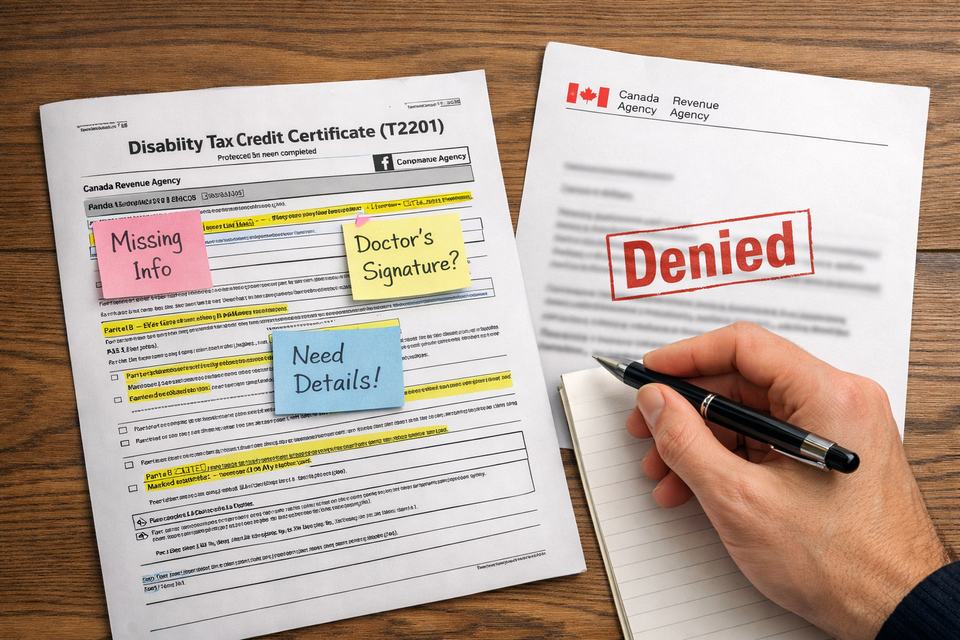

Disability Tax Credit (DTC) Application: How to Fix Common Rejection Errors

Receiving a rejection letter from the Canada Revenue Agency (CRA) is a soul-crushing experience, especially when you are already dealing with the physical, emotional, and financial toll of a severe impairment. For many, the Disability Tax Credit (DTC) isn't just a tax break—it is the essential "Golden Ticket" required to access the Canada Disability Benefit (CDB) and the Registered Disability Savings Plan (RDSP).

However, a denial is not the end of the road. In fact, many successful DTC recipients were denied on their first attempt. The CRA doesn't reject applications because they don't believe you are "sick"—they reject them because the Form T2201 failed to prove your functional limitations in the very specific language the tax law requires.

This is the Official 2026 Troubleshooting Guide for DTC rejections. We will decode your "Notice of Determination," explain the "3x Time" math, and show you exactly how to work with your doctor to fix the most common application errors.

Plan Your Financial Recovery

While you work on your appeal, stay on top of other scheduled payments. Bookmark our Master Payment Calendar 2026 to track your GST, Carbon Rebate, and provincial credits.

Frequently Asked Questions

Why was my Disability Tax Credit (DTC) application denied?

The most common reasons for DTC denial are insufficient medical evidence, failing to meet the "90% of the time" rule, or your doctor focusing on your diagnosis rather than your functional limitations. The CRA needs to know exactly how much longer it takes you to perform daily tasks compared to a person without your condition.

How do I appeal a DTC rejection in 2026?

You have three main options:

- Request a Review: Best if you have new medical information or your doctor missed a section.

- File a Formal Objection: A legal dispute filed within 90 days of your rejection letter.

- Reapply: Often the best choice if your condition has worsened or if your original doctor was not supportive.

Does receiving CPP Disability mean I automatically get the DTC?

No. This is a major misconception. CPP Disability and the DTC use different criteria. CPP-D focuses on your "ability to work," while the DTC focuses on your "activities of daily living." You can be too disabled to work but still be denied the DTC if you can walk, dress, and feed yourself within a reasonable amount of time.

Can I claim the DTC retroactively if I was previously denied?

Yes. If you are approved later, you can ask the CRA to adjust your taxes back as far as 10 years. However, you must prove that the impairment was just as severe in those previous years as it is today.

Step 1: Decoding the "Notice of Determination"

When the CRA denies your application, they send a Notice of Determination. Most people look at the "Denied" stamp and stop reading, but the real value is in the small print. Look for these specific 2026 rejection codes or phrases:

"The information provided does not describe a severe restriction..."

This is the most common error. It means your doctor likely listed your diagnosis (e.g., "Patient has Multiple Sclerosis") but didn't describe the effect. The CRA doesn't care about the name of the disease; they care that it takes you 30 minutes to walk 100 metres.

"The restriction is not present 90% of the time..."

If your condition is "episodic" (like Crohn's, Epilepsy, or certain Mental Health conditions), the CRA often argues that you are "fine" during your good periods. To beat this, you must prove that even during "good" days, the risk or the medication side effects result in a 90% restriction.

"The impairment has not lasted, or is not expected to last, for 12 months..."

The DTC is for prolonged impairments. If you apply 6 months after a major surgery, the CRA may deny you simply because they aren't sure if you will recover by month 12.

The "3x Time" Math: How to Prove Severity

The CRA uses a "Socially Unacceptable" time threshold for many categories. To qualify, you must prove that a basic activity of daily living takes you three times longer than a person of the same age without the disability.

$$Time_{Disabled} \ge 3 \times Time_{Average}$$

Example: Walking

- Average Person: Can walk 100 metres in about 1–2 minutes.

- DTC Qualifying Person: Takes 6+ minutes to walk 100 metres, or must stop frequently due to pain or shortness of breath.

If your doctor simply writes "Patient has difficulty walking," you will be denied. They must write: "Patient requires a cane and must stop every 20 metres to rest; a 100-metre walk takes approximately 8 minutes, which is significantly longer than an average peer."

Invisible Disabilities: Navigating the "Mental Functions" Criteria

One of the most difficult areas to get approved for in 2026 is the Mental Functions category. Unlike a physical restriction where a doctor can measure walking speed, mental impairments are "invisible." The CRA doesn't just want a diagnosis of Anxiety, Depression, or ADHD; they want to know how your brain fails to perform "Adaptive Functioning."

The "Memory and Judgment" Strategy:

To win a Mental Functions claim, your application must prove that you are unable to perform these tasks 90% of the time without significant help:

- Adaptive Functioning: Can you live alone safely? Do you forget to turn off the stove? Do you need someone to remind you to bathe or eat?

- Judgment: Can you manage your own finances? Do you understand the consequences of your decisions?

- Goal-Setting: Can you make and carry out a simple plan, like a grocery list or a doctor’s appointment?

The "Supervision" Hack:

If you require 24/7 supervision or "cues" (reminders) to perform basic daily tasks, you likely qualify. When your doctor fills out the form, they shouldn't just say "patient is forgetful." They must say: "Patient suffers from severe executive dysfunction and requires daily supervision to ensure basic hygiene is met and to prevent risks to personal safety."

The "Cumulative Effect" Loophole: When One Disability Isn't Enough

Many Canadians are denied because their disability isn't "severe enough" in one single category. For example, you can walk, but it's a bit slow. You can dress yourself, but it’s painful. Individually, these are "Significant Restrictions," not "Marked Restrictions."

The Math of the Cumulative Effect:

The CRA allows you to "add" two or more significant restrictions together. If the combined impact of these two issues is equal to one severe disability, you qualify.

- Example: You have moderate IBS (Eliminating) and moderate Fibromyalgia (Walking).

- The Argument: Because you spend 3x longer on the toilet AND 3x longer walking to the store, the total impact on your life is just as severe as someone who cannot walk at all.

Why this is a 7-day win:

Most doctors ignore this section because it’s at the back of the form. If you were denied because you weren't "disabled enough," look at your Notice of Determination. If it says you have "Significant but not Marked" restrictions, you should reapply or appeal using the Cumulative Effects section to bridge the gap.

Retroactive Payouts: Claiming the "10-Year Windfall"

The DTC is one of the few credits in Canada that allows you to reach back an entire decade. If your medical condition started in 2016, but you only applied in 2026, the CRA doesn't just give you the credit for this year—they owe you for the last ten.

The "Automatic Adjustment" Strategy:

On Part A of the T2201 form, there is a box that asks: "Do you want the CRA to adjust your previous tax returns?" - Always check YES. - The Result: If approved, the CRA will automatically recalculate your taxes from 2016 to 2025.

- The Payoff: For a single adult, the DTC can be worth roughly $1,500 to $2,000 per year in tax refunds. A 10-year retroactive approval can result in a lump-sum cheque of $15,000 to $20,000.

Note: If you are a newcomer on a Work Permit, your retroactive claim can only go back to the year you became a Canadian tax resident. Ensure your doctor clearly states the "Year the impairment began" matches your landing date to maximize this refund.

DTC and the RDSP: The $90,000 Opportunity

The real value of the DTC isn't just the tax break; it’s the access it gives you to the Registered Disability Savings Plan (RDSP). In 2026, the government has increased the matching grants for low-income families.

- The Grant: If you contribute $1,500, the government may add up to **$3,500** per year (a 3-to-1 match).

- The Bond: If your income is under $38,237, the government will just give you **$1,000 a year**, even if you contribute $0.

- The Lifetime Limit: You can receive up to $90,000 in free government money through the RDSP over your lifetime.

The "Carry Forward" Hack:

If you get approved for the DTC retroactively for 10 years, you also get the "Grant and Bond" room for those 10 years. In your first year of opening an RDSP, you could potentially receive $10,500 in matching grants in a single shot. This is why fixing a DTC rejection is the single most important financial move you can make in 2026.

Managing Your CRA My Account "Progress Tracker"

In 2026, the CRA has updated the Progress Tracker inside your My Account. You no longer have to call and wait on hold for hours to find out if you were approved.

- The Timeline: Currently, digital applications take 4 to 8 weeks, while paper applications can take 12 to 24 weeks.

- The "More Info" Flag: If your status changes to "Further information requested," it means the CRA has sent a questionnaire to your doctor. This is the critical moment. Call your doctor immediately to ensure they answer those specific follow-up questions, as a delay here is the #1 reason for a "technical denial."

Common Physician Errors (And How to Fix Them)

Your doctor is an expert in medicine, but they are often not experts in tax law. Most DTC rejections are actually "Doctor Errors."

Error 1: The "Diagnosis Only" Trap

Doctors often think the diagnosis is the proof.

- The Fix: Ask your doctor to focus on Function. Instead of "Patient has ADHD," they should write "Patient requires constant supervision and 3x more time to complete basic hygiene and feeding tasks due to severe deficits in executive function."

Error 2: Inconsistent Questionnaire Responses

After you submit the T2201, the CRA often sends a Follow-up Questionnaire to the doctor. If the doctor’s answers in the second form don't perfectly match the first form, the CRA will use the inconsistency to deny the claim.

- The Fix: Request a copy of the original T2201 from the CRA (or keep your own) and bring it to your doctor before they fill out the follow-up.

Error 3: Not Ticking the "Cumulative Effect" Box

If you have multiple moderate disabilities (e.g., you are partially deaf AND have moderate mobility issues), you might not qualify under one single category.

- The Fix: Use the Cumulative Effect section. This allows you to "add up" two or more restrictions that, together, equal a 90% severe restriction.

The Request for Review vs. Formal Objection

In 2026, you have two primary paths to fight a denial. Choosing the right one depends on why you were rejected.

Option A: Request for Review (Redetermination)

- When to use: Use this if you have new evidence.

- Process: Write a simple letter to your tax centre (Sudbury, Winnipeg, or Jonquière) titled "Request for Review of DTC Denial." Attach new letters from specialists, test results, or a more detailed letter from your GP.

- Pros: Faster than a formal objection. It keeps the file "open" with the medical assessors.

Option B: Formal Objection (Notice of Objection)

- When to use: Use this if the doctor’s info was perfect, but the CRA assessor made a mistake in interpreting the law.

- Process: You have 90 days from the date of the rejection. You can file this through the "Register my formal dispute" tool in CRA My Account.

- Pros: This moves your file to the Appeals Branch, a completely different department with different people. They are often more reasonable than the initial assessors.

The Newcomer Strategy: Foreign Medical Records

If you are a newcomer on a Work Permit or a recent PR, you might not have a long history with a Canadian doctor.

- The Problem: A Canadian doctor might say, "I’ve only known you for 2 months, I can't sign this."

- The Solution: Import your medical records from your home country. Use a certified translator if necessary. A Canadian doctor can use these records to "back-date" your eligibility, allowing you to claim the credit retroactively to the year you landed in Canada.

Why You Must Keep Fighting

In 2026, the stakes for the DTC have never been higher.

- Canada Disability Benefit (CDB): Without an approved DTC, you cannot receive the monthly CDB payments, which can be worth thousands of dollars per year.

- RDSP Grants: An approved DTC allows you to open an RDSP where the government may contribute up to $3 for every $1 you save.

- Child Disability Benefit: If you are a parent of a disabled child, the DTC adds a significant "Disability Supplement" to your monthly CCB payments.

Need Income While You Wait?

The DTC appeal process can take 16 to 24 weeks. If the financial strain of your disability is mounting, you may need accessible, low-stress work to help bridge the gap.

👉 Find Daily Pay Jobs at BetterPayJobs.ca

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Canada Revenue Agency: Review and decision process for the DTC

- Disability Alliance BC: Appealing a rejected DTC application

- Tax Court of Canada: Appeals and Procedures Guide

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.