The Disability Supplement for Students: Hidden Grants for 2026

Post-secondary education in Canada is expensive, but for students with disabilities, the costs are even higher. Between specialized equipment, tutoring, and the inability to work a full-time "survival job" while studying, the financial barrier can feel impossible.

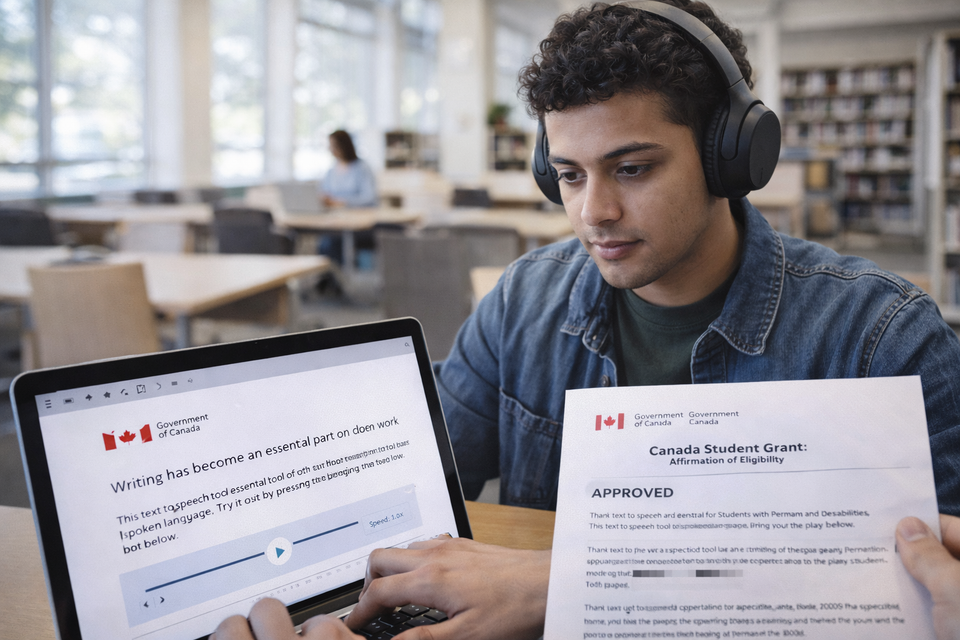

However, for the 2025-2026 academic year, the Canadian government has extended significant support for students with permanent or "persistent and prolonged" disabilities. These aren't just loans you have to pay back; they are grants—direct cash to help you succeed.

This is the Official 2026 Student Grant Guide. We explain the difference between the "Services and Equipment" grant and the "Disability Supplement," how to qualify with a learning disability like ADHD, and why having an approved Disability Tax Credit (DTC) is your strongest evidence.

Quick Answers: Student Disability Grants

How much is the Canada Student Grant for Students with Disabilities for 2026?

For the 2025-2026 school year, eligible students receive $2,800 per year. This amount is fixed and is not dependent on your financial need or your family's income. As long as your disability is verified, you receive this grant for every year of your studies.

Can I get money for a laptop or tutoring through a disability grant?

Yes. The Canada Student Grant for Services and Equipment provides up to $20,000 per year to cover exceptional costs. This includes assistive technology (like a specialized laptop or screen reader), note-taking services, and academic coaching. You must provide quotes and receipts to claim this specific funding.

Do I need the DTC to get student disability grants?

Not necessarily, but it is highly recommended. While you can apply for student grants using a medical form from your province's student aid office (like OSAP or StudentAid BC), having an approved Disability Tax Credit automatically verifies your status, making the grant approval process much faster.

MORE HELPFUL ARTICLES FROM US

- Canada Payment Guide (Browse All Payments )

- Can I Get EI if I Quit? (Just Cause Checklist)

- TFSA vs. RRSP for Low Income (The GIS Trap)

- Shared Custody CCB Rules (50/50 Split Guide)

- Warm Neighbor Programs (Heating Bill Help)

Top 3 Disability Grants for Post-Secondary (2025-2026)

1. The Canada Student Grant (CSG-D)

This is the "standard" grant for any student with a verified disability.

- Amount: $2,800 annually.

- The Best Part: You are automatically assessed for this when you apply for regular student loans. You don't have to "find" a separate application.

2. The Services and Equipment Grant (CSG-DSE)

This is for the "extra" costs that your school doesn't cover.

- Amount: Up to $20,000.

- Eligible Items: Ergo-chairs, noise-canceling headphones (for ADHD/Autism), sign-language interpreters, or specialized software like Dragon or Kurzweil.

3. The "Severe Permanent Disability" Benefit

If your disability is so severe that it prevents you from both studying and working indefinitely, you can apply to have your existing Canada Student Loans cancelled entirely.

- The Catch: Once your debt is cancelled under this program, you can never receive federal student grants or loans again.

The ADHD and "Invisible" Disability Strategy

Many students don't realize they qualify because their disability isn't physical. In 2026, the definition of "persistent or prolonged disability" includes:

- Learning Disabilities: Dyslexia, ADHD, and Processing Disorders.

- Mental Health: Chronic Anxiety, Depression, or PTSD.

- Medical Conditions: Crohn’s disease, chronic pain, or severe allergies.

The Action Plan:

If you have ADHD, your school's Accessibility Office is your best friend. They can provide the "Functional Limitation" letter that the government needs to approve your equipment grant.

Using Your DTC to Increase Your Funding

If you or your parents have an approved Disability Tax Credit, you should also check your CRA My Account.

An approved DTC status in the CRA system flows into your student aid application. It also allows you to receive the Canada Disability Benefit (CDB) starting in 2025, which provides an extra $200 per month that you can use for housing and food while in school.

The 520-Week Rule: More Time to Finish

Most Canadian students are limited to 340 weeks of student aid. However, the government recognizes that students with disabilities may need to take a lighter course load or more time to finish their degrees.

- The Benefit: Students with disabilities are allowed up to 520 weeks of financial assistance.

- The Strategy: Take 3 courses instead of 5. You keep your full-time student status (and your grants), but you reduce the risk of burnout.

Need Extra Income During the Summer?

Grants cover your tuition and books, but they rarely cover the high cost of rent in 2026. If you are a student looking for disability-friendly or remote summer work that understands your specific needs:

👉 Find Daily Pay Jobs at BetterPayJobs.ca

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Employment and Social Development Canada: Canada Student Grant for Students with Disabilities

- Canada.ca: Grants for Services and Equipment - Students with Disabilities

- PBO Canada: CDB Supplemental Payments 2026 Update

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.