The Ultimate Guide to Renting in Canada’s Housing Crisis (2026)

Renting in Canada in 2026 is no longer just about finding a place to live—it is about navigating a complex legal and financial battlefield. While the post-pandemic "rent spikes" have finally begun to level off in major hubs like Toronto and Vancouver, the crisis has simply shifted form. We are now seeing "rent compression," where mid-sized cities are becoming just as expensive as metropolitan centers.

Whether you are a newcomer on a work permit, a student, or a long-term resident, the "old way" of renting is gone. In 2026, your rental history can now impact your credit score, new federal agencies are building homes at scale, and provincial laws (like Ontario's Bill 60) have significantly shortened eviction timelines.

This master pillar page is your 2026 Rental Roadmap. It links every resource on this site—from finding the cheapest cities left in Canada to fighting an illegal eviction—into one cohesive strategy.

The 2026 Rental Reality: By the Numbers

As we enter 2026, the national average asking rent has stabilized at approximately $2,100 CAD. However, "averages" are deceptive in a country as geographically diverse as Canada.

- The Cooling Hubs: Toronto and Vancouver have seen year-over-year rent declines of 3% to 5%. While still the most expensive cities, the "bidding war" for apartments has finally cooled as supply from the 2023-2024 construction boom hits the market.

- The Rising Middle: Cities like Regina, Saskatoon, and Windsor are seeing the highest rent growth as people flee the high costs of the GTA and GVA.

- The Shared Economy: With one-bedroom apartments averaging $1,900+ in most urban areas, shared accommodations have become the standard for workers under 30. This has led to critical questions about Roommate Rights and how to protect yourself when sharing space.

2026 Provincial Rent Snapshots

| Province | Avg. 1-Bedroom Rent (2026) | Market Outlook |

| Ontario | $2,250 | Slowing growth; high tenant-landlord friction |

| British Columbia | $2,400 | Highly restrictive; shift to secondary markets |

| Alberta | $1,750 | Rapid growth; high demand in Calgary/Edmonton |

| Saskatchewan | $1,250 | High value; becoming the "new frontier" |

| Quebec | $1,600 | Increasing pressure on Montreal/Gatineau |

The 2026 Federal Shift: Renters’ Bill of Rights

The biggest change in 2026 is the full implementation of the Canadian Renters’ Bill of Rights. This is a federal framework designed to bring "Bank-level" transparency to the rental market and empower tenants who have traditionally been at a disadvantage.

1. The Credit Score Revolution

For the first time, renters can "opt-in" to have their on-time rent payments count toward their credit score. This is a game-changer for newcomers and students looking to build a financial profile for future homeownership. If you are managing your budget through your Benefit Payment Dates, ensuring your rent is paid on the 1st can now significantly boost your borrowing power.

2. The Build Canada Homes Agency

The newly launched Build Canada Homes federal agency has begun deploying its mandate to build deeply affordable rental units. If you are looking for "Rent-Geared-To-Income" housing, these new federal-provincial partnerships are where the 2026 supply is coming from.

3. National Standard Lease Protection

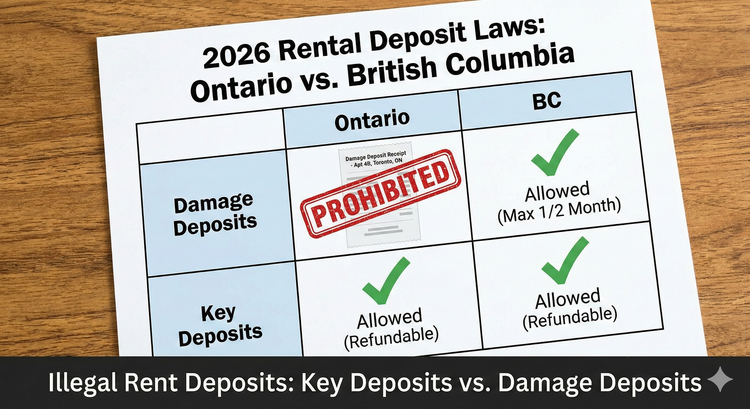

The federal government is pushing for a "National Standard Lease" to stop landlords from adding illegal clauses, such as banning overnight guests or demanding illegal damage deposits. In 2026, if your lease contains a "no pets" or "no guests" clause in Ontario, it is legally void from the moment you sign it.

Provincial Spotlight: Ontario’s Bill 60 (The "Fast-Track" Law)

If you live in Ontario, 2026 brings a major legal shift via Bill 60, which passed late in 2025. This law has changed the Residential Tenancies Act (RTA) to favor faster resolutions, which can be a risk for tenants in financial trouble.

- 7-Day Eviction Filings: The "grace period" for an N4 (Non-payment of rent) has been shortened from 14 days to 7 days. This means if you miss your rent because of a delay in your Ontario Works payment, your landlord can apply to the Landlord and Tenant Board (LTB) much faster.

- The 50% Rule for Hearings: To raise a maintenance defense (like a broken furnace or mold) during an unpaid rent hearing, tenants are now often required to pay 50% of the arrears into the Board upfront.

- N12 Compensation Shift: For "Personal Use" evictions (N12), if a landlord provides at least 120 days' notice, they are no longer required to provide the one-month rent compensation. This makes it vital to know exactly how to handle an Ontario Rent Increase Guideline notice versus an eviction notice.

Strategies for Finding a Home in 2026

The "Kijiji and a Prayer" method is no longer enough. To secure a home in 2026, you need a professional-grade "Tenant Portfolio."

1. The 2026 Tenant Portfolio

- Verified Employment: Have your BetterPayJobs.ca profile or employment letter ready.

- Rental Resume: A one-page summary of your rental history and references.

- Pre-Authorized Credit: Since 2026 rules allow rent to count for credit, show landlords that you are "Opted-In."

- Tenant Insurance: Most 2026 landlords require proof of insurance. Having a policy ready for $15-$25/month shows you are a low-risk tenant.

2. Identifying the "Value Cities"

If you are flexible, the best way to survive the crisis is to move to where the rent is under $1,500.

- Ontario: Look toward Timmins, Cornwall, or Sault Ste. Marie.

- BC: Explore Prince George or Nanaimo instead of Vancouver.

- Alberta: Consider Lethbridge or Red Deer for the best balance of wages and rent.

2026 Housing Navigation Hub (The 11 Master Guides)

Use the links below to navigate the specific sections of the 2026 Housing Crisis. Each guide is updated for the current year's laws and rates.

Finding Affordable Rent

- 10 Cheapest Cities to Live in Ontario 2026 (Rent Under $1,500)

- Cheapest Places to Live in BC 2026 (That Aren't Vancouver)

- Cheapest Cities in Alberta 2026: Calgary vs. Edmonton vs. Lethbridge

Knowing Your Legal Rights

- Ontario Rent Increase Guideline 2026: The Official 2.1% Cap

- Fighting "Renovictions": How to Handle an N13 Notice

- Can My Landlord Ban Guests? Understanding Guest Rules

- Room Rental Rights: Sharing a Kitchen with the Landlord

Deposits, Leases, and Moving Out

- Illegal Rent Deposits: Key Deposits vs. Damage Deposits

- How to Break a Lease in Canada Without Paying a Penalty

- "Cash for Keys": Negotiating a Buyout With Your Landlord

Financial Aid and Support Silo

If you are struggling to make rent this month, do not wait for an eviction notice. Access these 2026 support systems immediately:

- Rent Banks: If you have a one-time emergency, the Emergency Rent Bank List provides interest-free loans to keep you housed.

- Utility Help: Use the LEAP Program Guide to get up to $780 for overdue hydro or gas bills.

- Benefit Alignment: Ensure your AISH payments or other provincial supports are correctly timed with your rent due date.

- Employment Support: If your current wage doesn't cover rent, visit BetterPayJobs.ca to find roles that pay above the 2026 living wage of $22/hour in most urban centers.

In 2026, the most successful tenants are those who treat their housing like a business contract. The "Wild West" days of landlords doing whatever they want are ending, but only for those who know how to use the law.

The "N13 Renoviction" Defense

One of the highest-traffic issues in 2026 is the "Renoviction." A landlord gives you an N13 notice saying they need to do "major repairs" and you have to move out.

- The 120-Day Rule: They must give you at least 120 days' notice.

- The Right of First Refusal: This is your most powerful weapon. In writing, before you move out, you must tell the landlord you want to move back in when the work is finished—at the same rent you pay now. Most "renovicting" landlords will back off once they realize they can't raise the rent on the next person.

Negotiating "Cash for Keys" in a 2026 Market

With the LTB backlog still significant, many landlords are willing to pay you to leave voluntarily using an N11 (Agreement to End Tenancy).

- The 2026 Rate: Do not accept one month's rent. A fair "Cash for Keys" buyout in 2026 is typically (Market Rent - Current Rent) x 12 months + $1,000 for moving costs. If you pay $1,500 and the new unit is $2,000, that gap is $500/month. A fair buyout would be **$6,000 + $1,000 = $7,000.**

- The Trap: Never sign an N11 until the money is in your hands or in a lawyer's trust account. Once you sign, you lose your RTA protections.

Lease Assignment vs. Subletting

If you need to move out early, do not just "break the lease."

- Assignment: You find someone to take over your lease permanently at the exact same price. If the landlord refuses "arbitrarily," you can give an N9 notice and leave with just 30 days' notice—penalty-free.

- Sublet: You move out temporarily and plan to return. You are still responsible for the rent.

- Why it matters: Landlords in 2026 want you to break the lease so they can raise the rent for the next person. Assignment prevents them from doing this, giving you leverage.

The "Shared Kitchen" Warning

This is the most critical advice for students and low-income workers: If you share a kitchen or bathroom with the owner or the owner's immediate family, you have ZERO protection under the Residential Tenancies Act.

- The Risk: You can be evicted with "reasonable notice" (often just 24 hours). You cannot go to the LTB for help.

- The Fix: Always ask: "Does the landlord live here?" before signing a room rental agreement.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Government of Canada: Canada’s Housing Plan and Renters' Bill of Rights 2026

- Landlord and Tenant Board (Ontario): Bill 60 and the Residential Tenancies Act 2026 Updates

- Rentals.ca: 2026 National Rent Trend Analysis

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.