Digital News Subscription Tax Credit: Which Sites Qualify?

Looking for the $75 news tax credit on your 2026 return? Warning: The Digital News Subscription Tax Credit has officially ended. Learn the rules for back-claiming and which sites used to qualify.

Eligible Educator School Supply Tax Credit 2026: Complete Teacher’s Guide

Don't lose your $250 refund. Learn which 2026 classroom supplies qualify for the educator tax credit, from laptops to art supplies, and how to get your principal's signature.

Home Accessibility Tax Credit (HATC): Get Paid to Renovate

Is your home safe for aging in place? Discover the 2026 Home Accessibility Tax Credit rules, the $20,000 expense limit, and the secret to "Double-Dipping" HATC with medical expenses.

Medical Expense Tax Credit List 2026: What Can You Write Off?

From gluten-free bread to $1,000 air conditioners, discover the "weird" medical expenses you can claim on your 2026 Canadian tax return to maximize your refund.

Canada Caregiver Credit 2026: Can You Claim Your Parent or Spouse?

Caring for a loved one with an impairment? Discover the 2026 Canada Caregiver Credit rules, learn how to claim over $8,000 for a parent or spouse, and get the exact income thresholds for Line 30450.

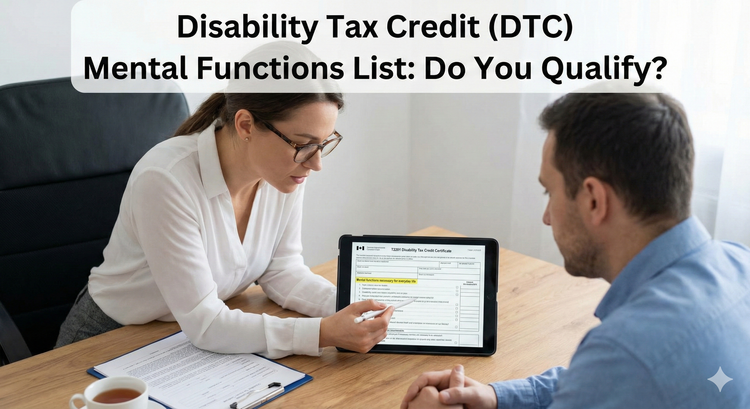

Disability Tax Credit (DTC) Mental Functions List: Do You Qualify?

Can you get the Disability Tax Credit for depression, anxiety, or ADHD? Yes. Discover the expanded 2026 "Mental Functions" list, the 90% rule, and how to unlock the $20,000 RDSP bond even without physical symptoms.

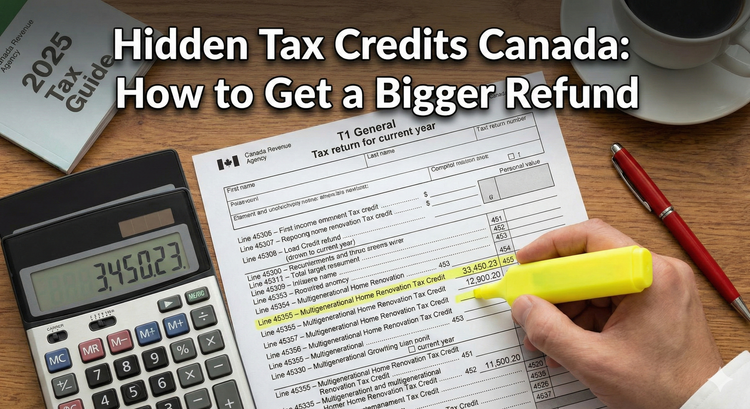

Hidden Tax Credits Canada 2026: How to Get a Bigger Refund

Don't file your 2026 taxes until you read this. From the $7,500 Multigenerational Home Renovation credit to the hidden "Training" cash, discover the credits that most Canadians miss.

Newcomer Guide to Filing Your First Tax Return in Canada (Get Benefits Back-Pay)

Filing your first Canadian tax return is more than just a legal requirement—it’s how you unlock thousands of dollars in "back-pay" benefits. Learn the 2026 deadlines, the forms you need as a newcomer, and how to claim missed GST and Carbon Rebate payments.