Uncashed Cheques: How to Find Old CRA Payments in Your My Account

Imagine logging into your bank account and finding a few hundred dollars you forgot existed. Now imagine that instead of a few hundred, there is a $1.4 billion pile of cash waiting for millions of Canadians. This isn't a scam or a "get rich quick" scheme; it is the reality of the Canada Revenue Agency’s (CRA) uncashed cheque database.

Every year, thousands of tax refunds, GST/HST credits, and Canada Child Benefit payments are mailed out as paper cheques. Many of these are lost in the mail, sent to old addresses, or simply forgotten in a junk drawer. Because Government of Canada cheques never expire, that money stays in the government’s hands until you claim it.

This is the Hidden Gem Guide to reclaiming your lost money. We will walk you through the 2-minute "treasure hunt" in your CRA My Account, the specific forms you need to sign, and the "Witness Rule" that often stops people from getting their cash.

Pro Tip: Before you start looking for old money, make sure you know when your new money is coming. Check our Master Payment Calendar 2026 to stay updated on all upcoming 2026 deposit dates.

Official 2026 Guide: Finding Your Uncashed Cheques

Follow these steps exactly to see if the CRA is holding your money.

The CRA launched a specific tool in February 2020 to help Canadians track down these "lost" payments. Here is how to access it in 2026:

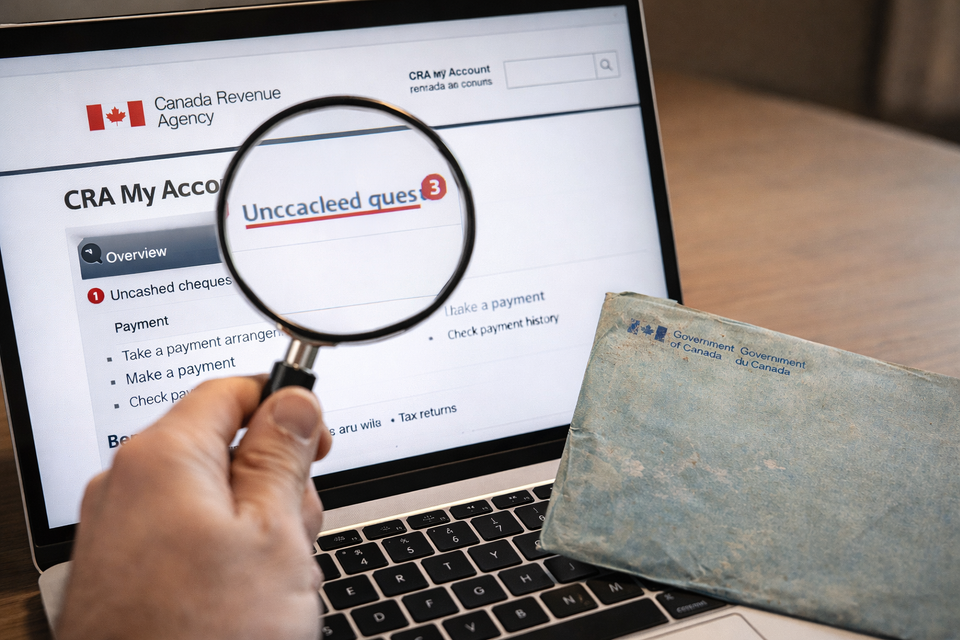

- Log In: Access your CRA My Account via the official Government of Canada sign-in partner (your bank) or CRA User ID.

- Navigate: On the main "Overview" page, look at the right-hand sidebar.

- The Link: Under the "Related services" section, click the link that says "Uncashed cheques".

- The List: If you have money waiting, a list will appear showing the date the cheque was issued, the type of payment (e.g., Income Tax Refund), and the exact amount.

What if the list is empty?

If it says "You have no uncashed cheques," it means you are up to date. However, if you see a list, you are looking at money that has been sitting stagnant for at least 6 months.

Quick Answers: CRA Uncashed Cheques

How do I find my uncashed CRA cheques?

You can find uncashed cheques by logging into CRA My Account and selecting "Uncashed cheques" from the "Related services" menu on the right. This section lists all government payments (tax refunds and benefits) that were issued by cheque more than six months ago but have not yet been deposited.

Do Government of Canada cheques expire?

No. Government of Canada cheques never expire and are not subject to "stale-dating" like private personal cheques. You can cash a government cheque regardless of how old it is, though banks may verify older cheques for security before releasing the funds.

How long does it take to get a replacement CRA cheque?

Once you submit Form PWGSC 535 (Undertaking and Indemnity), it typically takes 6 to 12 weeks for the CRA to process the request and issue a replacement payment. This timeline is faster if you are registered for direct deposit, as the funds will be sent electronically once the trace is complete.

Why Do Cheques Go Uncashed? (The Street Reality)

You might wonder, "How could anyone forget a $500 tax refund?" In reality, it happens to millions of people for very simple reasons:

- The Move: You moved from an apartment in North York to a house in Scarborough and forgot to update your address with the CRA. The cheque was delivered to your old landlord, who either threw it away or returned it to sender.

- The Student Gap: International students and young workers often move every 12 months. Since the GST credit and ACWB payments are spread throughout the year, at least one cheque almost always gets sent to a previous address.

- Estate Issues: When a family member passes away, their final tax refund is often issued as a paper cheque. If the executor doesn't know to look for it, that money sits in the "Uncashed" database for decades.

- The "Junk Mail" Filter: CRA envelopes are plain. Many people mistake them for generic government notices or "junk mail" and toss them without opening them.

The Form PWGSC 535: Your Key to the Cash

If you find a cheque on your list, you cannot just click a button to "send it again." Because a physical cheque was already printed, the CRA needs a legal document stating you never received it or that it was destroyed.

This document is Form PWGSC 535 (Undertaking and Indemnity).

Step 1: Download the Pre-Filled Form

In the "Uncashed cheques" section of My Account, click on the specific cheque you want to claim. The system will generate a pre-filled PDF with the cheque number and amount already typed in.

Step 2: The "Witness" Rule (Don't Skip This!)

This is where most people fail. Form 535 requires a witness signature.

- The Witness: Must be a person who knows you.

- The Restriction: They cannot be a family member.

- The Requirement: They must sign by hand and provide their address and occupation.

Step 3: The "Wet Signature"

The CRA is very old-school about this form. They do not accept digital signatures (like DocuSign). You must print the form, sign it with a pen (a "wet signature"), have your witness sign it with a pen, and then scan it back into your computer.

Step 4: Submitting via My Account

Do not mail the form if you can avoid it.

- Go back to My Account.

- Click "Submit documents".

- Select "No" for the case reference number.

- Choose the topic "Other" and then "Send Form PWGSC 535".

- Upload your scanned PDF.

How Much Money is Waiting?

The volume of uncashed money is staggering. As of the last major audit, there were approximately 8.9 million uncashed cheques worth over $1.4 billion.

The average amount per cheque is roughly $158. While that might not seem like a fortune, many users find multiple cheques from several years of Ontario Trillium Benefit or GST payments, leading to a "windfall" of $500 to $1,000.

$$Total\ Unclaimed\ Funds \approx 8,900,000\ cheques \times \$158.00\ average = \$1,406,200,000$$

If we break this down by province, Ontario residents typically hold the largest share of this "hidden" wealth simply due to population density and the number of provincial credits issued via the CRA.

Frequently Asked Questions

What if I still have the original physical cheque?

If you found an old cheque from 2018 in a book, you don't need to fill out any forms! Since government cheques never expire, you can take it to any bank. Note that a teller may need to call the CRA to verify the cheque is still valid (not cancelled), but they are legally required to cash it if it is legitimate.

Can the CRA take this money to pay my debts?

Yes. If you claim an uncashed cheque for $300, but you owe the CRA $500 in back taxes, they will not send you the cash. Instead, they will apply the $300 to your debt and send you a notice that your balance has been reduced. This is still a "win" as it stops interest from accruing on your debt.

I don't have a CRA My Account. How do I check?

If you cannot get online, you must call the CRA General Enquiries line at 1-800-959-8281. Be prepared for long wait times. You will need to provide your Social Insurance Number (SIN) and details from your last tax return (Line 15000) to verify your identity before an agent will check the uncashed cheque database for you.

Reclaiming "Family Wealth": Uncashed Cheques for Deceased Relatives

One of the most overlooked "hidden gems" in the CRA database is money belonging to family members who have passed away. When a person dies, their OAS & CPP payments and final tax refunds often continue to be issued by cheque until the estate is settled. If these cheques were never cashed, they sit in the CRA's vault indefinitely.

The "Representative" Strategy:

You cannot see these cheques in your My Account. To find them, you must be the legal representative (executor) of the estate.

- Authorization: You must first be registered with the CRA as the legal representative for the deceased.

- Represent a Client: Log in to the "Represent a Client" portal (separate from your personal My Account).

- Search: Once authorized, you can view the uncashed cheques for the deceased person just as you would for yourself.

- The Payout: The replacement cheque will be issued to "The Estate of [Name]".

Note: If you find a cheque for a deceased relative but are not the executor, you must contact the person handling the estate. That money belongs to the estate's beneficiaries and can often be used to pay off final funeral costs or estate taxes.

Troubleshooting Form 535: Why the CRA Rejects Claims

Even after finding the money, many Canadians fail at the finish line because of small technical errors on Form PWGSC 535. In 2026, the CRA's automated scanning system is more rigid than ever. If your form has a single error, it will be rejected, and you will have to wait another 6 weeks to try again.

The "No-Digital" Rule (Most Common Error):

In a world of DocuSign, it is tempting to sign the PDF digitally. Do not do this. The CRA strictly requires a "Wet Signature" (ink on paper).

- Fix: Print the form, sign with a blue or black pen, and then scan it back to your computer.

The "Witness Address" Trap:

Your witness must be a non-relative. However, the most frequent reason for rejection is that the witness forgot to provide their full address including the postal code.

- Fix: Ensure the witness writes their name, signature, AND current residential address clearly below their signature.

Finding "Old" Provincial Money (The Bank of Canada Hub)

Many users get confused between CRA uncashed cheques and Unclaimed Property. These are two different piles of "Lost Money."

- CRA Cheques: These are strictly government payments (GST, CCR, refunds) that stay with the CRA.

- Unclaimed Property: This is money from old bank accounts, forgotten insurance payouts, or uncashed utility refunds.

The "10-Year Rule":

If a bank account is inactive for 10 years, the money is transferred to the Bank of Canada.

- The Strategy: If you check your CRA account and find nothing, your next stop should be the Bank of Canada Unclaimed Property Office. In 2026, they are currently holding over $1.1 Billion in balances. Unlike CRA cheques, these balances do eventually expire after 30–100 years, so time is of the essence.

The "6-Month Wait" Rule

If you are missing a cheque from last month, it will not show up in the "Uncashed cheques" section yet.

- The Logic: The CRA only classifies a cheque as "Uncashed" once it has been sitting for at least 6 months.

- What to do if it's recent: If your Alberta Child Benefit or Ontario Trillium Benefit cheque was lost in the mail two weeks ago, you must call the CRA general enquiries line at 1-800-959-8281 to initiate a "Trace" manually. You cannot use the online self-service tool for recent payments.

Special Cases: Non-Residents & International Claims

If you lived in Canada for a few years on a Work Permit and have since moved back to your home country, you likely have uncashed tax refunds waiting.

The Challenge: The "Submit Documents" feature in My Account sometimes glitches if you are using an international IP address.

- The Solution: If you are outside Canada, you can mail the physical Form PWGSC 535 to the Sudbury Tax Centre.

- Direct Deposit Tip: The CRA can now wire these funds to foreign bank accounts in certain countries, avoiding the risk of sending another paper cheque overseas where it might get lost again.

Protecting Your "Treasure" from Scams

Because "Uncashed Cheques" is a trending topic, scammers are sending fake text messages saying, "CRA has found an uncashed cheque for you! Click here to claim your $450."

The Rule: The CRA will never text you about an uncashed cheque. They will only notify you through:

- CRA My Account notifications.

- Official paper mail.

- The "Nudge" letters sent to your email (which tell you to log in, but never provide a direct link to the money).

Street Reality: The "Direct Deposit" Solution

The best way to ensure you never have an "uncashed cheque" again is to delete the cheque entirely.

Over 80% of Canadians now use direct deposit. When you are registered, the money hits your bank account at 3:00 AM on payment day. There is no mail to lose, no landlord to intercept it, and no forms to sign.

- In My Account, click on "Direct deposit".

- Enter your Transit Number, Institution Number, and Account Number.

- The Result: Future Canada Disability Benefits or tax refunds will be deposited automatically.

Need Cash Faster?

Reclaiming an uncashed cheque takes 6 to 12 weeks. If you are in a financial pinch today, waiting for the CRA to process Form 535 isn't going to help you pay this month's rent. You need a way to earn money that hits your account in days, not months.

👉 Find Daily Pay Jobs at BetterPayJobs.ca

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Canada Revenue Agency (CRA): Uncashed cheques from the CRA - Official Guide

- CPA Canada: How to check for unclaimed CRA cheques

- Financial Consumer Agency of Canada: Cashing a Government of Canada cheque

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.