Cheapest Cities in Alberta 2026: Calgary vs. Edmonton vs. Lethbridge

For the last three years, Alberta has been the primary destination for thousands of Canadians fleeing the astronomical costs of Ontario and British Columbia. But as we move into 2026, the "Alberta Advantage" has shifted. The days of walking into a $1,200 one-bedroom apartment in downtown Calgary are largely gone. Instead, the 2026 market is defined by a "Move North and South" trend, where renters and buyers are looking toward Edmonton and Lethbridge to find the value that Calgary has lost to its own success.

In 2026, Alberta's economy remains a powerhouse, but the housing market has moved from a "frenzy" to a "balanced" state. This means that while prices have stabilized, the gap between cities is wider than ever. If you are a newcomer, a student, or a worker looking to maximize your take-home pay, choosing the right Alberta city is the most important financial decision you will make this year.

This guide breaks down the 2026 rental and real estate data for Alberta’s three major hubs and identifies the "Value Pockets" where you can still live a high-quality life for under $1,500 per month.

The 2026 Alberta Housing Leaderboard: Rent vs. Buy

| City | Avg. 1-Bedroom Rent (2026) | Avg. Detached Home Price | Market Vibe |

| Calgary | $1,675 | $715,000 | Balanced/High Demand |

| Edmonton | **$1,296** | $415,000 | Affordability Leader |

| Lethbridge | $1,325 | $357,000 | Steady/Value-Focused |

| Red Deer | $1,364 | $344,000 | The "Sweet Spot" |

| Medicine Hat | **$1,233** | $335,000 | Deep South Value |

MORE HELPFUL ARTICLES FROM US

- Canada Payment Guide (Browse All Payments )

- Can I Get EI if I Quit? (Just Cause Checklist)

- TFSA vs. RRSP for Low Income (The GIS Trap)

- Shared Custody CCB Rules (50/50 Split Guide)

- Warm Neighbor Programs (Heating Bill Help)

1. Edmonton: The "Investment King" of 2026

While Calgary’s prices surged, Edmonton grew at a slower, steadier pace. In 2026, the gap between the two cities is historically wide, making Edmonton the undisputed leader for both renters and first-time buyers.

- The Draw: You can still acquire detached homes or duplexes at a price point that actually covers the mortgage through rental income—something nearly impossible in Calgary in 2026.

- The Economy: A massive focus on the "Hydrogen Hub" and public sector stability (as the provincial capital).

- Pro-Tip: Focus on Oliver and Strathcona for a high-density, walkable lifestyle that still offers 1-bedroom units for $1,200–$1,400.

2. Calgary: The "New Toronto" (With Better Views)

Calgary is no longer a "cheap" city; it is a "value" city. While $1,675 for a one-bedroom sounds high to an Albertan, it is still $600 cheaper than Toronto.

- The Draw: The most diverse job market in the province, with a booming tech and finance sector.

- 2026 Shift: We are seeing a move toward "Exurbs." Families are fleeing the city limits for Airdrie, Cochrane, and Chestermere, where you can get significantly more square footage for your dollar.

- Neighborhood Pick: Beltline and Mission remain the high-demand areas, but for 2026 value, look at Deer Ridge or Huntington Hills for single-family homes in the $500k range.

3. Lethbridge: The Sunny Value Alternative

Lethbridge consistently ranks among Canada's most affordable urban markets. In 2026, its average 1-bedroom rent of $1,325 makes it a magnet for students and retirees.

- The Draw: 320 days of sunshine a year and a steady job market in agriculture and education (University of Lethbridge).

- Pro-Tip: New construction in West Lethbridge has kept inventory balanced, preventing the bidding wars seen in the north.

The 2026 Alberta "Relocation Strategy"

If you are moving to Alberta in 2026, your strategy should depend on your career stage.

For Students and Early Careers

Edmonton is your best bet. With rent for studios starting at $1,116, you can afford to live alone while attending the University of Alberta or NAIT. The transit system (LRT expansion) is making more affordable neighborhoods like Mill Woods accessible to the core. Ensure you time your move with your Benefit Payment Dates to handle the first and last month's rent.

For Families

Look at Red Deer or Medicine Hat. These cities offer "big-city" infrastructure (hospitals, malls, colleges) with home prices under $350,000. In 2026, these are the only places in the province where a median household income can comfortably afford a detached home with a backyard. If you are receiving the Canada Child Benefit (CCB), it goes significantly further here than in Calgary.

For Remote Workers

The "Exurbs" of Calgary offer the best of both worlds. Towns like Beiseker (45 mins from Calgary) or Strathmore offer a peaceful prairie setting with high-speed internet. In 2026, these communities are growing rapidly as "Zoom Towns" for those who want Rocky Mountain access without the $2,000 rent.

In 2026, the Alberta rental market has reached a "Soft Landing." The sight-unseen bidding wars of 2024 are mostly over, but the pressure remains high in the low-end of the market (units under $1,400). To secure a home, you need to understand the 2026 "Alberta Rules."

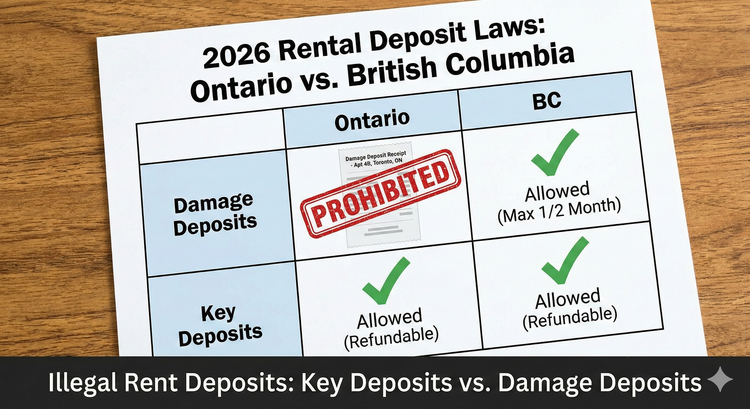

1. The "Security Deposit" Reality

Unlike Ontario, where Damage Deposits are illegal, Alberta landlords can legally charge a security deposit.

- The Limit: The deposit cannot exceed one month’s rent.

- The Interest Rule: Landlords are legally required to pay you interest on your security deposit. In 2026, with interest rates stabilizing, this is a small but important right to claim when you move out.

- The Trap: A landlord cannot charge you a "non-refundable" pet fee that, when added to your deposit, exceeds one month's rent. If your rent is $1,500 and they ask for a $1,500 deposit plus a $500 pet fee, they are breaking the law.

2. Rent Increases: The "Wild West" (With a 12-Month Shield)

Alberta has no "Rent Control" cap. A landlord can raise the rent to whatever the market will bear.

- The Only Shield: A landlord can only increase your rent if at least 12 months have passed since your last increase or since the start of your tenancy.

- The 2026 Strategy: In a cooling market, use this. If your landlord proposes a 10% increase, show them that similar units in Edmonton or Red Deer are $300 cheaper. In 2026, landlords are more afraid of a 2-month vacancy than a 5% rent discount.

3. Leveraging the "ADAP" Shift for Housing

For those on disability assistance, 2026 marks the launch of the Alberta Disability Assistance Program (ADAP).

- The Housing Impact: If you are transitioned to ADAP, your monthly allowance may be lower than the traditional AISH rate. This makes finding a "Value City" like Medicine Hat or Brooks a necessity rather than a choice. Many specialized housing providers in these cities are tailored to the new ADAP rate structures.

4. The "Secondary Market" Opportunity

In Calgary and Edmonton, the "Secondary Market" (condos owned by individuals rather than corporations) is seeing the largest rent declines in 2026.

- Why? Investors are facing higher mortgage renewals and are desperate for stable tenants to cover their costs.

- The Move: Search for "Condo for Rent" rather than "Apartment." You are more likely to find a landlord willing to include a parking spot or a storage locker for free just to secure a long-term lease.

Cheapest Cities in Alberta 2026

The cheapest cities to live in Alberta in 2026 for a one-bedroom apartment under $1,350 are **Edmonton ($1,296)**, Lethbridge ($1,325), and Medicine Hat ($1,233). While Calgary remains the most expensive at $1,675, Edmonton offers the best balance of high wages and low housing costs, with detached homes still available in the $400k range. For the best value, look toward secondary markets like Red Deer or the Calgary exurbs like Strathmore.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Zillow: Cheap Apartments For Rent in Alberta - January 2026 Listings

- RentFaster.ca: 2026 Alberta Rent Report - Calgary, Edmonton, Lethbridge

- Rentals.ca: National Rent Report - January 2026 Alberta Data

- liv.rent: Calgary & Edmonton Rent Report 2026 Forecast

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.