Working While on EI: The 50 Cents on the Dollar Rule Explained

One of the most persistent fears for Canadians on Employment Insurance (EI) is that getting a part-time job will "cancel" their benefits. This misunderstanding keeps thousands of people from accepting short-term contracts or "gig" work that could actually improve their bottom line. In 2026, with the "Working While on Claim" provisions firmly in place, the goal isn't to stop you from working—it's to encourage it.

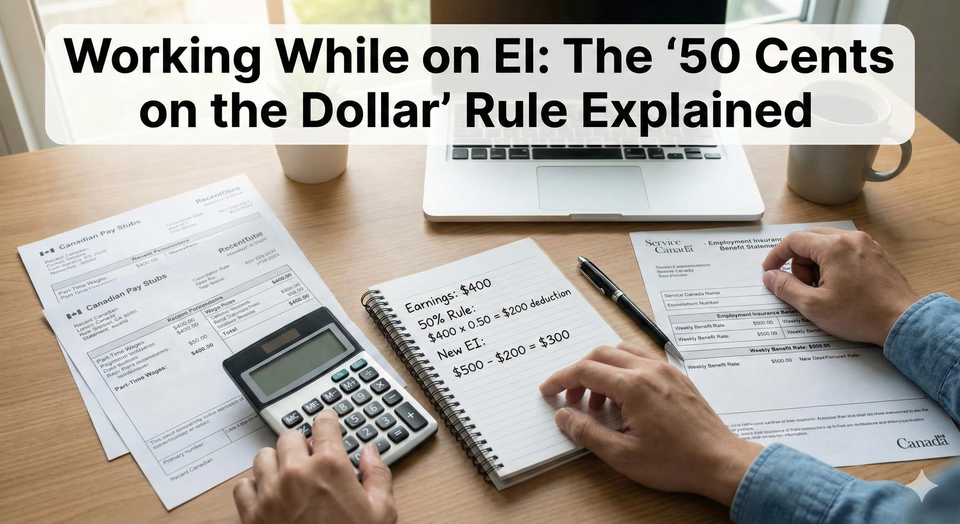

The rule is surprisingly simple: Service Canada allows you to keep 50 cents of your EI benefits for every dollar you earn at a job. This means that for every hour you work, you are always financially better off than if you stayed home. Instead of an "all or nothing" system, Canada uses a sliding scale that lets you transition back into the workforce without falling off a financial cliff.

As a centerpiece of our Employment Insurance Master Guide, this article breaks down the 2026 math, explains the "90% Threshold," and reveals the "Street Hacks" to reporting your earnings correctly so you never get a surprise bill from the CRA.

1. The Math: If I Earn $100, How Much EI Do I Lose?

The 50 Cents on the Dollar rule is the gold standard for 2026. Here is exactly how the math works for your bi-weekly report.

The Basic Formula

$$New Weekly Benefit = Weekly Benefit Rate - (Weekly Earnings \times 0.50)$$

Example:

- Your Weekly EI Rate: $600

- You earn at a part-time job: $200

- The Deduction: $100 (half of what you earned)

- Your New EI Payment: $500

- Your Total Take-Home: **$700** ($500 EI + $200 Wages)

The Payoff: By working that part-time shift, you ended up with $100 more in your pocket than if you had just collected EI alone.

2. The 90% Threshold: When the Math Changes

While the 50-cent rule is generous, there is a limit. Service Canada does not want your total income (Wages + EI) to significantly exceed what you were making before you lost your job.

The Cap Rule

Once your earnings reach 90% of your previous weekly earnings (the amount used to calculate your claim), your EI benefits are deducted dollar-for-dollar.

How to avoid the trap:

If you were earning $1,000 a week before your layoff, your 90% cap is **$900**. If you take a "part-time" job that pays $950, you have crossed the threshold. At this point, the extra work doesn't benefit you financially because Service Canada will take back every dollar over the cap.

Important for 2026: If you work a full week (typically 30+ hours), you are generally not eligible for EI for that week, regardless of how much you earned.

Working on EI Hacks

This deep dive identifies the technical "Street Hacks" to ensure your bi-weekly reports are bulletproof and your bank account stays full.

1. The "Gross vs. Net" Reporting Hack

How to report earnings on EI report.

- The Street Angle: People often report their "take-home pay" (Net).

- The Error: Service Canada requires you to report your Gross Earnings (before taxes) in the week you worked, not the week you were paid.

- The Strategy: Keep a simple log of your hours and your hourly rate. If you worked 10 hours at $20/hr between Monday and Friday, you report **$200** on that week's report, even if your paycheck doesn't arrive for another 14 days.

2. The Waiting Period Waiver 2026

Many users search for "EI waiting period waiver 2026 rules."

- The Hack: For claims starting between March 30, 2025, and April 11, 2026, the standard one-week waiting period is waived.

- The Impact: This means your "Working While on Claim" math starts from Week 1. You don't have to serve a "unpaid week" before the 50-cent rule kicks in, putting money in your pocket faster.

3. Reporting Tips and Commissions

A rising query in 2026 is "do I have to report tips on EI."

- The Reality: Yes. * The Hack: Tips, bonuses, and commissions are all considered "earnings."

- The Strategy: If you are a server or delivery driver, you must estimate your tips for the week and include them in your gross total. If you under-report and are audited later (Service Canada frequently cross-references with CRA tax filings), you will be hit with an "Overpayment" bill and a potential penalty.

4. The "Ready and Willing" Test

Service Canada allows you to work, but they also require you to be looking for full-time work.

- The Trap: If you work 25 hours a week at a coffee shop and tell Service Canada "I'm happy with this and not looking for anything else," they will cancel your claim.

- The Strategy: You must maintain your job search log. You are working "while on claim" as a temporary measure while you seek "suitable full-time employment."

5. Self-Employment and the "Minor in Extent" Rule

If you are starting a small business or doing freelance work (Gig economy), search for "self employment while on EI Canada."

- The Hack: You can be self-employed and get EI if your business is "minor in extent."

- The Criteria: Usually, this means you spend less than 20 hours a week on the business and it doesn't prevent you from taking a full-time job. You still report your net self-employment income, and the 50-cent rule applies.

4. Summary Table: 2026 "Working While on Claim" At-A-Glance

| If you earn... | Your EI is reduced by... | Benefit |

| $0 | $0 | Full Weekly EI Rate. |

| $100 | $50 | You keep $100 (Work) + $450 (EI) = $550. |

| **$500** | $250 | You keep $500 (Work) + $250 (EI) = $750. |

| >90% of Previous Pay | Dollar-for-Dollar | No financial benefit to working more. |

| Full Week (30+ hrs) | 100% | Claim is "suspended" for that week. |

Working While on EI

How much can I earn while on EI in Canada without losing benefits? Under the "Working While on Claim" rules for 2026, you can keep 50 cents of your EI benefits for every dollar you earn, up to a cap of 90% of your previous weekly earnings. If you earn $100, your EI is reduced by only $50, leaving you with more total income than benefits alone. However, if you work a full week (typically 30 hours or more), you are generally ineligible for benefits for that week regardless of your earnings.

Frequently Asked Questions (FAQ)

Q: Do I need to call Service Canada to tell them I got a part-time job?

A: No. You simply declare your hours and gross earnings on your regular bi-weekly report. The system will automatically calculate the 50% deduction.

Q: What if my part-time job becomes full-time?

A: Once you are working full-time, you simply indicate "Yes" to the question "Have you found full-time work?" on your report. This will close your claim.

Q: Does working longer extend my EI claim?

A: No. Working while on claim does not increase the number of weeks you can receive benefits, but because you are receiving less money each week, it can help your total "benefit bank" last until you find a permanent role.

Q: Can I work while on EI Sickness or Maternity benefits?

A: Yes. The "Working While on Claim" rules apply to most types of EI, including sickness and parental benefits, provided you are still meeting the other criteria for those specific leaves.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Service Canada: Employment Insurance – Working While on Claim

- Service Canada: Important notice about maximum insurable earnings for 2026

- Government of Canada: Digest of Benefit Entitlement Principles Chapter 24 - Earnings

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.