OTB vs. CCB: Are They the Same? (Ontario Trillium Benefit Explained)

Confused about the OTB and CCB? While both arrive as tax-free deposits, they serve very different purposes. We break down the 2026 payment dates, income rules, and why Ontario parents need to track both to maximize their household budget.

Alberta Child Benefit Calculator 2026: Max Payments and Income Thresholds

Understand your Alberta Child and Family Benefit (ACFB) for 2026. This guide breaks down the maximum payments for the base and working components, income thresholds, and the 2026 quarterly deposit schedule so you know exactly how much to expect.

CRA DTC Denied? 2026 Reconsideration Guide)

If your Disability Tax Credit (DTC) was denied, don't panic. Rejection is often a paperwork error, not a medical one. Learn how to use the CRA Reconsideration process to submit new evidence, fix doctor errors, and turn a 'No' into an approval without filing a formal legal objection.

How Much CCB Will I Get? (2026-2027) Calculator & Payment Table

Estimate your monthly child tax with our Live 2026-2027 CCB Calculator. Get exact payment amounts based on the latest CRA inflation adjustments and see your new totals before the July recalculation. Stop guessing and get your personal CCB breakdown today.

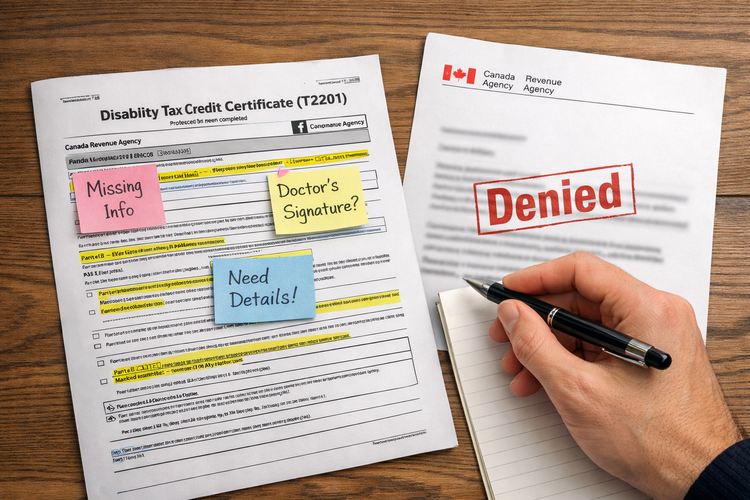

Disability Tax Credit (DTC) Application: How to Fix Common Rejection Errors

Receiving a rejection letter from the Canada Revenue Agency (CRA) is a soul-crushing experience, especially when you are already dealing

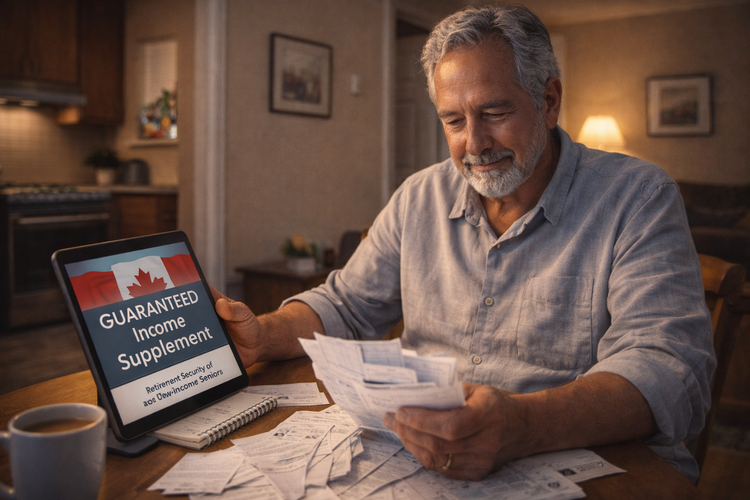

The GIS Guide: How to Get the Maximum Guaranteed Income Supplement in 2026

The 2026 guide to the Guaranteed Income Supplement (GIS). Learn the new income thresholds for singles and couples, how to qualify for the maximum $1,108 monthly payment, and why your GIS might be "suspended" if you miss a tax deadline.

Retirement Payment Comparison 2026: CPP vs. OAS & Calculator

Understanding the difference between CPP and OAS is essential for retirement. We break down the 2026 payment amounts, eligibility rules, and tax implications so you know exactly how much to expect from each.

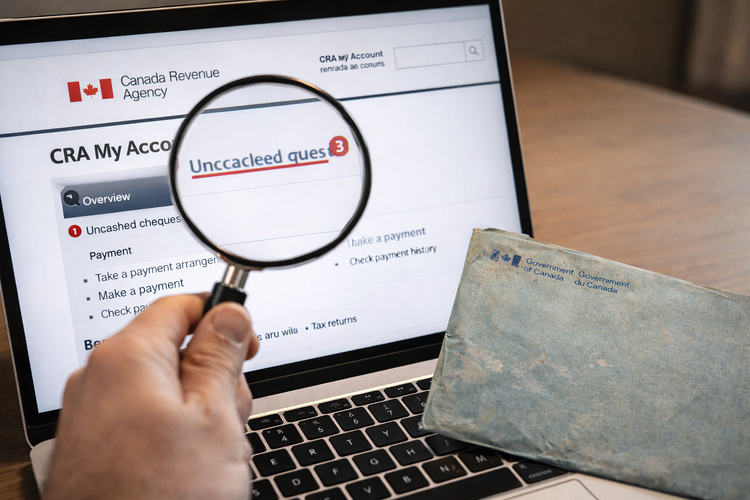

Uncashed Cheques: How to Find Old CRA Payments in Your My Account

Over $1.4 billion in uncashed CRA cheques is sitting in government accounts. Learn how to find your "hidden" money in 2 minutes using the My Account portal, download the required forms, and reclaim lost tax refunds or benefit payments from years ago.

Grocery Rebate 2026: Is it Coming Back? (Official CRA Update & Scams)

Excerpt:

The official update on the rumored "2026 Grocery Rebate." Find out if the $628 payment is real, why you might be receiving a different deposit on January 5th, and how to spot the dangerous text message scams targeting Canadians this month.

CDB Clawback List: Will My ODSP/AISH Be Reduced by the Canada Disability Benefit?

The definitive 2026 Clawback List for the Canada Disability Benefit (CDB). See which provinces have promised to treat the $200/month as exempt income and which ones (like Alberta) may deduct it from your social assistance cheque.