Digital News Subscription Tax Credit: Which Sites Qualify?

For the last few years, avid readers of Canadian journalism enjoyed a small but meaningful "thank you" from the federal government: the Digital News Subscription Tax Credit (DNSTC). It allowed you to claim up to $500 in subscription costs, putting $75 back in your pocket. However, as we enter the 2026 tax season, there is a major update that every taxpayer needs to know.

The Digital News Subscription Tax Credit was always designed as a temporary measure. As of the 2025 tax year, the credit has officially reached its "Sunset Date" and is no longer available for new expenses.

If you are following our Hidden Tax Credits Canada 2026 Master List, this is a rare case where the guide is about "Loss Prevention." While you can’t claim your 2026 subscriptions, you can still claim expenses from 2020–2024 if you haven't already. This guide explains the closure, the rules for claiming previous years, and which organizations qualified as QCJOs.

1. The 2026 Update: Is the Credit Gone?

Yes. The Canada Revenue Agency (CRA) has confirmed that the Digital News Subscription Tax Credit was only available for qualifying subscription expenses paid between January 1, 2020, and December 31, 2024.

- 2025 & 2026 Tax Years: You cannot claim a credit for any payments made to news organizations in these years.

- Line 31350: While this line may still appear on some tax software, it is only for those adjusting previous returns or catching up on back-taxes.

2. Can I Still Claim for Previous Years?

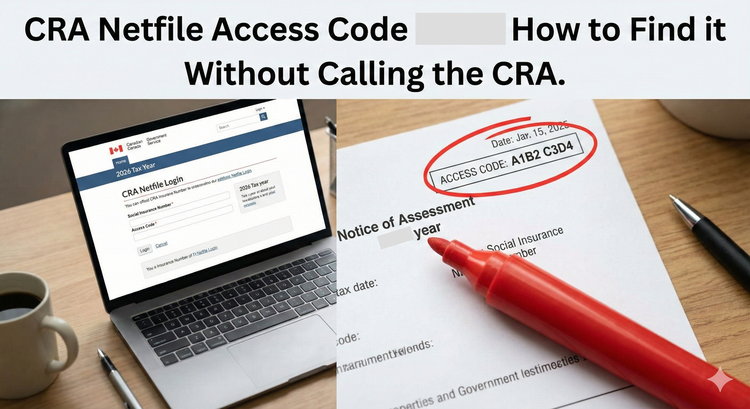

If you realized you missed this credit on your 2023 or 2024 tax returns, the door isn't closed yet. You can "Refile" or "Adjust" your return through CRA My Account to get that $75 back.

The "Back-Claim" Math:

- The Limit: 15% of up to $500 in eligible expenses per year.

- The Window: You can typically adjust a tax return for up to 10 years back, meaning you have until 2030 to claim the 2020 DNSTC.

News Credit Hacks

This deep dive identifies the specific "Final Receipts" and QCJO numbers that were used during the program. These "Street Hacks" are essential for anyone doing back-taxes for the 2020–2024 period.

1. The Globe and Mail QCJO Number

Globe and Mail QCJO designation number.

- The Street Angle: You cannot claim a subscription unless the organization has an official CRA number.

- The Hack: The Globe and Mail's QCJO number is Q2300382.

- The Strategy: For the 2020–2024 period, the Globe's standalone digital rate was often cited as $7.99 per week. If you were a print subscriber, you could still claim the digital portion of your subscription using this number.

2. The Postmedia / National Post Receipt Hack

Many users search for "National Post tax credit receipt 2026."

- The Street Angle: Postmedia (which owns the National Post, Calgary Herald, and Ottawa Citizen) was very proactive in sending receipts.

- The Hack: If you missed your email, you can usually log into the Postmedia Self-Serve Portal to download your 2024 tax receipt.

- The QCJO Number: For most Postmedia publications, the designation number is Q9469016.

3. Apple News+ and The "Non-Canadian" Trap

A rising search is "Can I claim Apple News+ on my Canadian taxes?"

- The Reality: No. * The Strategy: To qualify, the organization had to be a Qualified Canadian Journalism Organization (QCJO). International aggregators like Apple News, Google News, or The New York Times were strictly ineligible because they are not "primarily Canadian" in their ownership or content production.

4. The "Print-Digital Hybrid" Calculation

What if you had a physical newspaper delivery that included digital access?

- The Hack: You couldn't claim the full cost of the print paper.

- The Strategy: You could only claim the cost of a standalone digital subscription.

- The Move: If the paper didn't offer a standalone digital version, the CRA allowed you to claim 50% of your total print bill, up to the $500 cap. This was a "Secret Hack" for rural seniors who only had access to physical paper but used the website daily.

5. Splitting the Credit with Roommates

If you and your partner shared a digital login, who gets the $75?

- The Rule: Only the person whose name is on the billing agreement can claim the credit.

- The Move: If both your names were on the account, you could split the $500 claim ($250 each), but this was rare. It’s almost always better to have the person who paid the bill claim the full amount to simplify the "Proof of Payment" in case of a CRA check.

4. Summary: QCJO Designation Numbers (For Back-Claims)

| Organization | QCJO Number | Eligible Years |

| The Globe and Mail | Q2300382 | 2020–2024 |

| Postmedia (National Post) | Q9469016 | 2020–2024 |

| The Toronto Star | Q2310134 | 2020–2024 |

| La Presse | Q1340012 | 2020–2024 |

Digital News Tax Credit 2026

Is the Digital News Subscription Tax Credit still available in 2026? No. The Digital News Subscription Tax Credit has officially closed. It was only available for subscription expenses paid between 2020 and 2024. You cannot claim this credit for payments made in 2025 or 2026. However, if you missed claiming the credit on a previous return, you can still adjust your 2020–2024 taxes through CRA My Account to receive up to $75 per year.

Frequently Asked Questions (FAQ)

Q: Can I claim my 2026 subscription as a business expense instead?

A: Yes. If you are a digital entrepreneur or professional (like an editor, researcher, or stock trader) and you use the news for your work, you can deduct the cost as a Professional Fee or "Business Supply" on Form T2125. This is a deduction, not a credit, and it is still available in 2026.

Q: Why did the government stop the credit?

A: The program was part of a $595-million "Journalism Support" package introduced in 2019 with a five-year mandate. The government has shifted its focus to Direct Labour Tax Credits for newsrooms rather than individual subscriber rebates.

Q: Does my local community paper qualify?

A: Only if they were a registered QCJO. Most small independent blogs or local newsletters did not meet the rigorous CRA criteria for the designation.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Canada.ca: About the digital news subscription tax credit - Status: Closed

- CRA: List of qualifying digital news subscriptions

- The Globe and Mail: Digital News Subscription Tax Credit - My Account Guide

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.