Ontario GAINS Payment Dates 2026 (For Low Income Seniors)

For seniors in Ontario living on a modest budget, every dollar counts. While the federal government provides the foundation through Old Age Security (OAS) and the Guaranteed Income Supplement (GIS), the province of Ontario adds its own critical layer of support: the Guaranteed Annual Income System (GAINS).

In 2026, the GAINS program remains a vital "Top-Up" that ensures a guaranteed minimum income for the province's most vulnerable retirees. Unlike other programs that require complex paperwork, GAINS is designed to be invisible—it lands in your bank account automatically, provided you stay on top of your annual tax filing.

As part of our Senior Benefits in Canada 2026: The Complete "Top-Up" List, this guide identifies the exact payment dates for 2026, explains the income thresholds, and reveals the hacks to ensure your provincial money is never interrupted.

Ontario GAINS Payment Dates 2026 Schedule

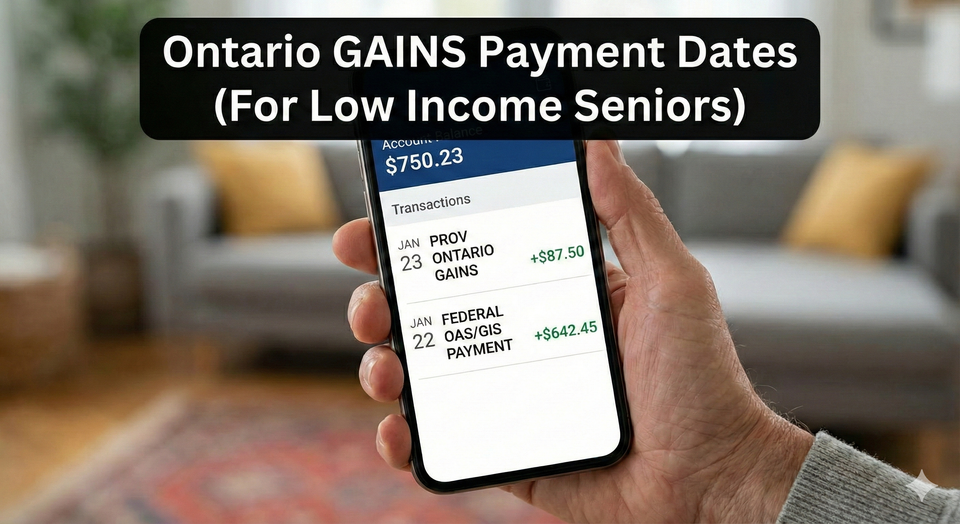

In Ontario, GAINS payments are synchronized with the federal pension system. If you receive your OAS and GIS via direct deposit, your GAINS payment will arrive on the same day as a separate line item labeled "PROV ONTARIO GAINS."

Official 2026 Deposit Calendar

Payments are typically issued on the third-to-last business day of each month.

| Month | Payment Date |

| January 2026 | Wednesday, January 28 |

| February 2026 | Wednesday, February 25 |

| March 2026 | Friday, March 27 |

| April 2026 | Tuesday, April 28 |

| May 2026 | Wednesday, May 27 |

| June 2026 | Friday, June 26 |

| July 2026 | Wednesday, July 29 |

| August 2026 | Thursday, August 27 |

| September 2026 | Friday, September 25 |

| October 2026 | Wednesday, October 28 |

| November 2026 | Thursday, November 26 |

| December 2026 | Tuesday, December 22 |

2026 GAINS Eligibility & Payment Amounts

The amount you receive through GAINS depends on your "Private Income" (income from sources other than OAS and GIS).

How Much Can You Get?

For the benefit year running from July 1, 2025, to June 30, 2026, the maximum payments are:

- Single Senior: Up to $90.00 per month.

- Senior Couple: Up to **$180.00 per month** ($90 each).

Who Qualifies?

To receive the GAINS payment in 2026, you must:

- Age: Be 65 years of age or older.

- Residency: Have lived in Ontario for the past 12 months (or for a total of 20 years since turning 18).

- Status: Have 10 or more years of Canadian residency.

- Federal Link: Be receiving both the OAS pension and the Guaranteed Income Supplement (GIS).

- Income: Have a total "Private Income" below the maximum threshold (approx. $4,320 for singles and $8,640 for couples).

GAINS Hacks

This deep dive identifies the specific administrative "glitches" that cause seniors to miss out on their provincial top-up. These "Street Hacks" ensure you get every cent you are owed.

1. The "Automatic Assessment" Trap

Why didn't I get my Ontario GAINS payment.

- The Street Angle: There is no separate application for GAINS. It is determined automatically based on your tax return and your federal GIS status.

- The Hack: If you file your taxes after April 30, or if the CRA hasn't processed your Guaranteed Income Supplement application, your GAINS payment will stop instantly in July.

- The Move: Always file your taxes by the deadline, even if you have $0 income. If your GAINS is missing, call Service Canada at 1-800-277-9914 first to check your GIS status; the province cannot pay you until the federal government confirms you are "Low Income."

2. GAINS vs. Ontario Trillium Benefit (OTB)

Seniors often confuse GAINS with the Ontario Trillium Benefit.

- The Difference: GAINS is a monthly top-up to your pension. The Trillium Benefit (OTB) is a refund of sales and property taxes.

- The Hack: You can receive both.

- The Strategy: Make sure you complete Form ON-BEN when filing your taxes. This single form unlocks the Trillium Benefit, the Ontario Senior Homeowners' Property Tax Grant, and confirms your eligibility for GAINS.

3. Retroactive GAINS Payments: The 11-Month Rule

A rising search in 2026 is "retroactive GAINS payments Ontario."

- The Hack: If you were eligible for GAINS but didn't receive it because your taxes were late, the province will pay you retroactively.

- The Limit: The province will generally only go back 11 months for retroactive payments. If you haven't filed taxes in three years, you have already lost over $2,000 in provincial money that you can never get back.

4. GAINS Eligibility for Newcomers in 2026

Newcomers following our Newcomer Savings Rules often search for "GAINS for immigrants."

- The Barrier: You must have 10 years of Canadian residency to receive GIS, which is the "Key" that unlocks GAINS.

- The 2026 Hack: If you are a senior on a sponsorship agreement, you generally cannot get GAINS. However, if your sponsor passes away or goes bankrupt, you can apply for a Sponsorship Breakdown review through Service Canada. If approved for GIS, your GAINS top-up will start automatically.

5. The "Private Income" Calculation for Couples

Many seniors search for "GAINS income thresholds for couples."

- The Reality: For GAINS, "Private Income" includes your CPP, private work pensions, and bank interest. It does not include your OAS or GIS.

- The Strategy: If your combined private income is $8,640 or higher, your GAINS payment will be $0. If you are just over this line, look into Senior Tax Deductions to see if you can lower your net income through medical expenses or charitable donations.

Ontario GAINS Payment Dates

When is the next Ontario GAINS payment? Ontario GAINS payments are issued on the same day as federal OAS and GIS payments, typically the third-to-last business day of each month. In 2026, the remaining payment dates are: January 28, February 25, March 27, April 28, May 27, June 26, July 29, August 27, September 25, October 28, November 26, and December 22. The maximum monthly payment for a single senior is $90.00.

Frequently Asked Questions (FAQ)

Q: Is the GAINS payment taxable?

A: No. Like the GIS, the Ontario GAINS payment is a non-taxable benefit. You do not have to pay income tax on this money, although you must report it on your annual tax return.

Q: Do I need to apply for GAINS if I just turned 65?

A: No. If you have applied for OAS and GIS and you file your Ontario tax return, the Ministry of Finance will automatically assess your eligibility and start your payments.

Q: Can I get GAINS if I live in a long-term care home?

A: Yes. Your place of residence in Ontario does not affect your eligibility, as long as you meet the income requirements. If you are struggling with care costs, check our guide on Senior Top-Ups for Long-Term Care.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Ontario.ca: Guaranteed Annual Income System (GAINS) - 2026 Payment Schedule

- Service Canada: Old Age Security and GIS Payment Dates 2026

- Ministry of Finance: GAINS Benefit Rates and Income Thresholds

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.