5 Best Secured Credit Cards for Newcomers (No Credit History Needed)

If you have already visited a major bank branch in 2026 and were told you don’t qualify for an "unsecured" credit card, you are not alone. Thousands of newcomers with a 9-digit SIN and a valid work permit face instant rejection because they lack a Canadian credit footprint.

This is where a Secured Credit Card becomes your most powerful financial tool. Unlike a standard card, a secured card requires a "security deposit" (e.g., $500) which acts as your credit limit. Because you provide the funds upfront, the bank takes zero risk, making it virtually impossible to be declined.

However, not all secured cards are created equal. In 2026, some cards report only to one credit bureau, while others charge predatory monthly fees. This is the Official 2026 Guide to the only 5 secured cards that actually help newcomers build a high-tier credit score while offering features the big banks won't tell you about.

Quick Summary: The 2026 Secured Leaderboard

| Card Name | Minimum Deposit | Approval Speed | Top 2026 Feature |

| Neo Secured Mastercard | $50 | Instant | Up to 15% Cashback |

| Capital One Guaranteed | $49 - $200 | 1 - 2 Days | "Guaranteed" Approval |

| Home Trust Secured Visa | $500 | 2 Weeks | No Annual Fee Option |

| KOHO (Secured Credit) | $30 | Instant | 4% Interest on Balance |

| BMO Secured Mastercard | $500 | 5 - 7 Days | Path to Unsecured |

1. Neo Secured Mastercard: The "Modern Newcomer" Choice

In 2026, Neo Financial has become the go-to choice for immigrants who want to skip the "bank-speed" bureaucracy.

- Why it wins: They have the lowest entry barrier in Canada with a $50 minimum deposit.

- The Approval: There is no credit check. If you have the $50 and a 9-digit SIN, you are approved.

- The Reward: Most secured cards offer 0% rewards. Neo offers up to 15% cashback at thousands of partners like Shell, Netflix, and local grocery stores.

- The 2026 Update: Neo now reports to both Equifax and TransUnion every single month, ensuring your score grows as fast as possible.

2. Capital One Guaranteed Secured Mastercard

If you have been rejected by the "Big Six," Capital One is the most reliable "Second Chance" lender in Canada.

- Why it wins: They live up to the "Guaranteed" name. As long as you aren't currently in a bankruptcy or a consumer proposal, they will give you a card.

- Security Deposit: Based on your profile, they will ask for a deposit as low as $49.

- The Hidden Perk: After 6 months of on-time payments, Capital One often automatically reviews your account for a Credit Limit Increase without requiring more deposit money.

- Internal Link Landmark: Near the credit limit increase mention: "Managing this limit correctly is key to hitting your 2026 targets; check our Newcomer Money Guide for utilization tips."

3. Home Trust Secured Visa: The "Low Fee" Traditionalist

Home Trust is a federally regulated trust company that has specialized in helping newcomers for decades.

- Why it wins: It is a classic Visa card that is accepted everywhere globally.

- No Annual Fee Option: They offer a version of the card with $0 annual fees.

- Interest Rates: In 2026, their purchase rate is standard at 19.99%.

- The Catch: The minimum deposit is $500, which is higher than Neo or Capital One. However, your deposit is insured by the CDIC.

4. KOHO Secured Credit Building: The Hybrid Solution

KOHO is not a "bank" in the traditional sense, but their "Secured Credit Building" tool is a 2026 breakthrough for international students and gig workers.

- How it works: You deposit between $30 and $500. KOHO creates a "line of credit" against that money.

- The Benefit: It is integrated with a "Prepaid Mastercard" that pays 1% cashback on groceries.

- The 2026 Perk: Your entire KOHO balance earns 4% interest, so your security deposit is actually making you money while it sits there.

- Internal Link Landmark: Near the groceries mention: "Using this for food is smart; pair it with the GST Payment Schedule to keep your budget balanced."

5. BMO Secured Mastercard: The "Big Bank" Bridge

If you prefer to keep your money within a major institution, BMO is the best choice among the Big Six for a secured card.

- Why it wins: It is the easiest card to "Graduate."

- Graduation: Once you reach a certain credit score (usually after 12 months), BMO will often refund your security deposit and switch your card to an "Unsecured" version.

- Note for Newcomers: This is an excellent way to maintain a long-term relationship with one bank before you eventually apply for a car loan or mortgage.

The Dual Bureau Strategy

Answer: For newcomers to Canada in 2026, the fastest way to build credit is to choose a card that reports to both Equifax and TransUnion. While the Big Six banks always report to both, smaller "fintech" cards sometimes only report to one. Cards like Neo Financial and Capital One now report to both, which ensures that no matter which lender you apply to in the future (for a phone plan or apartment), they will see your positive history.

The "90-Day Bump": How to Gain 50 Points Fast

Most newcomers make the mistake of spending up to their $500 limit.

- The Rule: Keep your balance under 30% ($150 on a $500 card).

- The 2026 Hack: Pay your balance 3 days before your statement date. This ensures the credit bureau sees a $0 balance every month, which triggers an "On-Time Payment" flag and a "Low Utilization" flag simultaneously, giving you a massive score bump in just 90 days.

- Internal Link Landmark: Near the 90-day bump: "This strategy works perfectly alongside the Master Payment Calendar 2026 routines."

Secured Cards and "Maintained Status" Work Permits

In 2026, many workers are on "Maintained Status" (waiting for an extension).

- The Pain Point: Big banks often reject you if your permit expires in less than 6 months.

- The Solution: Neo Financial and KOHO do not care about your permit expiry date. As long as you have a SIN and a deposit, they will keep your account open. This allows you to keep building credit while your immigration status is being processed.

The "Security Deposit" Insurance Myth

Newcomers often worry that if the bank goes out of business, their $500 is gone.

- The Fact: In Canada, if the lender is a CDIC member (like Home Trust or BMO), your security deposit is insured up to $100,000.

- The Fintech Rule: Companies like Neo are not "banks" but they partner with CDIC-member banks to hold your funds. Your money is safe.

Why You Should Avoid "Prepaid" Cards Without Reporting

A common trap for newcomers is using a standard "Prepaid" card from a grocery store.

- The Danger: These cards do not report to the credit bureaus. You can spend $10,000 on a prepaid card, and your Canadian credit score will stay at 0.

- The Fix: Ensure the card you choose explicitly says it reports to Equifax or TransUnion. Every card on our "Top 5" list above is a reporting card.

What if I Am Also an International Student?

International students are under even more scrutiny in 2026 due to the 24-hour work cap.

- The Tip: If you are a student, pick Neo or KOHO. They have the lowest monthly fees ($0 to $5), which is vital when you are living on a fixed GIC budget.

Frequently Asked Questions (FAQ)

When do I get my security deposit back?

You get your money back in two ways:

- Closing the account: When you close the card with a $0 balance, the bank mails you a cheque for your deposit (usually within 30-60 days).

- Graduation: If the bank "graduates" you to an unsecured card, they will apply the deposit back to your balance or send it to your chequing account.

Does a secured card have high interest?

Yes. In 2026, most secured cards have an interest rate of 19.99% to 29.99%. However, you never pay interest if you pay your full balance by the due date every month.

Can I use my secured card for car rentals?

Usually, yes. Because these cards are branded as Mastercard or Visa, they are accepted by most car rental agencies. However, some agencies may place a "Hold" of $500 on your card. If your limit is only $500, the hold will use up all your available credit.

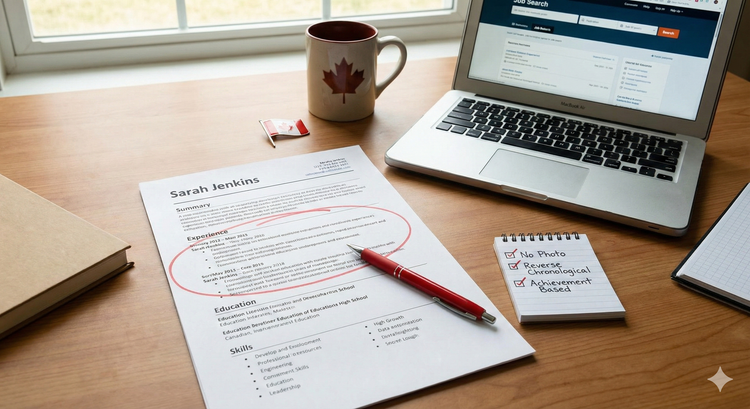

Action Steps to Build Credit Today

- Pick a card from the Top 5 list above (Neo or Capital One are the fastest).

- E-Transfer your deposit immediately to activate the card.

- Put one small bill on the card (like your phone bill or a $20 grocery trip).

- Set up Autopay for the full balance.

- Check your score in 4 months via a free app like Borrowell or ClearScore.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Canada Revenue Agency: Credit and your tax return

- Financial Consumer Agency of Canada: Choosing a secured credit card

- Neo Financial: Secured Card Product Disclosure 2026

- Capital One Canada: Guaranteed Mastercard Terms

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.