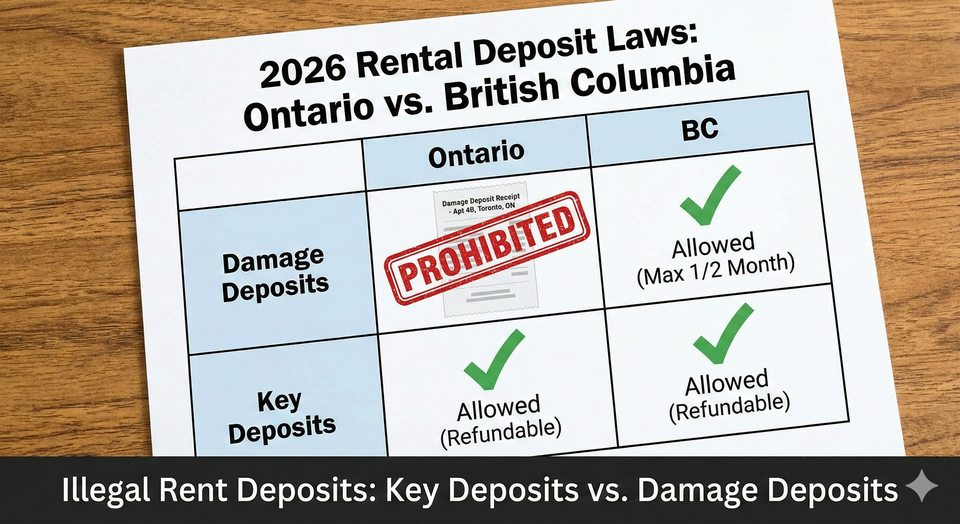

Illegal Rent Deposits: Key Deposits vs. Damage Deposits (2026)

The 2026 rental market has become a high-stakes environment where every dollar counts. As tenants navigate the Ultimate Guide to Renting in Canada's Housing Crisis (2026), the "upfront cost" of securing a home has skyrocketed. In major hubs like Toronto, Ottawa, Vancouver, and Victoria, landlords are increasingly asking for "extra" security to protect their investments.

However, many of these demands are flatly illegal. Depending on which province you are in, the words "Damage Deposit" could either be a standard legal requirement or a major red flag for a rental scam. In Ontario, the law is designed to keep your upfront costs low, while in BC, a deposit-based system is used to balance risk.

This master guide provides a breakdown of what your landlord can and cannot legally charge you in 2026. We will compare the strict "No-Damage" rules in Ontario with the "50/50" rules in British Columbia, ensuring you never pay a cent more than the law requires.

The Ontario Reality: Damage Deposits are 100% Illegal

If you are renting a home in Ontario in 2026, there is one rule you must memorize: Landlords cannot collect a security or damage deposit. Under the Residential Tenancies Act (RTA), any money collected that isn't for a "rent deposit" or a "refundable key deposit" is illegal.

1. The Last Month's Rent (LMR) Deposit

The only major deposit allowed in Ontario is the Last Month's Rent deposit.

- The Limit: It cannot exceed the rent for one rental period (typically one month).

- The Use: This money is not a "security" fund. It is literally your rent for the very last month you live in the unit. The landlord cannot use it to fix a hole in the wall or clean the carpets.

- The 2026 Interest: Landlords must pay you interest on this deposit every year. For 2026, the interest rate is 2.1%, matching the Ontario Rent Increase Guideline. Usually, the interest is "rolled over" to cover the small increase in your last month's rent.

2. Prohibited Fees in Ontario (2026)

Landlords often try to sneak these into the "Schedule B" of a lease. In 2026, all of the following are void and unenforceable:

- Pet Deposits: Even if you have a 100-pound dog, a landlord cannot ask for an extra $500.

- Cleaning Fees: Charging $200 for a "professional clean" at the end of the tenancy is illegal.

- Application Fees: Charging you $50 just to look at your credit score is against the law.

- Damage Deposits: Any fund meant to cover potential repairs is illegal.

The British Columbia Reality: The "50/50" System

British Columbia operates on a completely different philosophy. In 2026, BC landlords can and will ask for a security deposit, but it is strictly capped by the Residential Tenancy Branch (RTB).

1. The Security (Damage) Deposit

- The Limit: Exactly half of one month's rent. If your rent is $2,400, your security deposit is exactly $1,200.

- Timing: You must pay this within 30 days of the tenancy starting. If you don't, the landlord can issue an eviction notice.

2. The Pet Damage Deposit

- The Limit: Another half of one month's rent. This means if you have a pet in BC, your total deposit is one full month of rent ($1,200 for damage + $1,200 for pet).

- 2026 Interest: For 2026, the BC government has set the interest rate on deposits at 0% due to the low-interest environment calculated at the end of 2025. This is a drop from the 0.95% seen in 2025.

3. The 15-Day Return Rule

In BC, the "tug-of-war" over deposits happens when you move out.

- The Law: Once you provide your forwarding address in writing, the landlord has 15 days to either return the full deposit or apply for "Dispute Resolution" with the RTB to keep it.

- The Penalty: If they miss this 15-day window without your written permission to keep the money, they may be ordered to pay you double the deposit back.

Key Deposits: The Universal Rules for 2026

Both Ontario and BC allow for refundable key deposits, but this is where many "mini-scams" occur.

| Rule | Ontario (2026) | British Columbia (2026) |

| Legal? | Yes | Yes |

| Amount? | Actual Replacement Cost | Reasonable Replacement Cost |

| Refundable? | Mandatory | Mandatory |

| Fobs/Cards? | Included | Included |

The "Actual Cost" Test: If a landlord asks for a $200 key deposit for a standard metal key that costs $5 to cut at Canadian Tire, that deposit is illegal. You only have to pay what the key actually costs to replace. For a high-tech condo fob, $50–$100 is generally considered the legal limit in 2026.

The 2026 Security Deposit Master Strategy

Navigating the financial side of a new lease in 2026 requires a high degree of skepticism. As rents climb, landlords are looking for any way to mitigate the risk of a "bad" tenant. This often results in them asking for illegal deposits to "guarantee" the property's condition. If you find yourself in this situation, you need a multi-step defense.

1. The "Move-In First" Strategy (Ontario)

If you are applying for an apartment in a competitive city like Ottawa or Toronto, and the landlord demands a $1,000 "Damage Deposit," you are in a difficult spot. If you refuse, you won't get the apartment.

- The T1 Hack: In 2026, savvy tenants are paying the illegal deposit just to secure the unit. Once they have the keys and are safely moved in, they file a T1 Application (Tenant Application for a Rebate) with the Landlord and Tenant Board.

- The Result: The Board will order the landlord to return the illegal money plus the $50 filing fee. You cannot be evicted for doing this; it is your legal right to reclaim illegal charges.

2. The Condition Inspection Shield (BC)

In British Columbia, the only way a landlord can legally keep your deposit is if they performed a Move-In and Move-Out Inspection.

- The Move-In: If the landlord did not walk through the unit with you and fill out the official Condition Inspection Report on the day you moved in, they lose the right to claim against your deposit for damages.

- The Strategy: Many 2026 landlords are busy and skip the paperwork. If they didn't do the report, do not remind them! Their laziness is your financial protection. When you move out, you can demand your full deposit back, and they will have no evidence to stop you.

3. Fighting "Key Money" Scams

A rising trend in 2026 is "Key Money"—a non-refundable fee charged just to hand over the keys.

- The Law: This is 100% illegal across Canada. A key deposit must be refundable.

- The Proof: Always ask for a receipt that specifically uses the word "Deposit." If the receipt says "Non-refundable Key Fee," that is your evidence for a future Cash for Keys negotiation or a Tenancy Board hearing.

4. Deposits and Your Benefits

If you are relying on provincial supports like BC PWD or Ontario Works to cover your move-in costs, you may be eligible for a Security Deposit Loan or a Discretionary Health Benefit.

- The Benefit Hack: Most provinces will provide a one-time grant or loan for a legal deposit. However, they will not pay for an illegal one. If your caseworker sees a request for a $1,000 damage deposit in Ontario, they will deny the claim. Ensure your landlord provides a breakdown that matches the Master Payment Schedule requirements.

5. The "Forwarding Address" Trap

In 2026, many tenants lose their BC security deposits because they forget to provide a forwarding address.

- The Protocol: On the day you move out, send your landlord a registered letter or an email (if your lease allows for electronic service) containing your new address.

- The Timer: The 15-day clock for the landlord to return your money only starts after they receive this address. If you wait 6 months to give them your address, they don't have to pay you any interest for those 6 months.

Illegal Rent Deposits 2026

Are damage deposits legal in Ontario? No, damage deposits and pet deposits are illegal in Ontario in 2026. Landlords can only collect a Last Month’s Rent (LMR) deposit and a refundable key deposit. In BC, damage deposits are legal but are capped at 50% of one month’s rent. Key deposits in both provinces must not exceed the actual replacement cost of the keys or fobs. If you have paid an illegal deposit in Ontario, you can file a T1 application for a full rebate.

Frequently Asked Questions (FAQ)

Q: Can my landlord ask for 6 months of rent upfront?

A: In Ontario, they cannot demand it, but a tenant can offer it to secure an apartment if they have no credit history. However, once you are in, that money is technically an "illegal deposit" and you can apply to have it returned or applied to future rent months.

Q: Does my key deposit earn interest?

A: No. Unlike the Last Month's Rent deposit in Ontario, key deposits do not earn interest. They are simply held and returned in full.

Q: My BC landlord says they need to keep the deposit for "cleaning." Is that allowed?

A: Only if you left the unit "unreasonably" dirty. A landlord cannot deduct for "Normal Wear and Tear" (like dust on the baseboards or a few scuffs on the floor). They must have your written permission to keep any part of the deposit for cleaning.

Q: What if I shared a kitchen with the landlord?

A: In this case, the Roommate Rights rules apply. The RTA does not protect you, and the landlord can charge whatever deposits they want because it is a private contract.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- CLEO: Ontario Rent Deposits - What is Legal and What is Not

- Province of British Columbia: Tenancy Deposits and Fees - Official 2026 Rules

- Steps to Justice: Can a landlord ask for a security deposit in Ontario?

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.