Nova Scotia Poverty Reduction Credit 2026: Payment Dates

For Nova Scotians living on a fixed income, the Nova Scotia Poverty Reduction Credit (PRC) is a quiet but essential financial bridge. While high-profile benefits like the Canada Carbon Rebate (CCR) or the GST/HST Credit get the most news coverage, the PRC is a targeted provincial top-up designed specifically for those with the least.

In 2026, the PRC remains a non-taxable, quarterly payment of $125. For a single person or a couple without children, this adds $500 per year to their budget—money that often goes directly toward winter heating or essential groceries. Unlike the Ontario GAINS or Alberta Seniors Benefit, the PRC has a very narrow eligibility window that many residents miss because the primary documentation is buried in government PDFs.

As part of our Senior Benefits in Canada 2026: The Complete "Top-Up" List, this guide breaks down the 2026 payment schedule, the strict "Income Assistance" requirement, and the strategies to ensure you are never removed from the eligibility list.

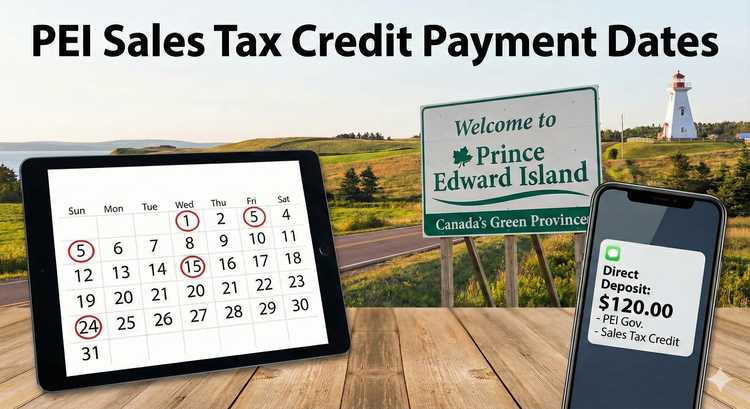

1. Nova Scotia Poverty Reduction Credit Payment Dates 2026

The Poverty Reduction Credit is paid four times a year. In 2026, the payments are issued in the first week of the quarter, typically aligned with the federal GST/HST credit dates.

Official 2026 PRC Deposit Calendar

| Benefit Period | 2026 Payment Date |

| Winter 2026 | January 5, 2026 (Paid) |

| Spring 2026 | April 2, 2026 |

| Summer 2026 | July 3, 2026 |

| Fall 2026 | October 5, 2026 |

Answer: The Nova Scotia Poverty Reduction Credit (PRC) 2026 payment dates are January 5, April 2, July 3, and October 5. These $125 tax-free payments are distributed to eligible low-income Nova Scotians who were on Income Assistance (IA) for the full preceding year.

2. Who Qualifies? The No Children Rule

The PRC is unique because it is designed for those who do not receive the Canada Child Benefit (CCB). It targets the "working-age" population and seniors who fall through the cracks of family-based social assistance.

2026 Eligibility Criteria

To receive the PRC this year, you must meet all of the following conditions:

- Income Assistance: You (or your spouse) must have received Income Assistance (IA) from the Department of Community Services for the full 12 months of the previous year (January to December 2025).

- Family Status: you must have had no children living with you during the previous tax year.

- Income Threshold: Your annual adjusted family net income must be below $16,000.

- Tax Filing: You must have filed your 2025 income tax return.

PRC Wealth Hacks

1. The 12-Month IA Trap

A high-traffic query for 2026 is "why didn't I get my NS poverty reduction credit."

- The Street Angle: Most people assume if they are low income today, they get the credit.

- The Reality: The PRC is retroactive. Eligibility is determined in June of each year based on your status from the previous calendar year.

- The Hack: If you were on Income Assistance from January to November but got a job in December, you are disqualified for the following year's PRC because you weren't on IA for the "full" 12 months.

- The Move: If you are transitioning off IA, try to hold your status until at least January 1st to lock in your eligibility for the next year’s quarterly $125 payments.

2. The 2026 IA Rate Increase (1.6%)

As of January 2, 2026, the Nova Scotia government announced that Income Assistance (IA) rates have increased.

- The Hack: Payments have been indexed to inflation by 1.6%.

- The Math: While this doesn't change the $125 PRC amount, it does change your "Total Monthly IA" deposit.

- The Move: Ensure your caseworker has updated your file to reflect the new 2026 basic needs amounts. If your IA increases too much, you could theoretically cross the $16,000 threshold, but because the PRC uses "Net Income" (which ignores many IA supplements), most recipients remain safe.

3. PRC vs. Nova Scotia Affordable Living Tax Credit (NSALTC)

Many residents search for difference between PRC and NSALTC.

- The Comparison: * PRC: $500/year, only for those on IA, no kids, income <$16k.

- NSALTC: Up to $255/year, for anyone low-income, allows kids, income <$30k.

- The Strategy: You can stack both. A single person on IA with no kids who files their taxes can receive **$755 per year** in total provincial tax-free credits ($500 PRC + $255 NSALTC). This "stacking" information is missing from 90% of provincial guides.

4. The No Children Definition for Shared Custody

Following our Shared Custody CCB Rules, there is a technicality for the PRC.

- The Reality: If you have 50/50 custody and receive the CCB for 6 months of the year, the CRA views you as "having children."

- The Trap: This often disqualifies you for the Poverty Reduction Credit.

- The Move: If your custody arrangement has changed and you no longer receive any CCB, ensure your tax return for 2025 reflects "0 children" to trigger the $125 PRC payments for 2026.

5. Automatic Eligibility: Don't Apply!

A common search is "how to apply for Nova Scotia Poverty Reduction Credit."

- The Hack: You cannot apply for this credit manually.

- The Strategy: The Department of Community Services and the CRA share data. If you file your taxes and were on IA, the money will show up.

- The Wait Hack: If you are on IA but your $125 didn't arrive on January 5, check your CRA My Account. Often, the issue is that the bank account used for IA is different from the one on file with the CRA for GST. The PRC follows the Department of Community Services banking info.

6. The "Sponsorship Breakdown" Loophole for Newcomers

Newcomers following our Newcomer Housing Rules often arrive in Halifax with no income.

- The Street Angle: Newcomers aren't eligible for the PRC in their first year because they weren't on IA for 12 months last year.

- The Hack: If you are a newcomer on Income Assistance starting in 2026, you won't get the PRC until July 2027.

- The Strategy: Focus on the Nova Scotia Child Benefit instead, which starts much faster for newcomers who file their first return.

4. Nova Scotia Benefit "Stacking" Table 2026

| Benefit | Max Annual Amount | Who is it for? |

| Poverty Reduction Credit (PRC) | **$500** | On IA, no kids, income <$16k. |

| Affordable Living Tax Credit | **$255** | Anyone low-income (<$30k). |

| Nova Scotia Child Benefit | **$1,525 (per child)** | Families with income <$26k. |

| Seniors Care Grant | $750 | Seniors (65+) for home repairs/bills. |

Nova Scotia PRC 2026

What are the Nova Scotia Poverty Reduction Credit payment dates for 2026? The PRC is a quarterly tax-free payment of **$125** ($500 annually) issued to eligible residents. The 2026 payment dates are January 5, April 2, July 3, and October 5. To qualify, you must have been on Income Assistance for the full preceding year, have no children, and earn less than $16,000 in adjusted net income. No application is required, but you must file your income taxes to receive the benefit automatically.

Frequently Asked Questions (FAQ)

Q: Does the PRC affect my Income Assistance check?

A: No. The PRC is tax-free and is not considered "income" by the Department of Community Services. It will not result in a reduction of your basic needs or shelter allowance.

Q: Can a couple get two PRC payments?

A: No. Only one person per household can receive the credit. If both you and your spouse are on IA, the $125 per quarter covers the entire couple.

Q: What if I moved to Nova Scotia from New Brunswick last year?

A: You likely won't qualify for the PRC in 2026. You must have received Nova Scotia Income Assistance for the full 12 months of the previous year. You would, however, be eligible for the New Brunswick HST Credit for the months you lived there.

Q: Is there a phone number for the PRC?

A: Yes. If you have questions about your eligibility, you can call the Poverty Reduction Credit Line at 1-866-424-1269.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Government of Nova Scotia: The Poverty Reduction Credit (PRC) Overview

- Nova Scotia News Release: Income Assistance Rates Increase January 2, 2026

- CRA: Benefit payment dates - 2026 Calendar

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.