Cash for Keys in Canada (2026): How to Negotiate a Fair Buyout

In the 2026 Canadian rental market, a "Cash for Keys" agreement has become one of the most powerful—and controversial—tools for both landlords and tenants. As property values in hubs like the GTA, GVA, and even the "rising middle" cities of Alberta stay high, many landlords find themselves "rent-locked." They own properties where the long-term tenant is paying $1,200 for a unit that could now easily fetch $2,600 on the open market.

For the landlord, the math is simple: paying a tenant $15,000 to move out might seem expensive, but if it allows them to increase the rent by $1,400 a month, they recoup their investment in just over a year. For you, the tenant, this is a high-stakes negotiation. Accepting a buyout means voluntarily giving up your rent-controlled home in the middle of the Ultimate Guide to Renting in Canada's Housing Crisis (2026).

If you don't know your worth, you might settle for a few thousand dollars and realize two months later that you can no longer afford to live in your own city. This guide provides the exact 2026 negotiation strategy, the legal forms you must use, and the "Street Math" required to secure a buyout that actually covers the cost of your next home.

What Exactly is Cash for Keys?

Cash for Keys is a voluntary, private agreement where a tenant agrees to end their tenancy and move out in exchange for a sum of money from the landlord. It is not an eviction. In fact, it is the opposite of an eviction—it is a contract where you agree to "sell" your right to remain in the unit.

In 2026, landlords prefer these deals because the provincial Landlord and Tenant Boards (LTB) and Residential Tenancy Branches (RTB) still face significant backlogs. A legal eviction for "Renovictions" (N13) or "Personal Use" (N12) can take 8 to 12 months to process. A Cash for Keys deal can happen in 30 days. You are essentially being paid for the "time and convenience" you are providing the landlord.

The "N11" Form: The Point of No Return

Every successful Cash for Keys deal in Ontario ends with the signing of an N11 (Agreement to End Tenancy).

- The Power of the N11: Once you sign this form, you have waived your rights to a hearing. The landlord can take this form directly to the Board and get an "Ex Parte" eviction order without you even being present.

- The Risk: You must never sign an N11 until the final buyout amount and the terms of the move are documented in a separate, written contract.

Why Landlords are Pushing Buyouts in 2026

To negotiate effectively, you have to understand the landlord's motivation. There are three primary reasons a landlord will offer you money in 2026:

- To Sell the Property Vacant: Properties sell for 10% to 15% more when they are vacant. A buyer doesn't want to inherit a tenant paying below-market rent. If a house is worth $800,000, "vacant possession" could be worth an extra $80,000 to the seller. This is why a $5,000 offer is often an insult.

- To Reset the Rent: If you pay $1,500 and the market rent is $2,800, the landlord is "losing" $15,600 per year. They are highly motivated to buy you out to capture that missing revenue.

- To Avoid Litigation: If they try a bad-faith eviction and you fight back, they risk being fined up to $50,000. A Cash for Keys deal is a clean, legal way to end the relationship without the risk of a T5 Bad Faith application.

The 2026 Buyout Math: How Much to Ask For

Do not let a landlord tell you that "one month's rent" is the standard. In 2026, the standard is based on the "Rent Gap." Use this formula to determine your "Floor" (the minimum you should accept):

The 2026 Buyout Formula

(Market Rent - Your Current Rent) x 12 Months + Moving Expenses + Security Deposit for New Unit.

Example Calculation:

- Your Current Rent: $1,400

- New Apartment Rent: $2,200

- Monthly Gap: $800

- 12-Month Gap Total: $9,600

- Moving Expenses: $1,500 (Truck, movers, boxes)

- New Deposit / Utility Connection: $1,000

- Fair Buyout Total: $12,100

In high-demand hubs like Toronto or Vancouver, savvy tenants are successfully negotiating for (Rent Gap x 24 Months), pushing buyout totals into the $20,000 to $30,000 range for long-term tenancies.

How to Conduct the Negotiation (Step-by-Step)

Step 1: The Initial Approach

If the landlord asks, "What would it take for you to move?" do not give a number immediately. Your response should be:

"I am very happy in my home and I wasn't planning on moving. However, if you are looking for vacant possession, I am willing to look at the market data and see if we can reach a fair agreement that covers my increased costs for the next two years."

Step 2: Documentation and Evidence

Bring a printed list of comparable rentals in your neighborhood. Show them that a unit like yours is now $2,500. This justifies your high "ask." You are proving that the money isn't a "bonus"—it is a necessity to keep you from becoming unhoused.

Step 3: The Payment Terms

The most critical part of a 2026 deal is how you get the money.

- The "Trust" Method: The funds should be held in a lawyer's trust account and released the moment you hand over the keys.

- The "Staged" Method: You receive 50% upon signing the N11 and 50% on the day you move out.

- Never accept "I'll e-transfer you after I check the place." Once you are out and the N11 is signed, you have zero leverage.

Legal Rights and "The Power of No"

In Ontario and BC, you have the absolute right to say "No" to a buyout. If you do not want to move, the landlord cannot force you into a Cash for Keys deal.

- Retaliatory Actions: If you say no and the landlord suddenly issues an N12 for personal use or stops doing repairs, this is considered retaliation. Keep a log of your "Cash for Keys" conversations. If you go to an LTB hearing for a later eviction, you can use these logs to prove the landlord is actually just trying to get rid of you for financial reasons, which is not a legal reason for an N12.

- The 12-Month Rule: Remember that even if you accept a deal, you need to ensure the timing aligns with your other financial obligations, such as your Benefit Payment Dates or EI reporting cycles.

Negotiation Strategy: Using "The Renters' Bill of Rights"

The 2026 implementation of the Canadian Renters’ Bill of Rights provides you with a new tool. Because your rent payments now count toward your credit score, a landlord threatening to "ruin your credit" if you don't move is committing a serious offense.

- Leverage: Remind the landlord that as a stable, long-term tenant who contributes to their property's value, you are entitled to a buyout that reflects the current market reality. If they want you to leave your rent-controlled "Safe Haven," they must pay for the "Market Premium."

Answer Target: How Much Should I Ask for Cash for Keys in 2026?

A fair "Cash for Keys" buyout in 2026 should typically range between $10,000 and $25,000, depending on your current rent gap. A professional negotiation is based on the difference between your current rent and market rent for 12 to 24 months, plus moving costs. In high-demand cities like Toronto, a tenant paying $1,200 for a unit that now rents for $2,400 should aim for a minimum of **$15,000 to $18,000** to ensure they can afford the transition.

Strategy for 2026 Tenants

The housing market in 2026 has created a "Tenant Equity" scenario. Your low-rent lease is essentially a financial asset. If a landlord wants to "buy" that asset back from you, they have to pay the market price.

Identifying the "Sell-Point"

Many landlords approach tenants when they are about to list the house for sale.

- The "Percentage" Play: If you know the house is going to sell for $1 Million, and your presence is holding it back, you can ask for a percentage of the sale price (e.g., 2% to 3%). A **$20,000 to $30,000** buyout is common in "flipping" scenarios where the landlord stands to make a $200k profit.

The "Silent" Negotiation: Maintenance

If your landlord is offering a buyout while refusing to fix a leaking roof or mold, do not use the buyout as an excuse to ignore the repairs.

- The Strategy: File your Maintenance Defense first. Having an active LTB case for repairs gives you massive leverage in a Cash for Keys negotiation. The landlord will pay more to have the "LTB headache" go away along with the tenant.

The "Moving Assistance" Clause

In 2026, moving is a logistical nightmare.

- The Add-on: Ask the landlord to hire and pay for a professional moving company directly. This removes the stress from you and ensures the landlord that you will actually be out by the deadline.

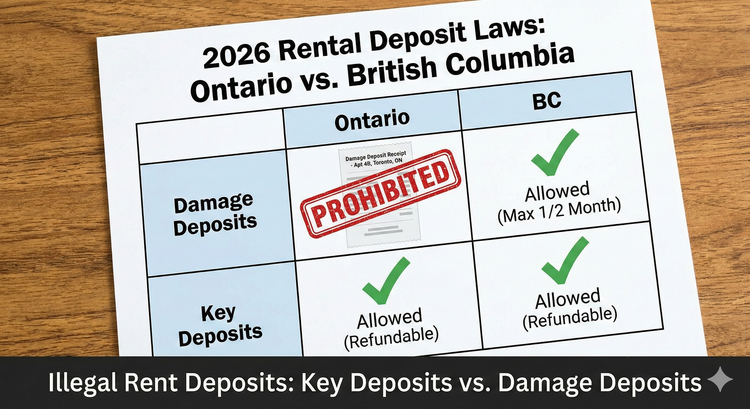

- Cleaning: Negotiate that you only have to leave the place "broom clean." This prevents the landlord from trying to claw back money for "damages" or "cleaning fees" later. Remember, in Ontario, Damage Deposits are illegal, so don't let them try to create one at the end of your tenancy.

Protecting Your Benefits

If you receive a $20,000 buyout, you must be careful if you are on BC PWD, ODSP, or AISH.

- The Asset Test: Large buyouts can put you over the asset limit for provincial benefits.

- The Hack: Negotiate to have the buyout paid into an RDSP or a Registered Disability Savings Plan if applicable, or spread the payments over several months to stay under the monthly income/asset thresholds. Always consult a legal aid clinic if you are on benefits before signing a buyout.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Tribunals Ontario: Form N11 - Agreement to End Tenancy Rules and Procedures

- Steps to Justice: Negotiating a settlement with your landlord - Cash for Keys

- Federation of Metro Tenants' Associations (FMTA): The Tenant Guide to Buyout Offers 2026

- CRA: Tax treatment of lease cancellation payments for tenants

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.