Quebec Solidarity Tax Credit Dates 2026: Payment Schedule & New Rates

For English-speaking residents of Quebec, navigating provincial benefits often feels like trying to read a map in the dark. While national blogs focus heavily on the GST/HST Credit or the Canada Child Benefit, the Quebec Solidarity Tax Credit (STC) is often overlooked.

In 2026, this is a massive mistake. The Solidarity Tax Credit is a refundable credit specifically designed to offset the cost of the QST (Quebec Sales Tax) and housing for low-to-middle-income families. With the 2026 cost of living in Montreal, Gatineau, and Quebec City reaching new highs, this credit can put over $1,000 per year back into your pocket—but only if you know how the payment frequency and the "Housing Component" work.

This deep dive provides the official 2026 payment schedule, the new income thresholds, and a step-by-step guide to claiming the "hidden" housing money that many English-speaking renters miss.

1. Why the RL-31 is Your "Golden Ticket"

The Solidarity Tax Credit is made of three parts: the QST component, the Housing component, and the Northern Villages component. To get the Housing Component, you must prove you were a tenant or owner on December 31, 2025.

- For Tenants: You need the Dwelling Number from Box A of your RL-31 slip. Without this number, Revenu Québec will automatically deny your housing credit, which can cost you $600+ per year.

- The "Bad Landlord" Fix: If your landlord hasn't sent you an RL-31 by mid-March 2026, you are still eligible. You can contact Revenu Québec or use your lease as proof, but you must manually file an adjustment.

2. International Students and "New" Residents

A common myth in Montreal is that you must be a Canadian citizen to get the Solidarity Tax Credit. This is false.

- Eligibility for 2026: If you arrived in Quebec in 2025 and lived here for at least 18 months by the time of your claim, you are eligible.

- The 18-Month Rule: For temporary residents (like international students or work permit holders), you must have lived in Canada for the last 18 months before you can claim the credit. If you landed in early 2025, the July 2026 – June 2027 period is likely your first chance to get paid.

Part 1: Official Solidarity Tax Credit Dates 2026

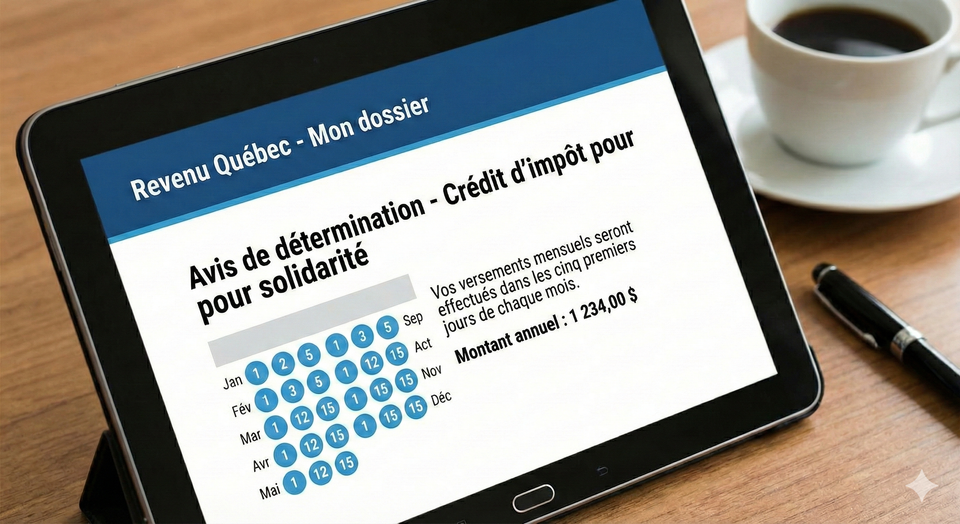

Revenu Québec issues payments in the first five days of the month. Unlike federal benefits, the Solidarity Tax Credit is mandatory direct deposit. If they don't have your bank info, you don't get the money.

| Period | Official Payment Date | Day of the Week |

| January 2026 | January 5, 2026 | Monday |

| February 2026 | February 5, 2026 | Thursday |

| March 2026 | March 5, 2026 | Thursday |

| April 2026 | April 3, 2026 | Friday |

| May 2026 | May 5, 2026 | Tuesday |

| June 2026 | June 5, 2026 | Friday |

| July 2026 | July 3, 2026 | Friday |

| August 2026 | August 5, 2026 | Wednesday |

| September 2026 | September 4, 2026 | Friday |

| October 2026 | October 5, 2026 | Monday |

| November 2026 | November 5, 2026 | Thursday |

| December 2026 | December 4, 2026 | Friday |

MORE HELPFUL ARTICLES FROM US

- Canada Payment Guide (Browse All Payments )

- Can I Get EI if I Quit? (Just Cause Checklist)

- TFSA vs. RRSP for Low Income (The GIS Trap)

- Shared Custody CCB Rules (50/50 Split Guide)

- Warm Neighbor Programs (Heating Bill Help)

Part 2: The "Amount" Trap: Why Frequencies Change

One of the most confusing parts of the STC is that you might get paid monthly, quarterly, or once a year. Your Annual Amount determines your frequency.

Payment Frequency Table (2026)

| Annual Credit Amount | Payment Frequency | Timing |

| $800 or more | Monthly | First 5 days of every month |

| $241 – $799 | Quarterly | July, October, January, and April |

| $240 or less | Annually | One lump sum in July |

The Strategy: If you are expecting $50/month but only get a deposit in July and October, don't panic. It means your total credit is between $241 and $799, and Revenu Québec has switched you to the quarterly schedule to save on processing.

Part 3: New Income Limits for 2026 (The "Clawback")

The credit is based on your 2025 Family Income. As your income goes up, the credit is "clawed back" (reduced).

Maximum Family Income for 2026 Eligibility

| Family Situation (on Dec 31, 2025) | Maximum Income (Estimate) |

| Individual without a spouse | $64,545 |

| Single-parent family | $64,545 + $2,634 per child |

| Individual with a spouse | **$70,395** + $2,634 per child |

If your family income exceeds these limits, your Solidarity Tax Credit will be reduced to $0. However, you should still file Schedule D just in case your income drops next year.

Solidarity Tax Credit Dates

The Quebec Solidarity Tax Credit payment dates for 2026 fall within the first five days of each month. For the July 2026 – June 2027 period, payments start on July 3, 2026. Depending on your annual credit amount, you will receive payments monthly ($800+), quarterly ($241–$799), or as a one-time lump sum in July ($240 or less). All recipients must be registered for Direct Deposit with Revenu Québec to receive the credit.

Part 4: The Three Components Explained

To maximize your 2026 payment, you need to understand what you are actually being paid for:

1. The QST Component

This is for everyone who meets the income criteria. It helps offset the Sales Tax you pay on groceries and clothing. It is the most "automatic" part of the credit.

2. The Housing Component

This is the "Money Maker." To get this, you must have lived in an "eligible dwelling" (not social housing or a dorm) on December 31, 2025.

- The Rule: You must be the owner, tenant, or subtenant. If you just "live with your parents" and don't pay formal rent with a lease, you cannot claim this component.

3. Northern Villages Component

If you live in a northern village (Kativik region), you get an additional supplement due to the extreme cost of shipping food and supplies to the north.

Frequently Asked Questions (FAQ)

Q: I didn't get my January payment. Why?

A: Check your frequency. If your annual credit is $600, your January payment arrived on January 5, 2026, but your next one won't be until April 3, 2026.

Q: Can I get the STC if I live in a dorm?

A: No. Student residences (dorms) are generally considered exempt dwellings and do not qualify for the housing component. However, you can still get the QST component.

Q: What if I moved during the year?

A: Your payment for the 2026-2027 period is based only on where you lived on December 31, 2025. If you move in August 2026, it does not change your payment for the current year.

Q: Is the STC taxable income?

A: No. It is a refundable tax credit, meaning it is tax-free and does not count as income for Employment Insurance (EI) or other federal benefits.

Q: Can the government take my STC to pay a debt?

A: Yes. If you owe money to the Quebec government (like unpaid tickets or previous tax debt), they can take up to 50% of each payment to offset your debt, provided your income is below $26,190.

How to Apply: Schedule D Checklist

- File Your Taxes: You cannot get the STC without filing a Quebec TP-1 tax return.

- Complete Schedule D: This is the specific form for the Solidarity Tax Credit.

- Enter Your RL-31: Ensure the dwelling number from your landlord is accurate.

- Register for Direct Deposit: If you haven't already, do this via My Account for Individuals on the Revenu Québec website.

- Job Search: If you are looking for work in Montreal or Gatineau to increase your income, visit BetterPayJobs.ca to find roles that value your bilingual skills.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Revenu Québec: Payment of the Solidarity Tax Credit 2026-2027

- Revenu Québec: Eligibility and Income Limits for 2026

- Educaloi: Understanding Quebec Tax Credits for Renters

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.