026

The official AISH payment dates for 2026 fall four business days before the first of every month. For example, the February payment will be deposited on January 27, 2026, and the March payment on February 24, 2026. Starting July 1, 2026, some recipients may transition to the Alberta Disability Assistance Program (ADAP), which has a maximum rate of $1,740, compared to the AISH maximum of $1,940.

Part 3: Protecting Your Health Benefits

Regardless of whether you stay on AISH or move to ADAP in 2026, your Alberta Health Benefits Card remains active. This covers:

- Prescription Drugs: Most medications on the Alberta Drug Benefit List.

- Dental Care: Basic cleanings, x-rays, and fillings (similar to the CDCP 2026 updates).

- Optical: One eye exam every two years and a pair of basic glasses.

- Emergency Travel: Travel to medical appointments if specialized care is not available in your town.

Frequently Asked Questions (FAQ)

Q: Will I be forced to move to ADAP?

A: All AISH recipients will technically move to ADAP on July 1, 2026. However, if you are assessed as "permanently unable to work," you can request a streamlined reassessment to stay on the higher AISH rate.

Q: Do I have to re-apply for AISH every year?

A: No, but you must complete an Annual Review where you submit your tax returns to prove you are still under the income and asset limits.

Q: Can I get AISH and EI at the same time?

A: Yes, but Employment Insurance (EI) is considered "Non-Exempt Income." It will be deducted dollar-for-dollar from your AISH check.

Q: What if I move to another province?

A: AISH is an Alberta-only program. If you move, you must apply for disability in your new province (e.g., Ontario Works or ODSP) and your AISH will stop the day you leave Alberta.

Q: Does AISH pay for emergency car repairs?

A: Sometimes. Under "Personal Benefits," you can apply for an emergency grant if the repair is essential for you to get to medical appointments or work.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Alberta.ca: AISH Payment Details and 2026 Schedule

- Alberta.ca: The New Alberta Disability Assistance Program (ADAP)

- Inclusion Alberta: Impact of ADAP on Current AISH Recipients

- CRA: Canada Disability Benefit and Provincial Clawbacks 2026

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.