Newcomer’s Guide to Money in Canada: Banking, Credit & Taxes (2026)

Welcome to Canada! If you are among the hundreds of thousands of immigrants, international students, or temporary workers arriving in 2026, your first 30 days are the most critical for your financial future.

In Canada, money isn't just about what you earn; it’s about how you navigate the "Big Three" systems: Banking, Credit, and Taxes. Get these right, and you can unlock thousands of dollars in government benefits and prime interest rates. Get them wrong, and you could be trapped in high-interest debt or miss out on critical "back-pay" from the CRA.

This is your Official 2026 Newcomer Financial Roadmap. We have analyzed the latest 2026 bank offers, tax laws, and credit-building hacks to give you a step-by-step guide to winning the Canadian money game.

Quick Checklist: Your First 48 Hours

Before you can open a bank account or apply for a credit card, you need your "financial foundation." Do these three things the moment you land:

- Get your SIN (Social Insurance Number): Visit a Service Canada office or apply online. You cannot work or receive benefits like the Canada Child Benefit without this 9-digit number.

- Get a Canadian Phone Number: You need this for "Two-Factor Authentication" (2FA) for your bank and the CRA My Account portal.

- Update your Address: Even if you are in an Airbnb, you need a residential address to start your "financial footprint."

Part 1: The Best Newcomer Banking Packages in 2026

In 2026, Canada’s major banks are aggressively competing for your business. Most offer a "Newcomer Package" that waives monthly fees for 12 months and provides a cash bonus of up to $500.

The "Big Five" 2026 Comparison

| Bank | Program Name | 2026 Cash Bonus | Key Benefit |

| Scotiabank | StartRight® | Up to $700 | Uses Nova Credit to import your foreign credit score. |

| RBC | Newcomer Advantage | Up to $500 | Most aggressive credit card limits (up to $15,000). |

| TD Bank | New to Canada | Up to $750 | Best for bundle deals (Savings + Chequing). |

| NBC | Newcomer Package | $0 fees for 3 years | Longest fee-waiver period in the market. |

| BMO | NewStart® | Up to $500 | Free safety deposit box for one year. |

Which bank is best for newcomers in 2026?

If you have a strong credit history in your home country (India, UK, Australia, etc.), Scotiabank is the best choice because they use the "Nova Credit" system to verify your foreign history. If you are starting from zero and need a high credit limit immediately, RBC tends to be the most flexible for work permit holders.

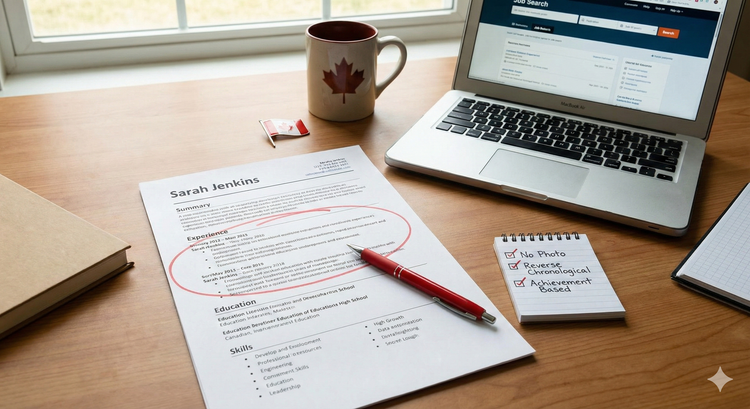

Part 2: Building Credit from Zero to 700+

In Canada, your credit score determines everything: your car insurance rate, your ability to rent an apartment, and your interest rates.

The 30% Utilization Rule

The fastest way to hit a 700+ score in 6 months is to keep your "Utilization" low. If your bank gives you a $5,000 limit, never spend more than $1,500 on that card at any one time. To the credit bureaus (Equifax and TransUnion), using 100% of your limit looks like "financial distress."

Unsecured vs. Secured Cards

As a newcomer in 2026, avoid secured cards if possible. A secured card requires you to give the bank a deposit (e.g., $500). The newcomer packages listed above almost all provide an unsecured card (no deposit) with a limit of $1,000 to $5,000 based on your work permit and job offer.

Part 3: Taxes and Government Benefits (The "Cash Back" Phase)

Most newcomers don't realize that they can get money back from the government before they even work a single day in Canada.

Filing for "Back-Pay"

As noted in our Guide to Filing Your First Tax Return, you should file your taxes as soon as possible after arriving.

- GST/HST Credit: Paid quarterly to low-income households. You can get roughly $130 every 3 months.

- Canada Carbon Rebate (CCR): If you live in an eligible province, you are entitled to the 2026 CCR payments.

- Ontario Trillium Benefit (OTB): If you live in Ontario, you can get money back for your rent and energy costs.

The "World Income" Requirement

To get these benefits, the CRA will ask for your income from the two years before you arrived in Canada. They don't tax this money, but they use it to see if you are "low-income" enough to qualify for the maximum CCB and OTB payments.

Part 4: 2026 Newcomer Financial Deep Dive

While chequing accounts are for spending, you should move your "Settlement Funds" into a High-Interest Savings Account (HISA) immediately. In 2026, the traditional big banks pay only 0.5% interest, but digital banks like EQ Bank and Wealthsimple are paying between 2.75% and 4.5%.

Answer: For a newcomer with $20,000 in settlement funds, the difference between a big bank and a HISA is over **$800 in extra interest** per year.

Life from "Identity Hijacking"

In 2026, scammers are targeting newcomers more than ever. Because you are new to the system, you may not know what a real CRA email or text looks like. This deep dive covers the three most dangerous financial traps for newcomers in 2026.

1. The "Social Insurance Number" (SIN) Harvest

Scammers will often call pretending to be from the "International Tax Division" or the "Border Services Agency." They will tell you that your SIN has been "suspended" due to suspicious activity.

- The Fact: A SIN can never be "suspended."

- The Trap: They ask you to "confirm" your SIN, which they then use to file Ghost Returns and steal your future tax refunds.

- The 2026 Rule: Never give your SIN to anyone who calls you. Only give your SIN to your bank, your employer, and the CRA (when you call them).

2. The "GIC" Verification Scam

For international students, the GIC (Guaranteed Investment Certificate) is a primary target. Scammers send emails that look like they are from Scotiabank or CIBC asking you to "re-verify" your funds by logging into a fake portal.

- The Strategy: Always check the URL. If it doesn't end in

.scotiabank.comor.cibc.com, close the window. - Internal Link: If you find yourself in a financial gap while waiting for your GIC funds, check the Emergency Rent Bank Programs available in your city.

3. The "Newcomer Grant" Myth

There is no such thing as a "Government Newcomer Grant" that pays you $5,000 just for arriving. If you see an ad on TikTok or Instagram promising a "Federal Welcome Payment," it is a scam designed to steal your bank login.

- The Reality: Your "Welcome Payment" comes from the Credits you claim on your first tax return, such as the GST credit and provincial energy rebates.

Strategic 2026 Tax Planning for Newcomers

In 2026, the federal government has implemented a Middle-Class Tax Cut. The lowest tax bracket (income up to $57,375) has been reduced to 14%.

- For Newcomers: This means you keep more of your first Canadian paycheck.

- The Pro-Rating Rule: Remember that your tax-free threshold ($15,000) is "pro-rated" based on the number of days you were in Canada. If you arrived on July 1st, you only get 50% of that tax-free amount.

Frequently Asked Questions (FAQ)

Can I get a mortgage as a newcomer in 2026?

Yes. Most big banks have a "Newcomer to Canada Mortgage" program. Even with zero Canadian credit history, you can often qualify with a 25% to 35% down payment, provided you can show a stable work history from your home country.

Is the Carbon Rebate available to students?

Yes. If you are a resident for tax purposes (usually after 6 months or once you establish residential ties), you can claim the Canada Carbon Rebate. International students are eligible for this even if they are not working.

What happens if I forget to file my first tax return?

You won't go to jail, but you will lose money. The government will stop your GST and OTB payments, and you will not build up "RRSP Room"—which is vital for saving for your first home tax-free.

Summary of Action Steps

- Open a Newcomer Bank Account: Pick a bank from the comparison table above.

- Get an Unsecured Credit Card: Keep your utilization under 30%.

- File Form RC151: This gets you the GST credit and CCR without waiting for tax season.

- Set Up CRA My Account: This is where you track your Notice of Assessment and benefits.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Canada Revenue Agency: Newcomers to Canada - Tax Guide 2026

- RBC Newcomer Advantage: Banking offers for foreign workers

- Scotiabank StartRight: Credit cards and Nova Credit info

- Government of Canada: Middle-class tax cut and benefit amounts 2026

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.