Financial Help for Low-Income Families (2026 Guide)

Raising a family in Canada in 2026 is more expensive than ever. With the cost of groceries, housing, and utilities continuing to climb, "making it" on a low or modest income requires more than just hard work—it requires knowing exactly where to find the "hidden" money the government and non-profits have set aside for you.

Many families leave thousands of dollars on the table simply because they don't know these programs exist or they assume they don't qualify. Whether you are looking for non-repayable grants, interest-free loans, or free essential services, this master list is your roadmap to the Canadian social safety net.

1. The "Emergency Assistance" Program (Provincial)

If you cannot pay for food or shelter and are not currently on social assistance, almost every province has a "one-time" emergency fund.

- Ontario Works (Emergency Assistance): Even if you aren't on "welfare," you can apply for emergency help if you are facing an eviction or a crisis.

- The "Rent Bank" System: Organizations like the Toronto Rent Bank or BC Rent Bank provide interest-free loans (often forgivable) specifically to prevent homelessness. This is a "silent" program that most newcomers miss.

2. The Connecting Families Initiative 2.0

In 2026, internet is no longer a luxury; it’s a necessity for kids' schoolwork and your job search on BetterPayJobs.ca.

- The Program: Eligible families receive $20/month high-speed internet (50/10 Mbps) with 200GB of data.

- How to get it: You must receive an "Invitation Letter" from the government based on your Canada Child Benefit (CCB) eligibility. If you lost your letter, you can call 1-833-206-0599 to retrieve your code.

Part 1: Federal Cash Grants (Non-Repayable)

These are the big-ticket items. This is "free money" from the CRA that you never have to pay back.

1. Canada Child Benefit (CCB) - 2026 Update

The CCB remains the single most powerful tool for low-income families. As of July 2026, the amounts have been adjusted for inflation:

- Under Age 6: Up to **$8,157 per year** ($679.75/month) per child.

- Ages 6 to 17: Up to **$6,883 per year** ($573.58/month) per child.

- Link: Check the exact CCB Payment Dates to time your bills.

2. Canada Workers Benefit (CWB)

This is for the "working poor"—people who have jobs but don't earn enough to rise above the poverty line.

- The "Advanced" Kick: You can get up to 50% of this credit in Advanced Canada Workers Benefit (ACWB) payments throughout the year rather than waiting for your tax return.

- 2026 Status: Ensure you check the ACWB Payment Schedule for your next deposit.

3. Canada Dental Benefit & Canadian Dental Care Plan (CDCP)

The 2026 expansion of the CDCP now covers most low-to-mid-income families without private insurance.

- For Kids: Up to $650 per child if their dental costs aren't covered elsewhere.

- For Adults: If your household income is under $90,000, you can now apply for the CDCP to cover cleanings, fillings, and even some major work.

Part 2: Interest-Free & Low-Interest Loans

Sometimes you don't need a gift; you need a "bridge." In 2026, avoiding high-interest payday loans is the #1 way to stay financially healthy.

| Program Name | Amount | Purpose | Terms |

| Canada Greener Homes Loan | Up to $40,000 | Energy retrofits (windows, heat pumps) | 10 years, 0% interest |

| Rent Bank Loans | Varies | Catching up on rent arrears | 0% interest, often forgivable |

| Canada Student Loans | Full Tuition + Living | Education/Retraining | 0% Interest (Federal portion) |

| Immigrant Access Fund | Up to $15,000 | Credential recognition/licensing | Low-interest for newcomers |

Spotlight: The Canada Greener Homes Affordability Program

This is a massive "Free Stuff" play for 2026. For low-to-median-income households, the government will now cover 100% of the cost of home energy retrofits (like heat pumps or insulation). You don't even pay a deductible. This can save you $200+/month on your winter heating bills.

Part 3: Free Stuff for Kids & Students

1. The Canada Learning Bond (CLB)

This is $2,000 of free money for your child’s future education.

- The Best Part: You do not have to put any of your own money into the RESP to get it. The government just drops the money in once the account is opened. If your child was born in 2004 or later and you were low-income during those years, you can claim this retroactively.

2. Jumpstart Individual Child Grants

Canadian Tire Jumpstart provides up to $600 per year per child to cover the costs of sports (hockey, soccer, swimming).

- Requirement: You must show your CCB statement as proof of low income. Applications for 2026 open in January.

3. Free Laptops & Computers

Through the Computers for Success Canada (CFSC) program, low-income families and students can often receive refurbished laptops for free or at a extremely low cost ($50). Contact your local library or "Connecting Families" rep to find the nearest distribution center.

Part 4: Provincial "Stackable" Benefits (The Multiplier Effect)

To maximize your income, you must "stack" provincial benefits on top of federal ones.

- Ontario Trillium Benefit (OTB): Combines the energy credit and sales tax credit. Check the OTB Payment Dates for your monthly $100-$150 boost.

- Alberta Child and Family Benefit (ACFB): Provides extra cash for families in the wild rose province.

- BC Family Benefit: A monthly tax-free payment for families with children under 18.

- Lease Support: If you are renting, see our guide on Tenant Insurance for Newcomers to find the $15/month plans required for many subsidized housing units.

How to Get Financial Help

To get emergency financial help in Canada (2026): Call 2-1-1 from any phone. This free service connects low-income families with local food banks, rent banks, and emergency utility assistance. For long-term help, ensure you file your taxes annually to trigger the Canada Child Benefit (CCB) and GST/HST Credit, which provide the baseline of the Canadian social safety net.

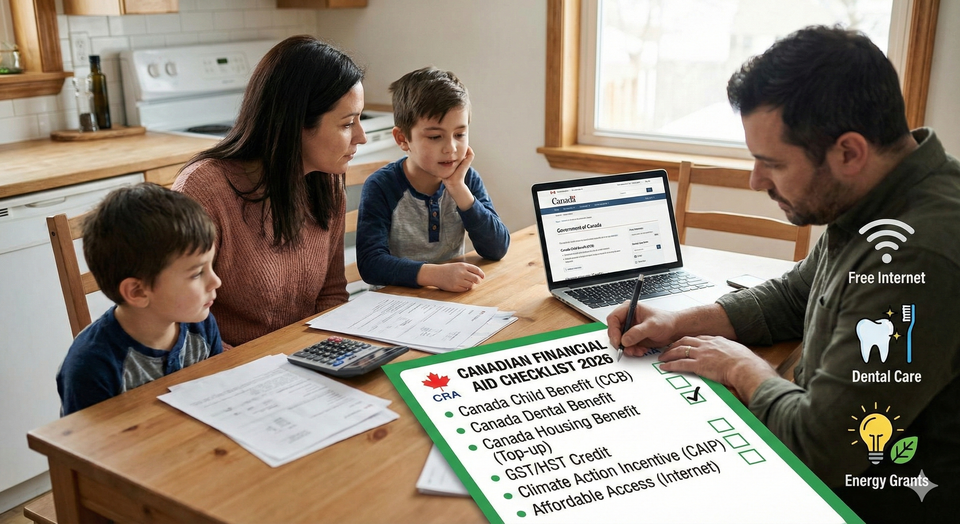

The "Master List" Checklist for 2026

- [✔ ] File your 2025 Taxes: This is the "key" that unlocks every other grant.

- [✔ ] Open an RESP: Claim your $2,000 Canada Learning Bond even with $0 deposit.

- [✔ ] Apply for the CDCP: Get your family's dental work covered for free.

- [✔] Check for the CFI Letter: Get your $20/month internet.

- [✔ ] Update your Resume: Visit BetterPayJobs.ca to find roles that pay above the "low-income" threshold.

Frequently Asked Questions (FAQ)

Q: Do I have to be a citizen to get these grants?

A: No. Permanent Residents, Protected Persons, and many Work Permit holders (if they have been in Canada for 18+ months) qualify for the CCB and GST credits.

Q: Can the government take back my CCB money?

A: Only if your income significantly increases or if you fail to file your taxes. This is why keeping your CRA My Account updated is vital.

Q: Where can I get free furniture?

A: Look for "Furniture Banks" in major cities (e.g., Furniture Bank Toronto). They provide free home furnishings to families transitioning out of displacement or poverty.

Q: What if I can't pay my electricity bill?

A: Every province has a LEAP (Low-income Energy Assistance Program). It provides a one-time grant of up to $500 to prevent your power from being shut off.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- CRA: Every Dollar Counts - Benefits and Credits 2026

- ISED: Connecting Families Initiative 2.0

- Jumpstart: Individual Child Grants for Sports

- Prosper Canada: The Benefits Wayfinder Tool

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.