BC PWD Payment Dates 2026: Official Schedule & New Earnings Limits

For the approximately 160,000 residents receiving Persons with Disabilities (PWD) benefits in British Columbia, the monthly deposit from the Ministry of Social Development and Poverty Reduction (MSDPR) is more than just a check—it is the lifeline for rent, groceries, and medical expenses. However, 2026 has introduced the most significant policy shifts in a decade, specifically regarding how much you are allowed to earn from a job while keeping your benefits.

Unlike other provinces that use a rigid monthly "clawback" system, British Columbia uses an Annual Earnings Exemption (AEE). In 2026, the AEE amounts have been significantly adjusted, and the controversial "Spousal Cap" for couples has been officially eliminated. Knowing exactly when your payments arrive and how to manage your 2026 earnings is critical to avoiding a "zero-dollar" benefit month.

This master guide provides the official BC PWD Payment Schedule for 2026, a breakdown of the new earnings limits, and a deep dive into the "AEE Reset" strategy to help you maximize your income.

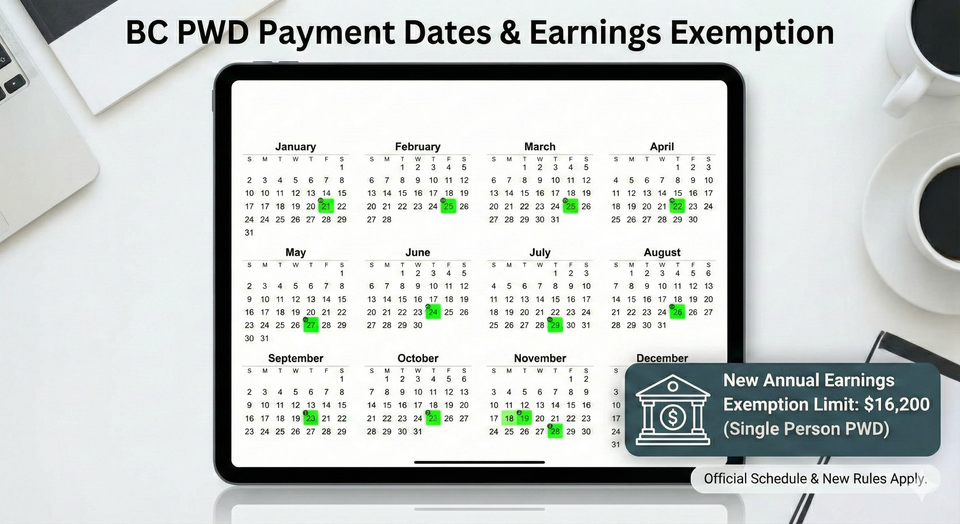

Official BC PWD Payment Schedule 2026

In British Columbia, disability assistance payments are issued on a Wednesday toward the end of the month. These payments are for the following benefit month (e.g., the January payment is to cover your February expenses).

| Benefit Month | Official Payment Date | Day of the Week |

| February 2026 | January 21, 2026 | Wednesday |

| March 2026 | February 18, 2026 | Wednesday |

| April 2026 | March 25, 2026 | Wednesday |

| May 2026 | April 22, 2026 | Wednesday |

| June 2026 | May 20, 2026 | Wednesday |

| July 2026 | June 24, 2026 | Wednesday |

| August 2026 | July 22, 2026 | Wednesday |

| September 2026 | August 26, 2026 | Wednesday |

| October 2026 | September 23, 2026 | Wednesday |

| November 2026 | October 21, 2026 | Wednesday |

| December 2026 | November 18, 2026 | Wednesday |

| January 2027 | December 16, 2026 | Wednesday |

Note: December payments are consistently issued mid-month to ensure families have funds before the holiday office closures. Always check your My Self Serve account for specific deposit confirmation.

MORE HELPFUL ARTICLES FROM US

- Canada Payment Guide (Browse All Payments )

- Can I Get EI if I Quit? (Just Cause Checklist)

- TFSA vs. RRSP for Low Income (The GIS Trap)

- Shared Custody CCB Rules (50/50 Split Guide)

- Warm Neighbor Programs (Heating Bill Help)

1. The $16,200 "Free Pass"

In 2026, a single person on PWD can earn up to $16,200 per year without any deduction from their monthly disability check.

- The Benefit: If you want to work full-time for three months in the summer and earn $5,000 a month, you can do that. You keep your full $1,483.50 PWD check for those months.

- The Risk: Once you earn dollar $16,201, the "Free Pass" is over. Every dollar you earn after that is deducted dollar-for-dollar from your PWD check for the rest of the year.

2. The January 1st Reset (The "Refresh" Strategy)

The AEE is a "Calendar Year" system. It does not matter when you start your job; the limit resets on January 1st every year.

- Strategy: If you reach your $16,200 limit in October 2026, your November and December checks will be $0. However, on January 1, 2027, you get a brand new $16,200 limit. Smart earners often time their overtime or holiday shifts to hit the limit toward the end of the year to ensure their basic needs are met throughout the winter.

3. Elimination of the "Spousal Cap" (The 2026 Game Changer)

Starting in early 2026, the BC government officially removed the "Spousal Cap" for couples where both partners have a PWD designation.

- Old Rule: Two people living together got less than two single people.

- New 2026 Rule: You now receive the same support allowance as you would if you were two single people. This removes the "Marriage Penalty" and increases a couple's combined monthly income to $2,662 (excluding supplements).

Part 1: How Much is BC PWD in 2026?

The monthly rate is comprised of two parts: the Shelter Portion and the Support Portion.

| Family Unit | Max Monthly Rate (2026) | Annual Earnings Limit (AEE) |

| Single Person | $1,483.50 | $16,200 |

| Couple (One PWD) | $2,073.50 | **$23,400** |

| Couple (Both PWD) | $2,662.00 | $32,400 |

| Single Parent (1 Child) | $1,828.50 | $16,200 |

The "Transportation Supplement" Choice

Every person with a PWD designation in BC is eligible for a Transportation Supplement. In 2026, you have a choice:

- The Bus Pass: An unlimited BC Transit or TransLink bus pass (best for daily commuters).

- The Cash: $52 per month added to your PWD check (best for those who have a car or live in rural areas).

- Pro-Tip: If you choose the cash, your monthly single rate increases to $1,535.50.

Part 2: Working with the "Modified" Monthly Rules

If you are not on PWD, but are on PPMB (Persons with Persistent Multiple Barriers), the AEE does not apply to you. You are on a Monthly system.

- PPMB Limit: You can earn $1,080 per month without deductions.

- Basic Assistance Limit: You can earn $600 per month.

- Why this matters: If you are currently on PPMB, obtaining your PWD designation is the only way to access the $16,200 AEE "flexible" model.

BC PWD Earnings Limit

The BC PWD earnings limit for 2026 is based on an Annual Earnings Exemption (AEE) system. A single person can earn up to $16,200 per year from employment or self-employment before any benefits are deducted. Couples where only one person has the PWD designation can earn up to $23,400, and couples where both have PWD can earn $32,400. All earnings must be reported monthly by the 5th day of the following month via the My Self Serve portal.

Part 3: The Asset Limit (The $100,000 Rule)

To stay on PWD in BC, you must stay under the asset threshold.

- The Limit: $100,000 for a single person; $200,000 for a couple where both have PWD.

- Exempt Assets: Your primary home, your primary vehicle, and your RDSP savings do not count.

- Inheritances: If you receive a large gift, you have the right to put it into a Discretionary Trust (up to any amount) or a Non-Discretionary Trust (up to $200,000) to keep your PWD eligibility.

Step-by-Step: How to Report Your 2026 Earnings

- Keep Your Paystubs: Even though you have an annual limit, you must report monthly.

- Log into My Self Serve: Submit your "Monthly Report" between the 1st and the 5th of every month.

- Track Your Total: Keep a simple spreadsheet. Once your "Total Earnings Since January 1" hits $16,000, stop or reduce your hours if you cannot afford to lose your disability check.

- Use BetterPayJobs: If you are capable of earning more than $16,200, you are ready for the next level. Use BetterPayJobs.ca to find roles that pay $40k+ so that you can transition off assistance with a massive pay raise.

Frequently Asked Questions (FAQ)

Q: Does the $16,200 limit include my PWD check?

A: No. The $16,200 is only for money you earn from a job or business. Your $1,483.50 monthly check is "free" income that is never taxed or counted toward that limit.

Q: Can I get PWD and EI at the same time?

A: Yes, but Employment Insurance (EI) is considered "unearned income." It is deducted dollar-for-dollar from your PWD check immediately. It does not go into your AEE "bank account."

Q: What happens if I earn $20,000 in one year?

A: Your checks for the remainder of that year will be $0. However, your Medical Coverage (dental, prescriptions, etc.) usually stays active under the "Section 9" rule even if your cash payment stops.

Q: Is the Canada Disability Benefit (CDB) clawed back in BC?

A: No! The BC government has officially committed to exempting the federal Canada Disability Benefit. You get to keep both.

Q: Does PWD pay for my crisis or emergency?

A: Yes. You can apply for "Crisis Assistance" for things like essential home repairs or emergency travel through your caseworker.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Province of British Columbia: Disability Assistance Rate Table 2026

- Disability Alliance BC: Annual Earnings Exemption Help Sheet 2026

- Province of British Columbia: Elimination of the Spousal Cap - Official Announcement

- CRA: Canada Disability Benefit and Provincial Inter-agency Agreements

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.