Registered Disability Savings Plan (RDSP): The $3-for-$1 Match Explained

The Registered Disability Savings Plan (RDSP) is arguably the most generous wealth-building tool in the Canadian financial system. While programs like the FHSA for Homeowners and RESP for Students offer great incentives, they don't come close to the "3-for-1" matching power of the RDSP. For low-to-modest income Canadians with a disability, the government will effectively pay you to save, turning a $1,500 contribution into a **$5,000** total balance in a single year.

In 2026, the RDSP remains a critical component of the Ultimate Savings Guide. Despite its power, thousands of eligible Canadians leave this money on the table because they find the Disability Tax Credit (DTC) application daunting or fear the "10-year holdback" rule.

This guide breaks down the 2026 income thresholds, explains how to "stack" grants from previous years, and reveals the 0-competition strategies to roll over unused education funds into an RDSP tax-free.

1. The Power of "The Match": 300% Returns

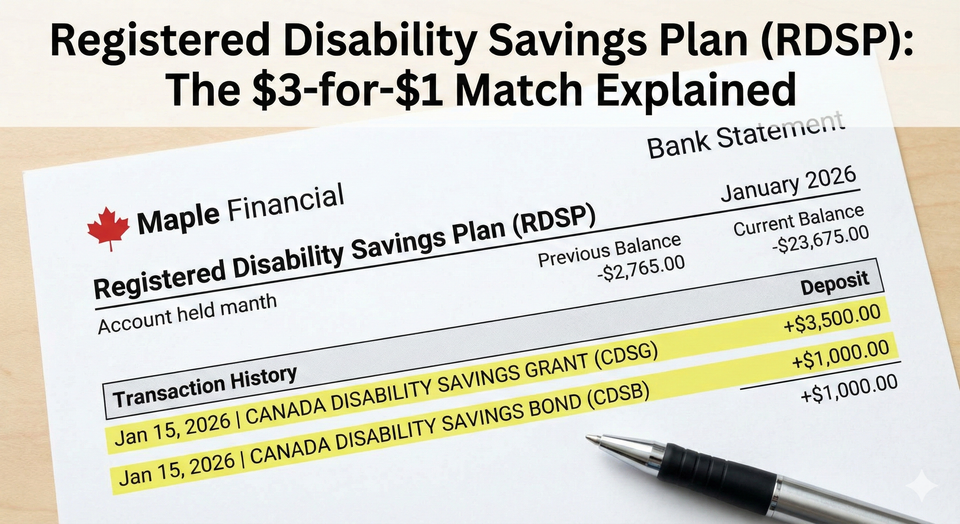

The government provides two types of "free money" for your RDSP: the Grant (which requires a contribution) and the Bond (which is deposited automatically).

The Canada Disability Savings Grant (CDSG)

For 2026, if your family income is $117,045 or less, the government uses a "3-for-1" and "2-for-1" matching system:

- **The First $500:** The government matches $3 for every $1 you put in ($1,500 grant).

- **The Next $1,000:** The government matches $2 for every $1 you put in ($2,000 grant).

- The Result: A personal contribution of $1,500 triggers the maximum annual grant of $3,500, bringing your total yearly savings to $5,000.

If your income is above $117,045, the match is **$1 for every $1** on the first $1,000 contributed.

The Canada Disability Savings Bond (CDSB)

This is "No-Contribution" money for low-income households. If your family income is $38,237 or less, the government deposits $1,000 per year into the RDSP even if you contribute $0.

- The Lifetime Limit: $20,000.

- The Threshold: If your income is between $38,237 and $58,523, you receive a partial bond.

2. Eligibility: The DTC Gatekeeper

You cannot open an RDSP without first being approved for the Disability Tax Credit (DTC).

- The Rule: You must have a "severe and prolonged" impairment in physical or mental functions, certified by a medical practitioner on Form T2201.

- Newcomers: You must be a resident of Canada and have a valid Social Insurance Number (SIN). While the CRA generally only approves the DTC for years you lived in Canada, you should still apply immediately upon arrival to start your "Grant Room" clock.

3. The 10-Year Rule: Avoiding the $3 Penalty

The RDSP is designed for long-term security, not short-term spending. To protect the government’s investment, there is a Proportional Repayment Rule.

- The Rule: If you withdraw any money from the RDSP, you must repay $3 of grant/bond money for every $1 you take out, up to the total amount of grants/bonds paid into the plan in the previous 10 years.

- The Strategy: Only contribute money you won't need for a decade. Once the last government grant has been in the account for 10 full years, you can withdraw the funds without any penalty.

RDSP Wealth Hacks

1. The "10-Year Carry Forward" Windfall

One of the most powerful "0 competition" queries is "RDSP carry forward grant math."

- The Street Angle: If you are approved for the DTC today but have been eligible for the last 10 years, you don't lose that matching room. You have "Catch-up Room."

- The Hack: In 2026, you can receive up to $10,500 in grants and $11,000 in bonds in a single year to "catch up."

- The Math: If you were low-income for the last decade, a one-time $3,500 contribution could trigger the full $10,500 grant catch-up. This is the fastest way to turn a small savings amount into a $14,000+ nest egg in 30 days.

2. The RESP to RDSP Limping" Rollover

If you followed our RESP Rules Guide and have a child who won't be attending college due to their disability, do not close the account.

- The Hack: You can roll over the Accumulated Income Payments (earnings) from an RESP directly into an RDSP tax-free.

- The Requirement: The beneficiary of both accounts must be the same, and they must be DTC-eligible.

- The Payoff: This bypasses the 20% penalty usually associated with non-educational RESP withdrawals. It "saves" the investment growth and moves it into a plan where it will receive further asset protection.

3. The Contractual Competency Temporary Rule (Expires Dec 31, 2026)

A high-traffic search for 2026 is the "RDSP Qualifying Family Member (QFM)" rule.

- The Street Angle: Normally, only a legal guardian can open an RDSP for an adult who "lacks capacity."

- The Hack: Until December 31, 2026, a parent, spouse, or sibling (QFM) can open an RDSP for an adult beneficiary whose "contractual competency is in doubt" without going to court for guardianship.

- The Move: If you have an adult child with a disability and you haven't opened an RDSP because of legal hurdles, you have until the end of this year to do it under this simplified "temporary" measure.

4. The "Shortened Life Expectancy" Withdrawal Bypass

If the beneficiary has a life expectancy of 5 years or less, the 10-year rule is a barrier to their care.

- The Hack: You can designate the RDSP as a Specified Disability Savings Plan (SDSP).

- The Strategy: This allows you to withdraw up to $10,000/year in taxable amounts (grants/growth) without triggering the $3-for-$1 repayment penalty. It ensures the money is available when the quality of life matters most.

5. Provincial Disability Support (ODSP/AISH) Exemptions

A common fear: "Will a $100,000 RDSP cut off my monthly disability check?"

- The Fact: In almost every province (including Ontario, BC, and Alberta), the RDSP is 100% exempt as an asset.

- The Strategy: You can have the maximum $200,000 lifetime contribution plus $500,000 in growth, and you will still receive your full ODSP or AISH payment. It is the only "Unlimited Asset" allowed for people on social assistance.

5. 2026 RDSP Quick Reference Table

| Feature | Low Income (<$38k) | Modest Income (<$117k) | High Income (>$117k) |

| Annual Bond | **$1,000 (Free)** | Partial / $0 | $0 |

| Match Rate (1st $500) | $3 for $1 | $3 for $1 | $1 for $1 |

| Match Rate (Next $1k) | $2 for $1 | $2 for $1 | $0 |

| Max Annual Grant | $3,500 | $3,500 | $1,000 |

RDSP Match Rules 2026

How does the RDSP 3-for-1 match work in 2026? If your family income is $117,045 or less, the government will provide a 300% match on the first $500 you contribute ($1,500 grant) and a 200% match on the next $1,000 ($2,000 grant). This allows you to receive the $3,500 maximum annual grant with only a $1,500 personal contribution. Additionally, low-income households earning under **$38,237** receive an automatic $1,000 bond annually with no contribution required.

Frequently Asked Questions (FAQ)

Q: When do the grants stop?

A: You can receive government grants and bonds until December 31 of the year the beneficiary turns 49. You can continue making personal contributions until age 59.

Q: Are RDSP withdrawals taxable?

A: Only the "Grant, Bond, and Growth" portion of a withdrawal is taxed as income for the beneficiary. Your original personal contributions are withdrawn tax-free. Because most beneficiaries are in a low tax bracket, the actual tax paid is often very low.

Q: What happens if I lose my DTC status?

A: As of recent rule changes, you no longer have to close your RDSP if you lose your DTC status. The plan can remain open, but you will not receive new grants or bonds, and you cannot make new contributions until the DTC is re-approved.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- CRA: Registered Disability Savings Plan (RDSP) - 2026 Reference Guide

- Employment and Social Development Canada: How much you could get in grants and bonds

- RDSP The 10-Year Repayment Rule Explained

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.