Newcomer Guide to Filing Your First Tax Return in Canada (Get Benefits Back-Pay)

Welcome to Canada! If you arrived in 2025 on a Work Permit, Study Permit, or as a Permanent Resident, your first big financial milestone is fast approaching: the April 30, 2026, tax deadline.

For many newcomers, the word "taxes" sounds like an expense. In Canada, it is often the opposite. Because our system uses tax returns to calculate social support, filing your first return is the only way to receive "back-pay" for benefits you were eligible for the moment you landed but haven't received yet.

This is the Official 2026 Newcomer Tax Guide. We simplify the jargon, explain the "World Income" rule, and show you how to claim your retroactive GST/HST credits and provincial benefits even if you had $0 income in Canada last year.

Quick Answers: First-Time Tax Filing

Do I have to file a tax return if I only arrived in late 2025?

Yes. If you established "residential ties" (like renting an apartment or opening a bank account), the CRA considers you a resident for tax purposes. Even if you only lived here for one month and earned no money, you must file to receive your benefits and to "start the clock" on your future RRSP and TFSA contribution room.

What is the deadline for filing my first tax return in 2026?

The deadline for most individuals is April 30, 2026. If you or your spouse are self-employed, you have until June 15, 2026, to file, but any taxes you owe must still be paid by the April 30th deadline to avoid interest.

Can I get "back-pay" for benefits I missed?

Absolutely. Many newcomers qualify for the GST/HST Credit and the Canada Carbon Rebate starting from their date of entry. When you file your first return, the CRA will automatically calculate what you were owed for the months you were here and send it as a lump-sum payment.

The "Benefits Back-Pay" Strategy

The most important reason to file as a newcomer is the Retroactive Benefit Claim.

When you land in Canada, you are often eligible for several tax-free payments, but the government doesn't know you exist until you file.

1. The GST/HST Credit Back-Pay

If you arrived in July 2025, you missed the July and October 2025 payments. By filing your 2025 tax return in Spring 2026, the CRA will see your "Entry Date" and issue those missed payments (usually worth about $130–$150 per quarter) all at once.

2. The Canada Carbon Rebate (CCR) Catch-Up

As noted in our CCR 2026 Update, the regular carbon rebate program ended in April 2025. However, if you were a resident in late 2024 or early 2025 and never received those cheques, filing your taxes now is the only way to claim that "Zombie Money" retroactively.

The Canada Child Benefit Back-Pay for Newcomer Families

If you moved to Canada with children under the age of 18, your first tax return is the key to unlocking the largest social payment in the country. Many newcomer families believe they have to wait a full year to get the Canada Child Benefit (CCB), but that is a myth.

The "Form RC66" Strategy:

While filing your taxes is the standard way to maintain CCB, as a newcomer, you can actually apply the moment you get your SIN. However, if you didn't do that, filing your first tax return in 2026 will trigger a massive retroactive payment.

- The Calculation: The CRA will look at your "Date of Entry" and calculate the monthly CCB you should have received from that date until now.

- The Payoff: For a family with two children under 6, the CCB can be worth over $1,200 per month. If you have been in Canada for six months without receiving it, your first tax assessment could result in a lump-sum deposit of over $7,000.

Important: To get this back-pay, you must ensure you provide your World Income for the two years before you arrived. The CRA uses this to determine your "income-tested" level. If you leave this blank, your CCB will be "stuck" in a pending status.

Ontario Trillium Benefit: The Newcomer "Welcome Gift"

If you settled in Ontario, you are eligible for the Ontario Trillium Benefit (OTB), which combines the sales tax credit and the energy/property tax credit. Most newcomers miss this because it requires a specific form inside the tax package called the ON-BEN.

- The Sales Tax Component: This is available to almost every newcomer with a low-to-modest income, even if you lived in a hotel or Airbnb for your first few weeks.

- The Energy Component: If you paid rent in Ontario during 2025, you can claim a portion of that rent back.

- The 2026 Strategy: Ensure your tax software (or paper return) includes the ON-BEN application. Without it, you will get your federal refund but miss out on the monthly provincial "top-ups" that start in July 2026.

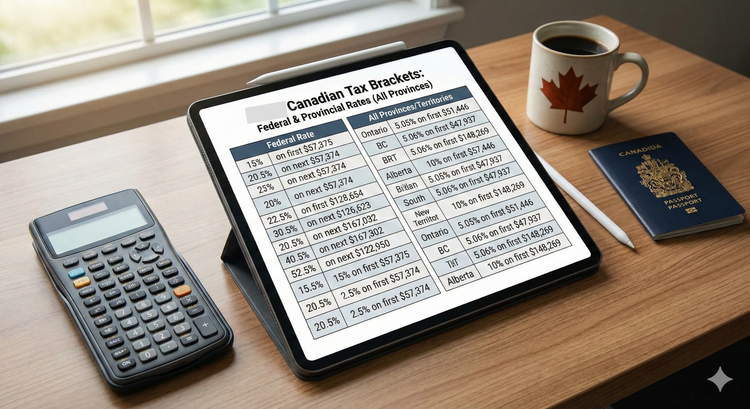

The "90% Rule" and Your Credit Eligibility

This is the most critical technical rule for anyone filing taxes for the first time in Canada after moving in 2026. The "90% Rule" determines if you get full tax credits or if the government "pro-rates" your money.

- How it works: To claim the full "Basic Personal Amount" (which makes your first ~$15,000 of income tax-free), you must prove that at least 90% of your total income for the year you arrived came from Canadian sources.

- The Newcomer Trap: If you earned $50,000 in your home country from January to October, and then earned $5,000 in Canada in November and December, you do not meet the 90% rule.

- The Result: The CRA will reduce your tax-free threshold. This might mean you owe a small amount of tax even if you didn't earn much in Canada. Understanding this prevents the "Tax Bill Shock" that many first-time filers experience in May.

Handling Marital Status from Your Home Country

A common error for newcomers is failing to correctly report a spouse who is still living abroad.

- The Mistake: Marking yourself as "Single" because your spouse isn't in Canada yet.

- The Reality: The CRA considers you "Married" or "Common-Law" regardless of where your spouse lives. If you mark yourself as single, you might receive a higher GST/HST credit than you are entitled to.

- The Consequence: When your spouse eventually arrives and gets their SIN, the CRA will link your accounts, realize the error, and ask you to pay back the "overpayment" from your first year. Always report your spouse’s "World Income," even if they never set foot in Canada in 2025.

Retroactive Carbon Rebates: The "Entry Date" Loophole

While the Canada Carbon Rebate (CCR) program officially wound down in 2025, first-time filers in 2026 have a unique opportunity.

If you were a resident of an eligible province (like Ontario or Alberta) on any of the "Base Dates" in late 2024 or early 2025, you are legally entitled to those payments.

- Filing your taxes in 2026 is the "trigger" that tells the CRA you were a resident during those months.

- Many newcomers find a surprise "Canada FPT" deposit in their bank account 2 weeks after filing—this is often the retroactive Carbon Rebate "back-pay" for the quarters they lived in Canada before the program ended.

Spotting "First Filer" Scams in 2026

Newcomers are the #1 target for tax scammers. In 2026, a new scam involves "Fake Tax Clinics" that promise to get you a $5,000 "Newcomer Grant" if you provide your bank login.

- The Fact: There is no such thing as a "Newcomer Grant" paid through the tax system. Your money comes from Credits (GST, CCB, OTB) and Refunds of tax you already paid.

- The Rule: If a website asks for your bank password to "deposit your refund," close the window. The CRA only uses Direct Deposit via your SIN or a physical cheque.

Step 1: Determine Your "Date of Entry"

The CRA needs to know the exact day you became a resident. This is usually the day you landed in Canada with the intent to stay (e.g., the day you signed your first lease or started your first job).

- Why it matters: Your "Basic Personal Amount" (the amount you can earn before paying tax) is pro-rated based on how many days you were in Canada.

- The Rule: If you were here for 50% of the year, you get roughly 50% of the tax-free threshold.

Step 2: Gathering Your Canadian Slips

By February 28, 2026, you should receive "Tax Slips" from anyone who paid you in 2025.

- T4 Slip: From your employer. It shows your total earnings and the tax already deducted from your paycheck.

- T5 Slip: From your bank. If you earned more than $50 in interest in your Canadian savings account, you will get this.

- T2202: If you are an international student, your college or university issues this so you can claim your tuition credits.

Step 3: Reporting "World Income"

This is where most newcomers get confused.

- The Period Before Arrival: You must report the income you earned in your home country before you moved to Canada. You aren't taxed on this money, but the CRA uses it to see if you qualify for low-income benefits like the Canada Child Benefit.

- The Period After Arrival: Once you are a Canadian resident, you must report all income earned anywhere in the world (e.g., rental income from a house back home or freelance work for a foreign client).

Step 4: Choosing Your Filing Method

As a first-time filer, you have three main options:

1. Certified Tax Software (NETFILE)

In 2026, many first-time filers can now use software like Wealthsimple Tax or TurboTax to file online.

- Note: Some first-time filers are still "blocked" from online filing if the CRA doesn't have their date of birth on file. If the software gives you an error, you must use the paper method.

2. The Paper Return (Mail)

If you cannot file online, you must print the T1 General form and mail it to your regional Tax Centre (usually in Winnipeg, Sudbury, or Jonquière).

- Warning: Paper returns take 8 to 12 weeks to process, whereas online filing takes only 2 weeks.

3. Free Tax Clinics (CVITP)

If you have a modest income and a simple tax situation, volunteers can do your taxes for free. Search for "Free Tax Clinics" on the Canada.ca website to find a location in your city.

Common Newcomer Tax Deductions

Don't miss these "Money Savers" that are specific to your first year:

- Moving Expenses: If you moved to Canada to start a specific job that you had lined up before you arrived, you may be able to deduct some of your travel costs. (This is rare and has strict rules—consult a pro).

- Tuition Carry-Forward: If you are a student, your tuition credits can be "saved" for future years when you have a high-paying job, potentially giving you a massive $5,000+ refund three years from now.

- Digital News Subscription: Did you subscribe to a Canadian news site (like the Globe and Mail) to stay informed? You can claim a small tax credit for that.

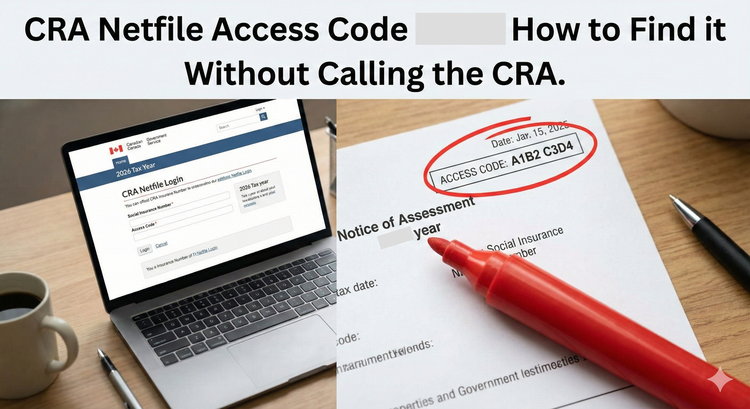

Setting Up "CRA My Account"

You cannot fully register for CRA My Account until after you file your first tax return and receive your Notice of Assessment (NOA).

- File your taxes in March/April.

- Wait for the paper NOA to arrive in the mail.

- Use the info on that paper to sign up for the online portal.

- Once inside, you can track your OAS and CPP progress or update your address instantly.

Need to Earn More Before Tax Time?

Moving to a new country is expensive, and your first tax refund won't arrive until May or June. If you need to boost your Canadian bank balance today to cover your 2026 bills:

👉 Find Daily Pay Jobs at BetterPayJobs.ca

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Canada Revenue Agency: Newcomers to Canada (Immigrants and Residents)

- Government of Canada: Tax-filing for first-time filers guide 2026

- CRA: World income reporting requirements

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.