PEI Sales Tax Credit Payment Dates 2026

For residents of Canada’s smallest province, the Prince Edward Island Sales Tax Credit (PEISTC) is a meaningful quarterly top-up that helps offset the cost of living on the Island. While federal benefits like the Canada Carbon Rebate provide a national baseline, the PEISTC is a specific provincial "thank you" for low-income Islanders. In 2026, as grocery and utility costs remain elevated across the Maritimes, staying informed about your provincial deposit schedule is essential for keeping your budget in the black.

The PEISTC is a non-taxable, refundable credit, meaning it is deposited directly into your account regardless of whether you owe taxes. Unlike the New Brunswick HST Credit, the PEI credit has unique thresholds designed for the Island's specific economy.

As part of our Senior Benefits in Canada 2026: The Complete "Top-Up" List, this guide identifies the official 2026 payment dates, the updated 2026 benefit amounts, and the "Street Hacks" to ensure you receive the full Island rebate.

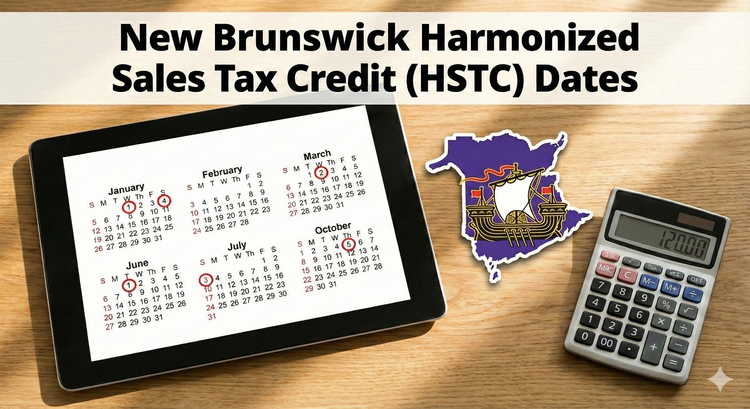

1. PEI Sales Tax Credit Payment Dates 2026 Schedule

Prince Edward Island synchronizes its sales tax credit with the federal distribution system. You will receive your provincial credit at the same time as your federal GST/HST Credit.

Official 2026 Deposit Calendar

| Quarter | 2026 Payment Date |

| Winter 2026 | January 5, 2026 (Paid) |

| Spring 2026 | April 2, 2026 |

| Summer 2026 | July 3, 2026 |

| Fall 2026 | October 5, 2026 |

Answer: The 2026 Prince Edward Island Sales Tax Credit (PEISTC) payment dates are January 5, April 2, July 3, and October 5. These quarterly payments are non-taxable and are combined into a single deposit with your federal GST credit.

2. 2026 Benefit Amounts: What to Expect

The amount you receive depends on your marital status and your family's net income from the previous year.

Annual Maximum Amounts (2025-2026 Benefit Year)

- Individual: **$150.00** ($37.50 per quarter)

- Spouse / Common-law Partner: **$150.00** ($37.50 per quarter)

- Per Child (under 19): **$75.00** ($18.75 per quarter)

The "Base" Rule: If you are a single person living alone in Charlottetown with a net income under $14,500, you will receive the full $150 annually.

Island Wealth Hacks

1. The $14,500 "Clawback" Trap

PEI sales tax credit income threshold.

- The Street Angle: PEI has one of the lowest thresholds in Canada before the credit starts to decrease.

- The Hack: If your income is over $14,500, the credit is reduced by 5% of the excess.

- The Strategy: For many workers, the credit disappears quickly. However, because the threshold for the federal credit is much higher (~$50,000+), you might see your provincial portion vanish while your federal portion stays intact. This is the #1 cause of "Missing Deposit" calls to the CRA in PEI.

2. The "Lump Sum" Efficiency Rule

Many residents search for "PEI sales tax credit July payment."

- The Hack: If your total annual credit (provincial + federal) is less than $200, the CRA will pay the entire year in one lump sum in July.

- The Move: If you were expecting an October check and it didn't come, check your July bank statement. You likely already got the "Island Bonus" for the whole year.

3. Stacking with the "Seniors Independence Initiative"

For seniors 65+ following our NL Seniors Benefit Guide, PEI has a specialized grant.

- The Hack: The Seniors Independence Initiative (SII) provides up to $1,700 per year.

- The Purpose: It covers "practical" help like snow removal, grass cutting, or light housekeeping.

- The Strategy: Eligibility is based on having a net income under $32,750 (single) or $41,850 (couple).

- The Move: If you qualify for the PEI Sales Tax Credit, you almost certainly qualify for this $1,700 grant. This is "Free" money for home support that most Islanders forget to claim.

4. PEI "Carbon Rebate" Difference

A common search is "PEI carbon tax rebate 2026 schedule."

- The Reality: Unlike the Sales Tax Credit, the Canada Carbon Rebate (CCR) in PEI includes the 20% Rural Supplement for everyone because the entire province is considered rural.

- The Hack: You get your CCR on the 15th and your Sales Tax Credit on the 5th.

- The Strategy: Use the 5th for small bills and the 15th for your larger utilities to smooth out your monthly cash flow.

5. Automatic Eligibility: Don't Apply!

A rising query in 2026 is "how to apply for PEI provincial tax credits."

- The Hack: There is no application. It is 100% based on your tax return.

- The Move: If you are a student or a low-income worker and you didn't file your taxes because you "made no money," you are essentially throwing away $150. File your taxes even with $0 income to trigger the payment.

4. Summary Table: PEI Provincial vs. Federal GST (2026)

| Feature | Federal GST Credit | PEI Provincial Credit |

| Max Individual | $533 | $150 |

| Max Spouse | $698 (Family) | $150 |

| Max Per Child | $184 | $75 |

| Income Threshold | ~$56,181 (Phases out) | **$14,500 (Phases out)** |

PEI Sales Tax Credit 2026

What are the Prince Edward Island Sales Tax Credit payment dates for 2026? The PEISTC is a quarterly tax-free benefit paid on January 5, April 2, July 3, and October 5. In 2026, eligible single residents can receive up to $150 annually, while couples receive $300. Families also receive $75 per child. The credit is automatically calculated based on your annual income tax filing and is issued alongside your federal GST/HST credit.

Frequently Asked Questions (FAQ)

Q: Do I need the Disability Tax Credit to get the PEI Sales Tax Credit?

A: No. This is an income-based credit, not a disability-based one. However, if you have a DTC (T2201), you should check your eligibility for the PEI Disability Support Program, which provides much higher monthly funding.

Q: Is the PEI Sales Tax Credit taxable?

A: No. It is a non-taxable benefit. It does not count as income for GIS or other government programs.

Q: I just moved to Summerside from Ontario. When do I get paid?

A: Ensure you update your address in CRA My Account. Your provincial eligibility usually starts the month after you move, with the first payment arriving on the next quarterly date (e.g., if you move in January, your first check is April 2).

Q: What is the phone number for PEI tax credit questions?

A: For payment status, call the CRA at 1-800-959-1953. For provincial policy questions, you can contact PEI Finance at 902-368-4030.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Government of PEI: Prince Edward Island Sales Tax Credit Details

- CRA: Provincial and territorial programs - Prince Edward Island

- PEI Social Development: Seniors Independence Initiative - Home Support Grant

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.