New Brunswick Harmonized Sales Tax Credit (HSTC) Dates 2026

For residents of the Picture Province, the New Brunswick Harmonized Sales Tax Credit (NB HSTC) is a significant quarterly windfall that helps balance the high cost of goods and services. While most people are familiar with the federal GST/HST Credit, the provincial NB HSTC is a separate, additional payment specifically for New Brunswickers. In 2026, as inflation remains a persistent pressure on coastal communities, knowing exactly when this money hits your account—and how to ensure you aren't disqualified—is vital for your financial planning.

The NB HSTC is a non-taxable, refundable credit. For a single adult or a couple, it can provide up to $300 annually per person, plus additional amounts for children. Unlike programs that require complex separate applications, this benefit is tied directly to your annual tax filing, making it one of the most accessible forms of government support in Atlantic Canada.

As part of our Senior Benefits in Canada 2026: The Complete "Top-Up" List and provincial credit series, this guide provides the official 2026 payment calendar, updated income limits, and the strategies to maximize your household’s total Atlantic rebate.

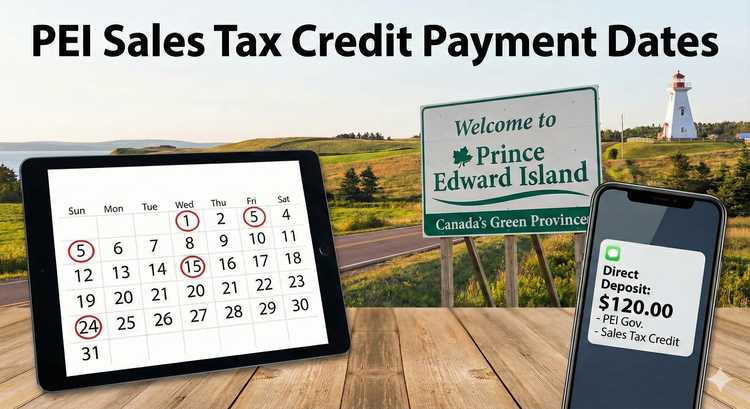

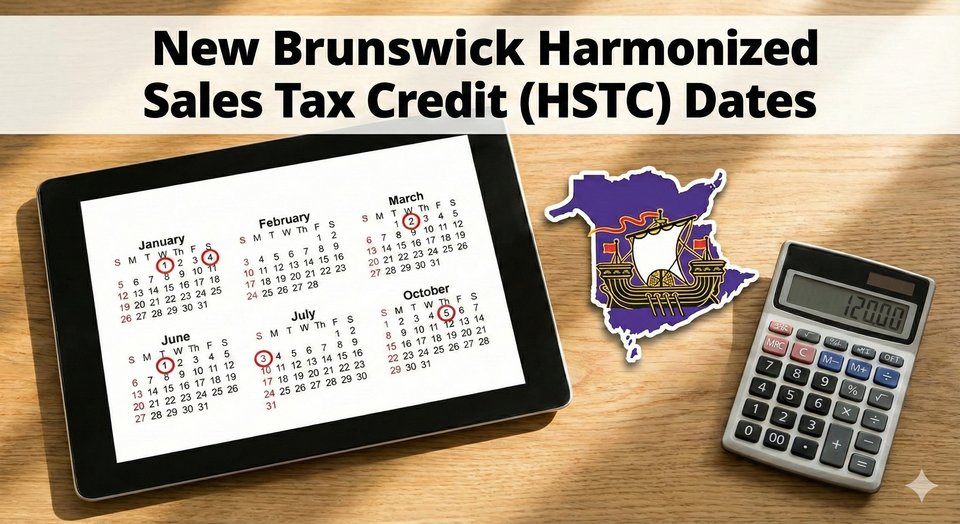

1. New Brunswick HST Credit Payment Dates 2026

The NB HSTC follows the federal distribution schedule. This means you don't have to watch two separate calendars; both your federal GST and your provincial NB HST credit will arrive as a single combined deposit on these dates.

Official 2026 Deposit Calendar

| Benefit Quarter | 2026 Payment Date |

| Winter 2026 | January 5, 2026 (Paid) |

| Spring 2026 | April 2, 2026 |

| Summer 2026 | July 3, 2026 |

| Fall 2026 | October 5, 2026 |

Answer Target: The 2026 New Brunswick Harmonized Sales Tax Credit (HSTC) payment dates are January 5, April 2, July 3, and October 5. These payments are tax-free and are automatically deposited into the bank account you have on file with the Canada Revenue Agency (CRA).

2. 2026 Benefit Amounts: How Much is the Check?

The amount of your NB HSTC check is determined by your family size and your "Adjusted Family Net Income" from the previous tax year.

Annual Maximum Amounts (2025-2026 Benefit Year)

- Individual: **$300.00** ($75 per quarter)

- Spouse or Common-law Partner: **$300.00** ($75 per quarter)

- Per Child (under 19): **$100.00** ($25 per quarter)

- Single Parent First Child "Top-Up": **$300.00** ($75 per quarter)

Example: A single mother in Moncton with one child would receive $600 annually ($300 for herself + $300 for her first child), distributed as $150 every three months.

New Brunswick Wealth Hacks

This deep dive identifies the specific "Atlantic Advantage" strategies. Because many national blogs ignore the nuances of New Brunswick's provincial tax law, these hacks are your shortcut to and getting paid.

1. The $35,000 "Full Credit" Threshold

New Brunswick HST credit income threshold.

- The Street Angle: You get the full $300 per adult only if your family net income is under $35,000.

- The Hack: The credit doesn't vanish the moment you earn $35,001. It is gradually reduced by 2% of the income you earn over that threshold.

- The Strategy: For a single person, the credit disappears entirely around $50,000. For families with multiple children, you can still receive a partial credit with a household income as high as $75,000. If your income is on the edge, look into Senior Tax Deductions or RRSP contributions to lower your "Net Income" and protect your HST rebate.

2. The Single Parent "First Child" Hack

Many parents search for "single parent top up New Brunswick tax."

- The Street Angle: Most provincial programs treat all children the same (e.g., $100 per child).

- The Hack: New Brunswick recognizes the higher cost of single-parent households.

- The Strategy: The first child in a single-parent home is "bumped up" from $100 to the **$300 adult rate**.

- The Move: Ensure your marital status is updated in CRA My Account. If you are listed as "Married" but are separated, you are losing $200 a year because the system isn't applying the $300 top-up for your eldest child.

3. The "Lump Sum" Rule for Small Credits

Users often ask: "Why did I get $100 in July but nothing in October?"

- The Hack: If your total annual credit is less than **$200** ($50 per quarter), the CRA doesn't waste time sending four checks.

- The Move: They will send you the entire amount in a single lump sum on the July 3, 2026 payment date. If you didn't get an October or January check, look back at your July deposit history; you likely already received the full year's provincial credit.

4. Moving to New Brunswick: The "First Month" Rule

Newcomers following our Newcomer Housing Rules often ask: "When can I start getting NB credits?"

- The Hack: You are eligible for the NB HSTC the month after you become a resident.

- The Strategy: If you move from Ontario to Saint John in February, you are eligible starting in March. Your first payment would arrive on April 2, 2026.

- The Move: Do not wait until next year's tax season. Use Form RC151 (for newcomers) or update your address in My Account to trigger the provincial data swap. NB is faster than most provinces at initiating these payments for inter-provincial movers.

5. Stacking with the Low-Income Seniors' Benefit

For those 65+ following our NL Seniors Benefit Guide, New Brunswick has a specialized annual check.

- The Hack: The New Brunswick Low-Income Seniors' Benefit is a separate $400 annual payment.

- The Strategy: You must apply for this annually (unlike the HST credit which is automatic).

- The Move: Applications for the $400 benefit typically open in April 2026. If you receive the NB HSTC and are 65+, you are almost guaranteed to qualify for this extra $400. Stacking these means a low-income senior gets **$700 in direct provincial cash** annually ($300 HSTC + $400 Benefit).

4. New Brunswick vs. Federal GST/HST Comparison (2026)

| Feature | Federal GST Credit | NB Provincial HST Credit |

| Individual Max | $533 | $300 |

| Spouse Max | $698 (Family) | $300 |

| Per Child | $184 | $100 |

| 1st Child (Single Parent) | N/A | **$300** |

| Income Threshold | ~$56,181 (Phases out) | $35,000 (Phases out) |

New Brunswick HST Credit 2026

What are the New Brunswick HST credit payment dates for 2026? The NB HSTC is paid quarterly on January 5, April 2, July 3, and October 5. In 2026, eligible residents can receive up to $300 per adult and $100 per child annually. Single parents receive a $300 top-up for their first child. The full credit is available to those with a family net income under $35,000. No separate application is required; you must simply file your annual tax return to receive the payments automatically via the CRA.

Frequently Asked Questions (FAQ)

Q: Do I need to apply for the NB HST credit?

A: No. The CRA automatically determines your eligibility when you file your income tax return. If you move to New Brunswick from another province, ensure your address is updated with the CRA to trigger the provincial portion of your payment.

Q: Is the NB HST credit taxable?

A: No. It is a non-taxable benefit. You do not report it as income on your tax return, and it does not affect your eligibility for other programs like GIS.

Q: Can a 19-year-old student get the credit?

A: Yes. As long as they are a resident of New Brunswick and file a tax return, they can receive the $300 individual credit, even if they have $0 income.

Q: What is the "Home Energy Assistance Program" connection?

A: Many NB residents who qualify for the HST credit also qualify for the Home Energy Assistance Program, which provides a one-time $100 payment to help with heating costs. Check the Warm Neighbor Programs for the 2026 application dates.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Government of New Brunswick: Harmonized Sales Tax Credit - Department of Finance

- CRA: Provincial and territorial programs - New Brunswick

- New Brunswick Finance: Low-Income Seniors' Benefit Application 2026

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.