CRA Mileage Rates 2026: How much can I claim for my car in Ontario?

For any Ontarian who uses their personal vehicle for work, the start of 2026 brings a critical update to your wallet. Every year, the Canada Revenue Agency (CRA) adjusts the "Prescribed Automobile Allowance" to reflect the actual cost of gas, insurance, and maintenance. If you are still being reimbursed at 2024 or 2025 rates, you are essentially paying your employer for the privilege of driving to meetings.

The "Street Angle" for 2026 is that the mileage rate has officially hit a new high. As of January 1, 2026, the CRA has increased the "Reasonable" rate by another cent, acknowledging that inflation in Ontario's insurance and repair sectors hasn't cooled down. Whether you are an employee getting a per-km check or a self-employed contractor looking for the easiest tax deduction, understanding the "5,000 KM Cliff" is the key to maximizing your return.

As a high-value branch of our Canada Payment Guide, this deep dive reveals the official 2026 rates, the "Simplified vs. Detailed" math, and the audit-proof way to track your trips.

1. Official CRA Mileage Rates for 2026 (Answer Target)

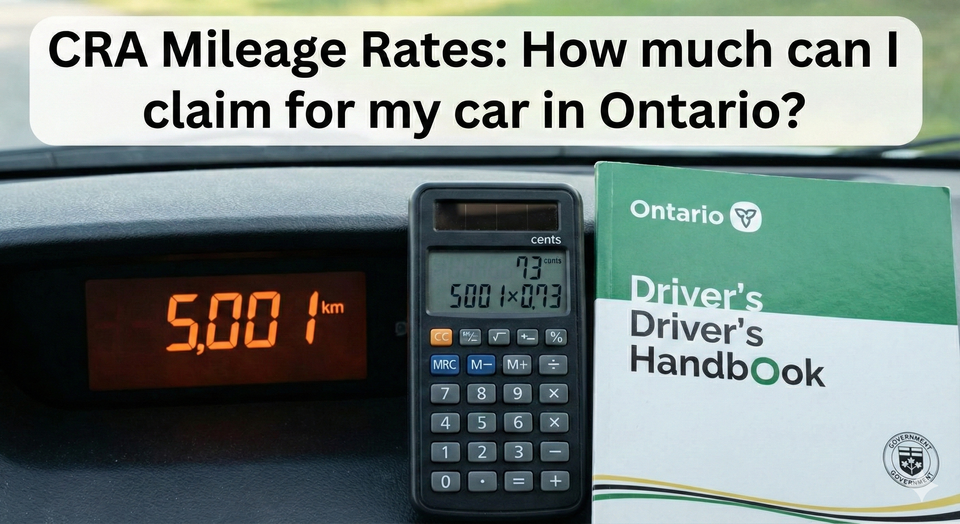

What are the 2026 CRA mileage rates for Ontario and Canada? For the 2026 taxation year, the CRA has set the reasonable automobile allowance at $0.73 per kilometer for the first 5,000 kilometers driven for business. Once you exceed the 5,000 km threshold, the rate drops to $0.67 per kilometer. In the Northwest Territories, Yukon, and Nunavut, the rate is 4 cents higher, at $0.77 and $0.71 respectively. These rates are tax-exempt for employees and serve as the "Simplified Method" guideline for self-employed individuals.

Car Cash Hacks

This deep dive identifies the technical "Profit Shields" to ensure your vehicle isn't a financial drain.

1. The "73-Cent" Tax-Free Shield

Most employees search for "is my car allowance taxable."

- The Rule: If your employer pays you $0.73/km or less, that money is 100% Tax-Free. It does not appear on your T4, and you don't pay a cent of income tax on it.

- The Trap: If your employer pays you a "Flat Monthly Rate" (e.g., $500/month) regardless of kilometers, that $500 is 100% Taxable.

- The Strategy: In 2026, always push for a per-km reimbursement. A $500 monthly allowance might only net you $350 after taxes, whereas 700km of driving at the CRA rate gives you $511—all of which stays in your pocket.

2. The "5,000 KM Cliff" Explained

Why does CRA mileage rate drop after 5000km.

- The Reality: The CRA assumes your "Fixed Costs" (insurance, registration, depreciation) are covered in those first 5,000 kilometers.

- The Strategy: After the "Cliff," you are only being reimbursed for "Variable Costs" like gas and oil.

- The Move: If you drive 10,000 business km in 2026, your math is: (5,000 x $0.73) + (5,000 x $0.67) = **$7,000**.

- Link: This calculation is vital for Uber and SkipTheDishes drivers who easily blow past the 5,000 km mark in the first three months.

3. Simplified vs. Detailed: Which One Wins?

Many self-employed users search for "best way to claim car expenses 2026."

- The Simplified Method: You just track your kilometers and multiply by the CRA rate ($0.73/$0.67).

- The Detailed Method: You track every gas receipt, oil change, insurance payment, and lease bill, then multiply the total by your "Business Use Percentage."

- The Strategy: If you drive an older, fuel-efficient car, the Simplified Method usually wins because the 73-cent rate is generous. If you drive a gas-heavy SUV or a luxury lease, the Detailed Method often results in a $2,000 - $3,000 higher deduction.

4. The "Northern Bonus" Hack

Users in remote areas search for "territories mileage rate 2026."

- The Hack: If you are working in the NWT, Yukon, or Nunavut, you get a 4-cent premium.

- The Move: Ensure your reimbursement reflects $0.77/km. Because gas prices in the North can be 50% higher than in Toronto, that extra 4 cents is the difference between breaking even and losing money on every trip.

- Innerlink: Pair this with our Northern Residents Deduction guide to maximize your total remote-work benefits.

5. Audit-Proofing: The "Start-Stop" Odometer Rule

If you want to survive a CRA review, search for "how to keep a mileage log CRA."

- The Strategy: The CRA requires the date, destination, purpose, and kilometers for every single trip.

- The Hack: On January 1, 2026, take a photo of your odometer. Do the same on December 31.

- The Move: Without these two "Anchor Dates," the CRA can disqualify your entire log. They need to see the "Total KM" for the year to verify that your "Business KM" percentage is reasonable.

3. Summary Table: 2026 vs. 2025 CRA Rates

| Region | First 5,000 KM (2026) | After 5,000 KM (2026) | Change from 2025 |

| Provinces (ON, BC, AB, etc.) | $0.73 | $0.67 | +$0.01 |

| Territories (NWT, YT, NU) | **$0.77** | **$0.71** | +$0.01 |

| Flat Rate (Taxable) | N/A | N/A | No Change |

CRA Mileage Rates 2026

What is the official CRA mileage rate for Ontario in 2026? The 2026 CRA prescribed automobile allowance rate is $0.73 per kilometer for the first 5,000 business kilometers and $0.67 per kilometer thereafter. For the Northwest Territories, Yukon, and Nunavut, the rate is $0.77 per kilometer for the first 5,000 km. These rates are considered "reasonable" by the CRA, meaning reimbursements at or below these levels are tax-free for employees and do not need to be reported as income.

Frequently Asked Questions (FAQ)

Q: Can I claim my commute from home to the office?

A: No. The CRA considers commuting to your "regular place of employment" a personal expense. You can only claim trips from the office to a client site, or from home directly to a client site if you don't stop at the office first.

Q: My employer only pays 50 cents per km. Can I claim the difference?

A: Yes. If your employer pays less than the CRA rate, you can claim the remaining 23 cents as a deduction on your taxes using Form T2200 (Declaration of Conditions of Employment) signed by your boss.

Q: Does the 73-cent rate include GST/HST?

A: Yes. The prescribed rate is meant to cover all costs, including the sales tax you paid on gas and repairs. If you are a GST/HST registrant (like an Uber Driver), you can actually "un-bundle" the GST from your mileage to claim Input Tax Credits.

Q: Is there a maximum I can claim?

A: There is no maximum number of kilometers, but for the "Detailed Method," there is a Capital Cost Allowance (CCA) ceiling of $39,000 (plus tax) for most passenger vehicles in 2026.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- CRA: Automobile Allowance Rates 2026

- Department of Finance: 2026 Automobile Deduction Limits and Expense Benefit Rates

- Ontario Ministry of Finance: Business Use of Personal Vehicle Guidelines

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.