EI Sickness Benefits 2026: How Long Can You Stay Off?

For years, one of the biggest gaps in the Canadian social safety net was the "15-week wall." If you were diagnosed with a long-term illness like cancer or required major surgery, your Employment Insurance (EI) sickness benefits would often run out months before you were physically ready to return to work. In 2026, that wall is officially gone.

The permanent extension of EI sickness benefits to 26 weeks is now the gold standard across Canada. Combined with new provincial job-protected leaves that align with this federal timeline, workers in 2026 have more breathing room than ever to focus on recovery without the immediate fear of bankruptcy or job loss. However, navigating the medical certificates, the "600-hour" rule, and the reporting process still requires a strategic approach.

As a core part of our Employment Insurance Master Guide, this article breaks down the 2026 benefit rates, the "26-week" duration, and the "Street Hacks" to ensure your medical leave doesn't result in a financial disaster.

1. The 2026 Math: How Much and How Long?

In 2026, the maximum insurable earnings have increased, which means your weekly check might be higher than you expect.

The 2026 Benefit Rates

- Maximum Weekly Benefit: $729 per week.

- The Percentage: You receive 55% of your average weekly insurable earnings.

- Maximum Duration: 26 weeks.

- Required Hours: You must have worked at least 600 insurable hours in the 52 weeks prior to your claim.

The 2026 Waiting Period: Like regular EI, there is a one-week waiting period (effectively a deductible) where you are not paid. However, if you are transitioning from an employer-paid sick leave plan, this waiting period can often be waived.

Medical Leave Hacks

This deep dive identifies the technical "Street Hacks" to manage a long-term medical claim without the typical Service Canada headaches.

1. The 27-Week Provincial Job Protection Hack

Job protected medical leave Canada 2026.

- The Street Angle: EI gives you money, but it doesn't protect your job. That is the province's responsibility.

- The 2026 Hack: As of 2025/2026, Ontario, British Columbia, and Alberta have all implemented new 27-week unpaid, job-protected medical leaves.

- The Strategy: This extra week (27 vs 26) is designed specifically to cover the 26 weeks of EI plus the 1-week waiting period.

- The Move: When you inform your employer of your leave, explicitly cite the provincial Employment Standards Act (e.g., Section 50.1 in Ontario). This prevents them from "letting you go" while you are on your 26-week EI claim.

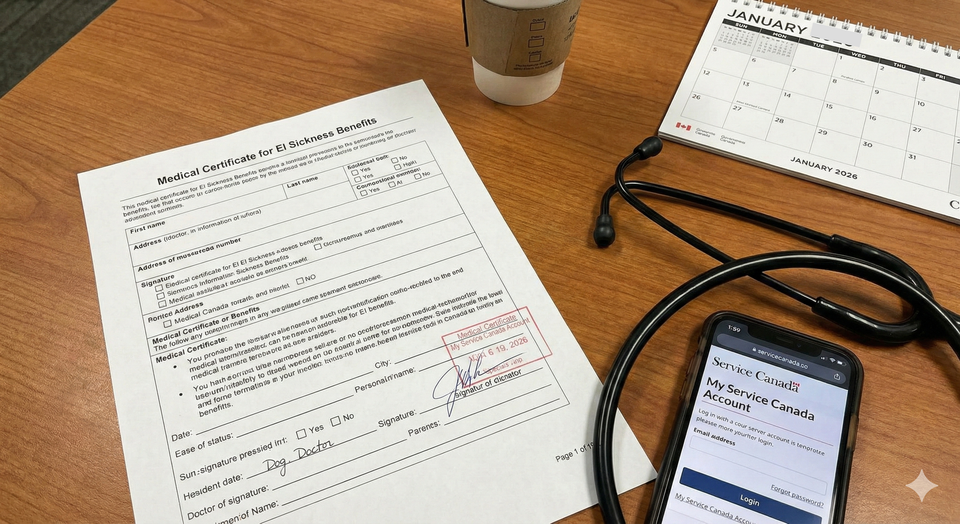

2. The Medical Certificate (Form INS5140) Strategy

Many users search for "how to get a medical certificate for EI."

- The Street Angle: You don't actually need to submit the certificate to apply.

- The Hack: Apply for EI the day you stop working, even if you don't have the doctor's note yet.

- The Strategy: Use Service Canada Form INS5140 or a standard doctor’s note. It must state your start date, end date, and that you are "incapable of work for medical reasons."

- The Move: Keep the original in a safe place for 6 years. Service Canada only asks to see it if your claim is audited. Waiting for the doctor to sign the form before applying can cost you weeks of benefits because of the "4-week delay rule."

3. The "Intermittent Leave" Hack for Chronic Illness

A rising query in 2026 is "can I take EI sickness benefits in blocks."

- The Reality: Yes. * The Hack: If you have a condition like MS or are undergoing chemotherapy, you can take your 26 weeks non-consecutively.

- The Strategy: You can work for two weeks, go off for three, and come back.

- The Reporting Move: On your bi-weekly report, mark the days you were sick as "unavailable due to illness." This keeps your claim open without requiring a new 600-hour qualification every time you have a flare-up.

4. Working While on Sickness Claim: The 50-Cent Rule

Can you work part-time while recovering?

- The Hack: Yes, the Working While on Claim rules apply.

- The Strategy: If your doctor says you can do a "gradual return" of 10 hours a week, you keep 50 cents of your EI for every dollar earned.

- The Payoff: This allows you to test your strength without losing your entire financial safety net. If the return-to-work fails, you simply revert to your full EI sickness benefit.

5. Transitioning to Disability (CPP-D)

What if 26 weeks isn't enough?

- The Strategy: If your condition is "severe and prolonged," start your Canada Pension Plan Disability (CPP-D) application around Week 18 of your EI claim.

- The Move: CPP-D takes months to process. By starting early, you minimize the "income gap" that occurs when your 26 weeks of EI run out.

3. Summary Table: EI Sickness vs. Regular Benefits (2026)

| Feature | EI Sickness Benefits | EI Regular Benefits |

| Max Duration | 26 Weeks | 14 to 45 Weeks |

| Weekly Max | $729 | $729 |

| Core Requirement | Incapable of working | Ready and looking for work |

| Medical Proof | Required (INS5140) | Not Required |

| Hours Needed | 600 Hours | 420 to 700 (varies by region) |

EI Sickness Benefits 2026

How long are EI sickness benefits in Canada for 2026? EI sickness benefits provide up to 26 weeks of financial support at 55% of your earnings, up to a maximum of $729 per week. To qualify, you must have accumulated 600 insurable hours in the past 52 weeks and provide a medical certificate from a doctor or nurse practitioner. Most provinces, including Ontario and BC, now provide 27 weeks of job protection to ensure your position is held while you collect your 26 weeks of benefits.

Frequently Asked Questions (FAQ)

Q: Does Quarantine still count for sickness benefits?

A: Yes. If you are required to quarantine due to a public health order or doctor's note, you are eligible for sickness benefits for the duration of the quarantine (subject to the 26-week max).

Q: Can I get EI sickness if I am pregnant?

A: If you have a medical complication before your maternity leave begins, you can take 26 weeks of sickness benefits and then transition to your full Maternity/Parental leave. The sickness weeks do not "eat into" your maternity weeks.

Q: My employer has a Short-Term Disability (STD) plan. Which do I use?

A: You must use your employer's plan first. If your employer is part of the Premium Reduction Program, their plan is the primary payer. Once that ends, if you are still sick, you can apply for EI to "top up" your remaining weeks to the 26-week total.

Q: Can a Nurse Practitioner sign my form?

A: Yes. In 2026, the CRA and Service Canada accept signatures from Medical Doctors, Nurse Practitioners, and in some cases, Chiropractors or Optometrists, depending on the nature of the illness.

👉 Find Daily Pay Jobs at BetterPayJobs.ca

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Service Canada: EI Sickness Benefits - Overview

- Employment and Social Development Canada: Maximum insurable earnings and benefit rates for 2026

- Government of Ontario: ESA - New Long-Term Illness Leave 2026

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.