Hidden Tax Credits Canada 2026: How to Get a Bigger Refund

Tax season in 2026 is officially here, and for many Canadians, the goal is simple: get every single dollar back from the CRA. While most people know about the Basic Personal Amount, there is a "Second Tier" of hidden credits—some new, some expanded—that can easily add $2,000 to $7,000 to your refund.

If you are following our Ultimate Savings Guide, you know that tax efficiency is the ultimate wealth builder. In 2026, the CRA has introduced stricter verification for the Canada Dental Care Plan (CDCP) and updated thresholds for the OAS Clawback, but they’ve also hidden some massive wins for families and workers.

This master guide is the "Golden List." We identify the credits most likely to be missed, explain the technical eligibility for the 2026 tax year, and reveal the Street Hacks to maximize your refund.

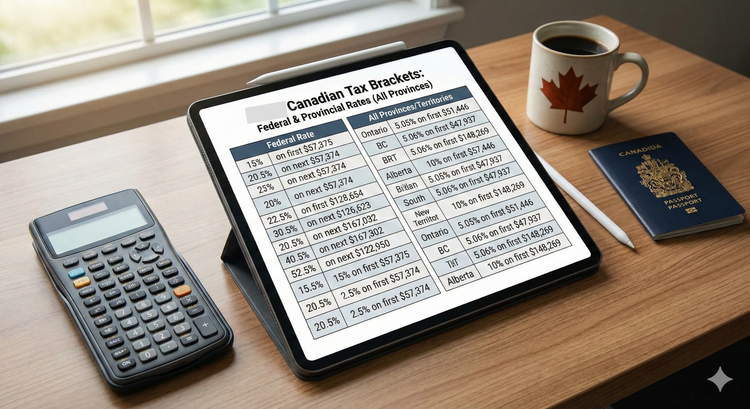

1. The 2026 Federal Tax Bracket Update

Before we dive into credits, you need to know the baseline. Federal tax brackets have been indexed for inflation for the 2026 tax year.

| Tax Rate | 2026 Taxable Income Threshold |

| 15% | On the first $58,523 or less |

| 20.5% | On the portion over $58,523 up to $117,045 |

| 26% | On the portion over $117,045 up to $181,440 |

| 29% | On the portion over $181,440 up to $258,482 |

| 33% | On the portion over $258,482 |

Note: Your provincial tax rates (like Ontario GAINS or Alberta Seniors Benefit eligibility) are added on top of these federal rates.

2. The Multigenerational Home Renovation Tax Credit (MHRTC) - Line 45355

This is the biggest "Hidden" win for 2026. If you built a "Granny Suite" or a secondary unit to house a senior or a person with a disability, the government owes you thousands.

- The Credit: 15% of your eligible expenses, up to $50,000.

- The Refund: A refundable tax credit of up to $7,500.

- The Requirement: The suite must be a self-contained unit with a private entrance, kitchen, and bathroom. The occupant must be a senior (65+) or an adult eligible for the Disability Tax Credit (DTC).

3. The Canada Training Credit (CTC) - Line 45350

If you took a course to upgrade your skills in 2025 or early 2026, you likely have a "hidden" balance waiting for you at the CRA.

- The Credit: You can claim up to 50% of your tuition fees, limited by your "Training Limit."

- The Hack: Your "Training Limit" grows by $250 every year you file taxes, up to a lifetime maximum of $5,000.

- The Strategy: Check your latest Notice of Assessment (NOA). If you see a "Canada Training Credit Limit," that is literally cash the government has set aside for you. Use it to pay for that coding bootcamp or trade certification.

Tax Hacking

This deep dive identifies the specific "Street Angles" and scams that are circulating in 2026. Mastering these ensures you stay safe while getting paid.

1. The "Grocery Rebate" Scam Warning

A high-traffic query for 2026 is "Canada grocery rebate 2026 payment date."

- The Street Angle: There is significant disinformation online claiming a new $628 grocery rebate is coming in January 2026.

- The Reality: This is a scam. The Canada Revenue Agency has confirmed that the Grocery Rebate was a one-time payment in 2023. There is no such rebate for the 2026 tax year.

- The Move: Do not click on texts or emails asking you to "Apply" for a grocery rebate. If the government announces new inflation relief, it will appear automatically in your GST/HST Credit payment.

2. Volunteer Firefighters & Search and Rescue Credits

In 2026, the government increased the recognition for our first responders.

- The Hack: If you performed at least 200 hours of eligible volunteer service, you can claim a $6,000 non-refundable tax credit (Line 31220 or 31240).

- The Strategy: If you do both firefighting and search and rescue, you can combine your hours to hit the 200-hour mark, but you can only claim one of the two credits. This results in an automatic $900 reduction in your federal tax bill.

3. The "Medical Travel" Loophole

Many Canadians travel to major hubs like Toronto or Vancouver for surgery. They search for "medical expense tax credit travel."

- The Hack: If you had to travel at least 40 kilometres (one way) to get medical services not available near you, you can claim the cost of gas and parking.

- The "Street" Hack: If you traveled at least 80 kilometres, you can also claim meals and accommodation.

- The Strategy: Use the "Simplified Method" for meals (approx. $23 per meal, no receipts required) to maximize this credit without the paperwork headache.

4. Digital News Subscription Credit: Status 2026

A common search is "Can I claim my Globe & Mail subscription on my 2026 taxes?"

- The Update: This credit was officially closed for the 2025 tax year onwards.

- The Reality: If you are filing for previous years, you can still claim it, but for your 2026 return, this $500 claim is gone. Don't waste time looking for it on your current form.

5. First-Time Home Buyers' Tax Credit (HBTC) - Line 31270

For newcomers following our FHSA for Newcomers Guide, this is a must.

- The Value: A $10,000 non-refundable tax credit.

- The Refund: A flat $1,500 off your tax bill.

- The Hack: You can split this credit with your spouse. If only one of you is working, the working spouse should claim the full $10,000 to maximize the tax reduction.

5. 2026 "Hidden" Credit Checklist

| Credit | Line | Max Value | Who is it for? |

| MHRTC | 45355 | $7,500 | Families building a "Granny Suite" |

| Canada Training Credit | 45350 | $1,000 (Avg) | Workers upgrading skills |

| Volunteer Firefighter | 31220 | $900 | Volunteer first responders |

| Canada Caregiver | 30450 | $1,200+ | Those caring for infirm parents |

| Canada Workers Benefit | 45300 | $1,518 | Low-income workers |

Hidden Tax Credits Canada 2026

What are the top hidden tax credits for Canadians in 2026? The most significant "hidden" credit is the Multigenerational Home Renovation Tax Credit (MHRTC), which offers a refundable **$7,500** for building secondary suites. Other key credits include the Canada Training Credit (up to 50% of tuition), the Volunteer Firefighter Credit ($900 value), and the Home Accessibility Tax Credit for seniors. Note that the Digital News Subscription Credit has been discontinued for 2026, and any "Grocery Rebate" offers are currently scams.

Frequently Asked Questions (FAQ)

Q: Is the Canada Dental Benefit still active?

A: The interim benefit for children under 12 has been replaced by the Canadian Dental Care Plan (CDCP). You must renew your CDCP coverage by June 1, 2026, to avoid losing coverage.

Q: Can I claim my home office in 2026?

A: The "Flat Rate" ($2/day) method ended in 2023. For 2026, you must use the Detailed Method, which requires a signed Form T2200 from your employer.

Q: Do I get more money if I am 75+?

A: Yes. Your OAS benefit is 10% higher, and the Age Amount (Line 30100) threshold has increased for 2026, providing a larger tax-free income base.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Canada.ca: Tax rates and income thresholds for individuals - 2026

- CRA: Multigenerational Home Renovation Tax Credit (MHRTC) Guide

- CRA: Canada Training Credit - Line 45350 Eligibility

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.