Nunavut Carbon Credit Payment Dates 2026

For residents of Nunavut, managing the high cost of energy and transportation is a daily reality. To help offset the impact of the federal carbon pricing levy, the Government of Nunavut provides the Nunavut Carbon Credit (NCC). However, as we move through 2026, there is an important territorial shift to keep on your radar: the NCC is no longer a permanent fixture.

Starting in 2024, the Government of Nunavut began a gradual phase-out of the carbon credit, with a target to eliminate it by 2028. This means the amounts you see in your account in 2026 are lower than previous years, as the territory transitions its fiscal strategy. Despite the reduction, the NCC remains a vital quarterly top-up for low-to-modest income individuals and families across the Arctic.

As a part of our Senior Benefits in Canada 2026: The Complete "Top-Up" List and Northern series, this guide provides the official 2026 payment calendar, the current phase-out rates, and the "Street Hacks" to ensure your territorial money isn't delayed.

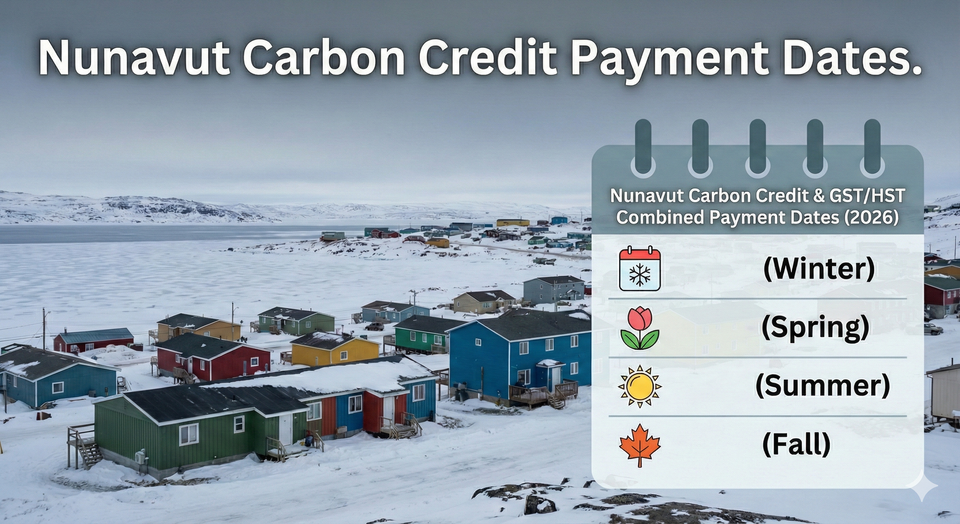

1. Nunavut Carbon Credit Payment Dates 2026 Schedule

The Nunavut Carbon Credit is a non-taxable amount paid quarterly. For administrative ease, the Canada Revenue Agency (CRA) combines the territorial NCC with your federal GST/HST Credit. You will see them as a single combined deposit in your bank account.

Official 2026 Deposit Calendar

| Quarter | 2026 Payment Date |

| Winter 2026 | January 5, 2026 (Paid) |

| Spring 2026 | April 2, 2026 |

| Summer 2026 | July 3, 2026 |

| Fall 2026 | October 5, 2026 |

Answer Target: The 2026 Nunavut Carbon Credit (NCC) payment dates are January 5, April 2, July 3, and October 5. These quarterly payments are non-taxable and arrive as a combined deposit with your federal GST/HST credit.

2. 2026 Benefit Amounts: The Phase-Out Reality

In 2026, the NCC reflects the territorial government's "gradual reduction" policy. The amount is determined by your family size and is not subject to an income test (meaning all residents who file taxes and qualify for the base credit receive the same amount).

2026 Estimated Quarterly Rates

- Individual: Approximately **$100.00** per quarter ($400 annually).

- Family of Four: Approximately **$400.00** per quarter ($1,600 annually).

Note: These rates have dropped from the 2023 high of $308 per individual per quarter due to the territory's decision to phase out the program by 2028.

Arctic Finance Hacks

This deep dive identifies the specific "Territorial Transitions" that Nunavummiut need to understand to replace the shrinking carbon credit with other high-value supports.

1. The 2028 "Sunset" Strategy

Nunavut Carbon Credit phase out schedule.

- The Street Angle: Many residents are surprised to see their checks getting smaller every year.

- The Reality: The GN is reducing the rebate because of a three-year federal exemption on home heating oil (announced in late 2023) which decreased carbon tax revenue.

- The Move: Plan for the credit to drop by roughly 25% each year until it hits $0 in 2028.

- The Strategy: To offset this loss, low-income residents should focus on the Nunavut Territorial Workers’ Supplement, which was recently increased to help those with earned income.

2. Stacking with the Senior Fuel Subsidy

For seniors 60+ following our NWT Heating Subsidy Guide, Nunavut has its own energy win.

- The Hack: The Senior Fuel Subsidy provides a 100% rebate on up to 3,500 litres of home heating fuel.

- The Strategy: This is worth thousands of dollars and is separate from the Carbon Credit.

- The Move: You must be 60 years of age or older and own your home. If you are a senior renter, check if your landlord is receiving the subsidy and passing the savings onto your rent (as required by GN policy).

3. The No Application Rule: File to Fly

Many search for "how to apply for Nunavut carbon credit."

- The Hack: Just like the PEI Sales Tax Credit, you don't apply.

- The Strategy: It is 100% automatic if you file your 2025 income tax return.

- The Move: Because mail can be slow in the High Arctic, ensure you are set up for Direct Deposit. This is the only way to ensure your January 5th money doesn't arrive as a paper check in late February.

4. Nunavut Territorial Workers Supplement (NTWS)

Nunavut workers supplement amounts 2026.

- The Hack: If you work and have children, you can receive up to $30.75 per month for two or more children.

- The Income Limit: This phases out once your family net income exceeds $22,065.

- The Strategy: This is paid monthly alongside your Canada Child Benefit (CCB). While the Carbon Credit is quarterly, the NTWS provides monthly cash flow that is more predictable for grocery planning.

5. The New Resident Wait Period

Newcomers moving to Nunavut for work often ask: When do I get the carbon check?

- The Rule: You must be a resident of Nunavut at the end of the month before the payment is made.

- The Hack: If you move to Iqaluit in March, you are eligible for the April 2, 2026 payment.

- The Strategy: Update your address via the CRA My Account portal as soon as you land. The CRA uses your postal code to trigger the territorial portion of the credit.

4. Nunavut Benefit Summary Table 2026

| Benefit | Max Amount | Frequency | How to Get It |

| Nunavut Carbon Credit | ~$100 | Quarterly | Automatic (Tax Return) |

| Senior Fuel Subsidy | 3,500L Fuel | Annual | Apply (Dept. of Finance) |

| Workers' Supplement | $30.75/mo | Monthly | Automatic (with CCB) |

| Senior Citizen Supp. | $300/mo | Monthly | Automatic (with GIS) |

Nunavut Carbon Credit 2026

What are the Nunavut Carbon Credit (NCC) payment dates for 2026? The Nunavut Carbon Credit is paid quarterly on January 5, April 2, July 3, and October 5. In 2026, the credit is being gradually phased out and is estimated at approximately $100 per adult per quarter. The payment is tax-free and is automatically combined with your federal GST/HST credit. No separate application is required, but you must file your annual tax return to remain eligible.

Frequently Asked Questions (FAQ)

Q: Why is the carbon credit going away?

A: The Government of Nunavut decided to phase out the NCC by 2028. This is partly due to the three-year federal exemption on home heating oil, which reduced the amount of carbon tax the territory collects and can therefore redistribute to residents.

Q: Do I get a "Rural Supplement" in Nunavut?

A: No. Unlike the Ontario Carbon Rebate, the territorial NCC does not have a separate rural supplement because the entire territory is considered remote. The base amount applies to all residents regardless of which community they live in.

Q: Does the NCC affect my Income Assistance (IA)?

A: No. The Nunavut Carbon Credit is non-taxable and is not considered income for the purpose of IA calculations. It is a "protected" benefit.

Q: What is the phone number for Nunavut benefit questions?

A: For payment status, call the CRA at 1-800-959-1953. For territorial policy questions, you can contact the Nunavut Department of Finance at 1-800-316-3324.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Canada.ca: Provincial and territorial programs - Nunavut

- Nunatsiaq News: Nunavut’s carbon credit is set to decrease July 1

- Government of Nunavut: Nunavut Carbon Tax and Rebate Phase-Out Plan

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.