How to Get a Credit Card with a 9-Digit SIN in 2026: Work Permit Guide

For most people arriving in Canada on a work permit in 2026, the first major hurdle isn't finding a job—it's getting a credit card. You walk into a bank with your 9-digit Social Insurance Number (SIN) and a valid work permit, only to be told that you need "Permanent Residency" or a "Canadian Credit History" to qualify for anything other than a $500 secured card.

This "Credit Catch-22" is frustrating and can slow down your progress in Canada. Without a credit card, you can't easily rent an apartment, get a car loan, or even sign up for a post-paid phone plan without a massive deposit.

This is the Official 2026 Guide for Work Permit Holders. We have identified the specific banks and fintechs that offer high-limit, unsecured cards specifically for 9-digit SIN holders, and the exact steps you need to take to avoid an instant rejection.

Quick Answers: Credit Cards for Temporary Residents

Can I get a credit card with a 9-digit SIN?

Yes. While a 9-digit SIN indicates you are a temporary resident (on a work or study permit), most "Big Six" banks have specific newcomer programs that bypass the need for a 10-digit (Permanent) SIN. In 2026, you can qualify for an unsecured limit of up to $15,000 if you apply through the right program.

Which bank is easiest for work permit holders?

Currently, RBC and Scotiabank are the most flexible. Scotiabank allows you to use your foreign credit history through Nova Credit, while RBC offers the most aggressive unsecured limits (up to $15,000) for those who have arrived in Canada within the last 12 months.

Why was my application rejected instantly?

The most common reason for an "Instant Decline" is applying through a standard online form instead of a Newcomer-Specific Link. Standard forms are often programmed to reject 9-digit SINs automatically. You must apply through the "Newcomer" or "StartRight" portals to ensure your permit status is factored in.

The Best Credit Cards for Work Permits in 2026

If you have a 9-digit SIN, these are the cards that are currently saying "Yes" with the highest frequency.

1. RBC Cash Back Mastercard (Newcomer Offer)

- Limit: Up to $15,000 (Unsecured).

- Eligibility: Work permit holders who arrived in the last 12 months.

- Why it wins: RBC does not require a security deposit and is very generous with initial limits for foreign workers with a valid job offer.

2. Scotiabank Scene+ Visa Card

- Limit: Up to $15,000 (Unsecured).

- Eligibility: Available through the StartRight® Program.

- Why it wins: If you are from India, the UK, the Philippines, or Nigeria, Scotiabank can pull your home country's credit report to approve you for a "Premium" card even if you have $0 in Canadian history.

3. Neo Secured Mastercard (The "Safety" Card)

- Limit: Equal to your deposit (as low as $50).

- Eligibility: Instant approval for anyone with a SIN.

- Why it wins: If you have been rejected by the big banks, Neo is the fastest way to start building your credit score while you wait to build up 3-6 months of Canadian history.

The Work Permit Expiry Approval Loophole

Answer: To get approved for a credit card on a work permit in 2026, your permit must generally have at least 6 months of validity remaining. If your permit expires in less than 180 days, most "Big Six" banks will automatically decline your application. The 2026 Strategy: If you are in the process of an extension (Maintained Status), do not apply online. Visit a branch with your "Proof of Application" from the IRCC to have a human advisor manually override the expiry date block.

SIN Number 9 vs 1 for Credit Applications

A SIN starting with 9 tells the credit bureau that you are a temporary resident. In 2026, this status is actually a "High-Risk" flag for standard credit algorithms.

- The Solution: Always check the box that asks: "Are you a newcomer to Canada?" * The Logic: By ticking this box, you move your application from the "Standard" pile to the "Newcomer" pile, where a 9-digit SIN is expected and accepted.

Building Credit with "Daily Pay" Jobs

Many work permit holders work in sectors with flexible pay. In 2026, you can use these earnings to boost your credit limit.

- The Hack: If your bank allows it, link your payroll account to a tool like Borrowell. They can analyze your steady income flow (even if it's daily) to give you a "Rent and Bill Reporting" boost to your score, which helps you move from a $1,000 limit to a $5,000 limit in half the time.

The "Pain Points": Why Temporary Residents Get Denied

Even with a job, you might face a "No" from the bank. Here is how to navigate the three most common 2026 rejection reasons.

1. The "18-Month Rule" Confusion

Some bank staff mistakenly apply the CCB 18-month rule to credit cards. They might tell you that you need to be in Canada for 18 months to get a card.

- The Correction: This rule only applies to the Canada Child Benefit. Credit cards can be issued on your Day 1 in Canada. If a teller tells you otherwise, ask for a "Newcomer Specialist."

2. The "Employment Gap" Trap

If you apply for a credit card in your first week without a signed "Letter of Offer," you will likely be asked for a Security Deposit.

- The Fix: Wait until you have your first Canadian paystub or a signed employment contract that shows your annual salary. Presenting this in a branch almost always waives the security deposit requirement.

3. The "MFA Lockout" in 2026

As noted in our Tax Scams 2026 Guide, security is tighter than ever. If you don't have a permanent Canadian phone number, you may be unable to complete the "Verified by Visa" or "Mastercard ID Check" steps, leading to an automatic decline. Ensure your Canadian SIM is active before you apply.

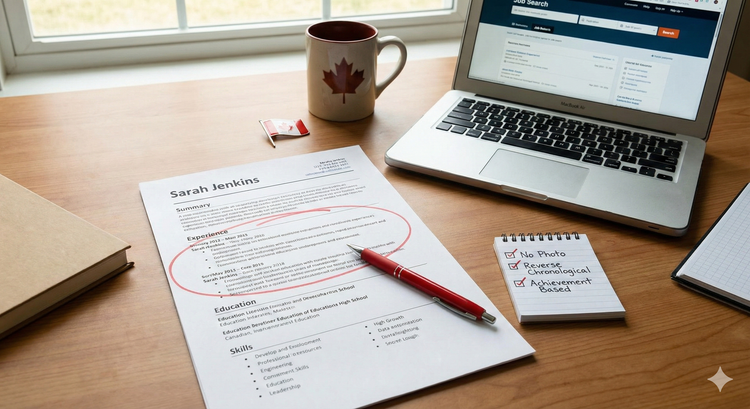

Step-by-Step: Getting Approved with a 9-Digit SIN

- Collect Your Paperwork: You need your Passport and your original Work Permit (IMM 1442).

- Avoid Online Forms: Visit a branch in person. In 2026, branch managers have the authority to "Manually Approve" newcomer cards that the online computer system would reject.

- The "Bundle" Strategy: Open a No-Fee Bank Account at the same time. Banks are 50% more likely to give you a credit card if you have a chequing account where your salary is being deposited.

- Ask for "Unsecured": Always ask if you qualify for the newcomer "Unsecured" card first. Only accept a "Secured" card (where you pay a deposit) as a last resort.

- Set Up Autopay: Once you get the card, set up an automatic payment for the "Minimum Amount." Even if you forget to pay the full bill, your Master Payment Calendar 2026 habits will ensure your credit score never takes a hit.

Frequently Asked Questions (FAQ)

Does a 9-digit SIN expire?

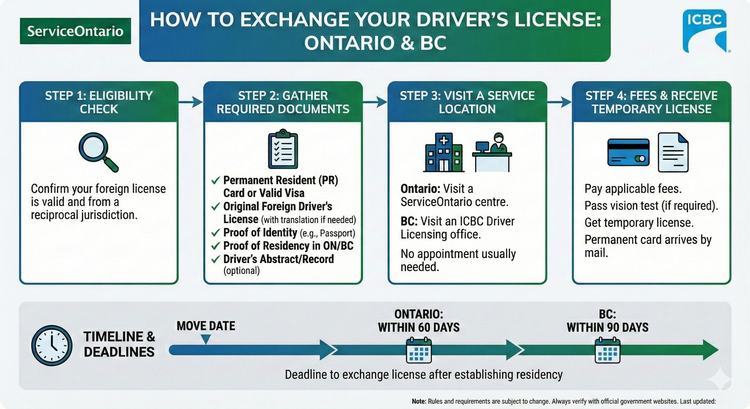

Your SIN is tied to the expiry date on your work permit. When you renew your permit, you must also update your SIN at a Service Canada office. If you don't, your bank may "Freeze" your credit card account because they think your legal right to work has ended.

Can an international student get a $5,000 limit?

It is rare. In 2026, most banks cap student limits at $1,000 to $2,000 unless the student can prove a high income from a co-op placement or part-time work. Check our International Student Benefit Guide for more on student-specific finance.

Will applying for multiple cards hurt my score?

Yes. Every "Hard Inquiry" drops your score by about 5 to 10 points. If you are rejected by one big bank, do not immediately go to another big bank. Go to a "Guaranteed Approval" fintech like Neo Financial to build your score for 3 months before trying a major bank again.

Final Word for 2026 Newcomers

Getting a credit card with a 9-digit SIN is about proving Sustainability. The bank wants to see that you have a reason to stay in Canada and the means to pay them back. By using the Newcomer Money Roadmap and applying in-person, you bypass the digital gatekeepers and start your Canadian life with the purchasing power you deserve.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- CRA: Social Insurance Number (SIN) - Overview

- RBC: Newcomer Credit Card Options

- Scotiabank: StartRight Program Eligibility

- Equifax Canada: affects credit reporting

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.