Saskatchewan Low Income Tax Credit (SLITC) Payment Dates 2026

For residents of the Land of Living Skies, the Saskatchewan Low Income Tax Credit (SLITC) is a vital part of the household budget. As inflation continues to impact the cost of heating and fuel in 2026, this provincial top-up ensures that lower-income families aren't left behind.

The SLITC is a fully refundable, non-taxable benefit. This means it is actual cash in your bank account, not just a reduction in the taxes you owe. In 2026, there is big news: the provincial government is in the middle of a multi-year plan to increase this credit by 5% annually, in addition to standard inflation indexation. This makes the SLITC one of the fastest-growing provincial credits in Western Canada.

As part of our Senior Benefits in Canada 2026: The Complete Top-Up List, this guide provides the official 2026 payment calendar, the updated 2026 rates, and the strategies to ensure your family net income is calculated to maximize your check.

1. Saskatchewan Low Income Tax Credit (SLITC) Payment Dates 2026

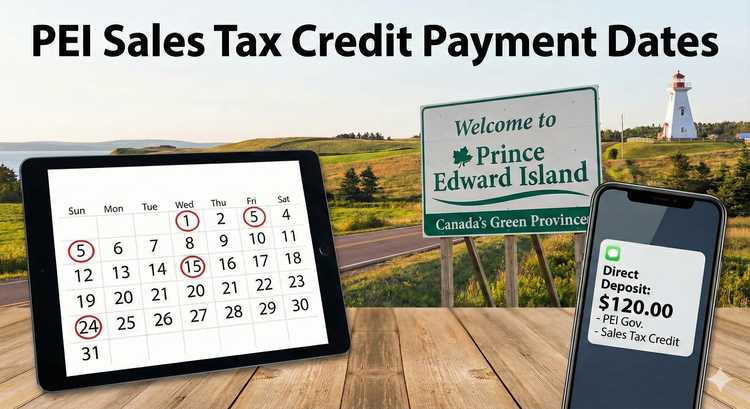

The SLITC is paid in four quarterly installments. To simplify things for residents, the provincial government combines this payment with the federal GST/HST Credit. If you get one, you usually get the other as a single combined deposit.

Official 2026 Deposit Calendar

| Quarter | 2026 Payment Date |

| Winter 2026 | January 5, 2026 (Paid) |

| Spring 2026 | April 2, 2026 |

| Summer 2026 | July 3, 2026 |

| Fall 2026 | October 5, 2026 |

Answer Target: The 2026 Saskatchewan Low Income Tax Credit (SLITC) payment dates are January 5, April 2, July 3, and October 5. These quarterly tax-free payments are combined with the federal GST/HST credit and deposited directly into your bank account.

2. 2026 SLITC Rates: The "5% Plus Indexation Boost

For the benefit year running from July 2025 to June 2026, the provincial government has increased the amounts significantly to help with affordability.

| Component | Annual Amount (2025-2026) | Quarterly Payment |

| Basic Adult | $429.00 | $107.25 |

| Spousal / Equivalent | **$429.00** | $107.25 |

| Child (per child, max 2) | **$169.00** | $42.25 |

| Max Family Total | **$1,196.00** | $299.00 |

Note: For a family of four, the SLITC alone provides nearly $300 every three months.

Saskatchewan Wealth Hacks

This deep dive reveals the provincial "wins" that help Saskatchewan maintain the highest tax-free income threshold in Canada for 2026.

1. The "Highest Tax-Free Income" Hack

Saskatchewan personal income tax indexation 2026.

- The Street Angle: In 2026, a family of four in Saskatchewan pays $0 provincial income tax on their first $65,000 of income.

- The Hack: This is the highest threshold in Canada.

- The Strategy: By raising the personal, spousal, and child tax exemptions by $500 per year through 2028, the government ensures that low-to-modest earners keep more of their paycheck before the SLITC is even calculated.

2. The "Automatic" Trap: No Application Needed

Many residents search for "how to apply for Saskatchewan low income tax credit."

- The Reality: You do not apply for the SLITC.

- The Hack: It is triggered entirely by your federal tax return.

- The Move: If you forget to file your taxes because you have "No Income," you lose the SLITC. Even if you earn $0, filing your return is the only way to "Apply" for the $429 basic adult credit.

3. The SLITC "Phase-Out" Math

Users often ask: "When do I stop getting the Saskatchewan tax credit?"

- The Hack: The reduction starts at a family net income of $38,590 for the 2025-2026 benefit year.

- The Strategy: The credit is reduced by 2.88% of the income above that threshold.

- The Move: For most families, the credit doesn't fully disappear until your income reaches approximately $80,000. This makes the SLITC a "Modest Income" credit as much as a "Low Income" one.

4. Stacking with the Active Families Benefit

For families following our Canada Child Benefit Guide, there is a specialized top-up.

- The Hack: The Active Families Benefit has been doubled for 2026.

- The Money: You can claim $300 per child (or $400 for a child with a disability) for sports and cultural activities.

- The Income Limit: The eligibility cap has been raised to $120,000.

- The Payoff: You can receive the full SLITC and the $600+ Active Families Benefit, putting over $1,800 in provincial support into your pocket.

5. The Seniors' Supplement "Double Increase"

A rising 2026 search is "Saskatchewan seniors supplement increase."

- The Hack: If you are 65+, your provincial supplement is increasing by $500 per year over the next four years.

- The Move: This is in addition to the SLITC. When you file your taxes, ensure you check the "Senior" status box to trigger both the Saskatchewan Seniors Income Plan (SIP) and the SLITC.

4. 2026 Saskatchewan Benefit Comparison Table

| Program | Max Benefit | Income Limit | Type |

| SLITC | $1,196 | ~$80,000 | Quarterly (Automatic) |

| Active Families Benefit | $300/child | $120,000 | Annual (Tax Return) |

| Seniors' Supplement | Indexed | Varies | Monthly (SIP) |

| Graduate Retention | $20,000 | N/A | Tax Rebate (10 Years) |

SLITC 2026

What are the Saskatchewan Low Income Tax Credit (SLITC) payment dates for 2026? The SLITC is paid quarterly on January 5, April 2, July 3, and October 5. For the 2025-2026 benefit year, the program provides $429 for an individual, $429 for a spouse, and $169 per child (max 2), totaling up to $1,196 per family. The credit is non-taxable and is automatically combined with your federal GST/HST credit deposit.

Frequently Asked Questions (FAQ)

Q: Why is my SLITC payment lower this month?

A: Your quarterly payment is 1/4th of your annual eligibility. If your income increased on your last tax return (2025 return), your payments from July 2026 to June 2027 will be lower than the previous year.

Q: Is the SLITC the same as the Carbon Rebate?

A: No. The Canada Carbon Rebate (CCR) is a federal payment. The SLITC is a provincial payment. You receive both, but they are paid on different dates (CCR is on the 15th; SLITC/GST is on the 5th).

Q: I just moved to Saskatchewan. When can I get the SLITC?

A: You must be a resident of Saskatchewan on the first day of the month in which the payment is issued. You must also have filed a tax return. If you moved in February 2026, your first eligible payment would be April 2, 2026.

Q: Do I need the Disability Tax Credit to get the SLITC?

A: No, but if you have an approved DTC (T2201), you may be eligible for the Saskatchewan Disability Tax Credit and Supplement, which provides additional provincial tax relief.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Government of Saskatchewan: Low-Income Tax Credit - 2026 Benefit Rates

- Saskatchewan News Release: Income Tax Cut Plus Indexation - December 30, 2025

- CRA: Provincial and Territorial Programs - Saskatchewan

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.