Ontario Rent Increase Guideline 2026: Can My Landlord Raise It?

For approximately 1.4 million rental households in Ontario, the annual rent increase announcement is the most important date on the financial calendar. In 2026, the Ontario government has officially set the rent increase guideline at 2.1%. This is a significant cooling from the 2.5% maximums seen in 2023, 2024, and 2025, and marks the lowest rent cap the province has seen in four years.

However, a "guideline" is only useful if you know the rules behind it. In 2026, the rental market is split into two distinct worlds: those protected by the 2.1% cap and those living in "exempt" units where a landlord can legally raise the rent by any amount. Understanding which world you live in—and how to spot the "paperwork errors" that can void an increase—is essential for protecting your budget.

This master guide provides a deep dive into the 2026 Ontario rent rules, the specific legal forms your landlord must use, and the "Answer Targets" for fighting a rent hike that exceeds the legal limit.

The 2.1% Guideline and the "2018 Rule"

The 2026 guideline of 2.1% is based on the Ontario Consumer Price Index (CPI), a measure of inflation calculated by Statistics Canada. By law, the guideline is capped at a maximum of 2.5% to protect tenants from "inflation shock." Because the CPI has cooled, the government was able to set the rate below that maximum for the first time since 2022.

1. Who is Protected by the 2.1% Cap?

The guideline applies to the vast majority of private residential rental units covered by the Residential Tenancies Act (RTA). This includes:

- Standard apartment buildings and condo rentals.

- Basement apartments and secondary suites first occupied before 2018.

- Rented houses and townhomes.

- Care homes (only for the rent portion, not the care services).

The Eligibility Test: If your rental unit (or the building it is in) was first occupied for residential purposes on or before November 15, 2018, you are protected. Your landlord cannot raise your rent by more than 2.1% in 2026 without a special order from the Landlord and Tenant Board (LTB).

2. The "Post-2018" Exemption: The World of No Rent Control

The biggest "High Anxiety" topic in the 2026 market is the November 15, 2018 exemption. Units first occupied after this date are not subject to the 2.1% cap.

- New Condos: If you are renting a condo in a tower that was finished in 2019 or later, your landlord can legally raise your rent by 5%, 10%, or even 50%.

- New Basement Suites: If a homeowner created a new basement apartment in 2020, that unit is exempt from rent control, even if the house itself was built in 1950.

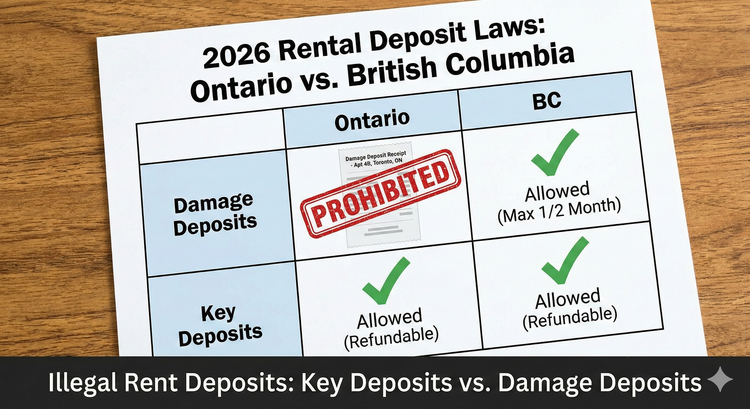

- The Only Protection: Even in these exempt units, the landlord must still follow the 12-month rule and provide 90 days' notice using the correct Illegal Rent Deposits and Forms guide.

3. The Three Golden Rules of a Legal Increase

For an increase to be legally binding in 2026, it must meet three criteria. If any of these are missing, the increase is void, and you do not have to pay it.

- Rule 1: The 90-Day Notice. You must receive written notice at least 90 days before the increase takes effect. If you receive it on January 1st, the increase cannot start until April 1st.

- Rule 2: The 12-Month Rule. Your rent can only be increased once every 12 months. This applies regardless of whether you have signed a new lease or have moved to a month-to-month agreement.

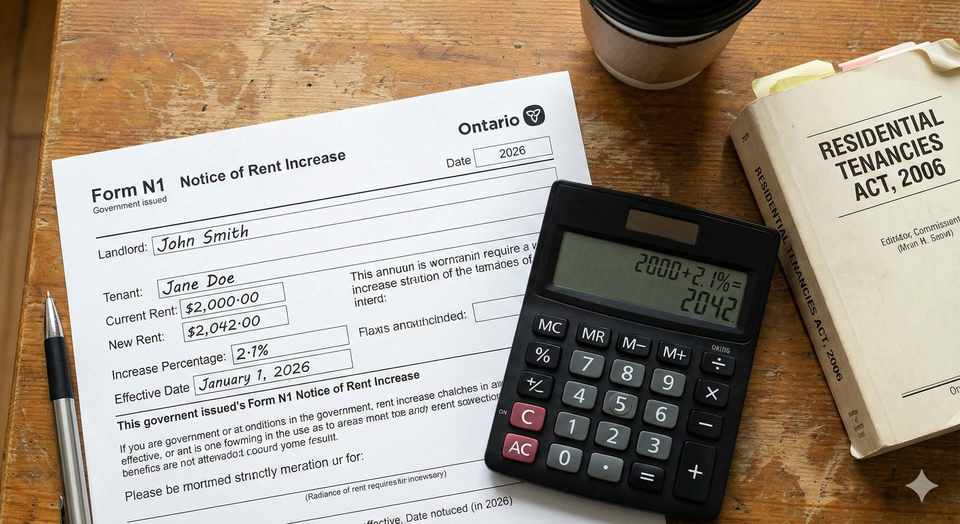

- Rule 3: The Correct Form. Landlords must use the official LTB forms. For rent-controlled units, this is the N1 Form. For exempt units, it is the N2 Form. A text message or a handwritten note is not a legal notice.

Part 1: How to Calculate Your 2026 Increase

To ensure your landlord isn't "rounding up" (which is illegal), use the following math for the 2026 cycle.

| Current Monthly Rent | Max 2.1% Increase | New 2026 Rent |

| $1,200 | $25.20 | $1,225.20 |

| **$1,500** | $31.50 | $1,531.50 |

| **$1,800** | $37.80 | $1,837.80 |

| **$2,200** | $46.20 | $2,246.20 |

| **$2,500** | $52.50 | $2,552.50 |

The "Penny Rule": A landlord cannot round up even a single cent. If the math comes to $1,531.50, and they ask for $1,532, the notice may be considered invalid. Ensure you align your budget with your Benefit Payment Dates to account for these shifts.

Part 2: Above Guideline Increases (AGI)

In some cases, a landlord can apply to the LTB for an Above Guideline Increase. This is common in older buildings where major work has been done. In 2026, an AGI is usually limited to 3% above the guideline per year, for a maximum of three years.

Landlords can only get an AGI for three reasons:

- Major Capital Repairs: For example, replacing the roof, the elevators, or the windows.

- Significant Tax Increases: If the municipal property taxes for the building rose by more than 1.5 times the guideline.

- Security Services: If the landlord added a new security guard or high-tech security system to the complex.

The Tenant Defense: You do not have to pay the "Above Guideline" portion until the LTB officially approves it. However, if they approve it later, you will owe the back-pay. Most tenants choose to set the extra 3% aside in a separate account while waiting for the hearing.

1. The "Notice of Rent Increase" Form Trap

The most common mistake landlords make in 2026 is using a text message or an email without the official LTB form attached.

- The Law: Under the RTA, a rent increase notice must be on the prescribed form (N1 or N2).

- The Defense: If your landlord sends a text saying "Rent is up $50 next month," you do not need to argue. You can simply continue paying your old rent. If they take you to the LTB for "unpaid rent," the Board will likely dismiss the case because the increase was never legal.

2. Spotting the N1 vs. N2 Error

This is a high-traffic "Street Secret" for 2026: Landlords of exempt units (post-2018) often use the N1 Form by mistake because it’s the most common one.

- The Difference: The N1 form is only for guideline-protected units. The N2 Form is for exempt units.

- The Hack: If you live in a new condo (built in 2022) and your landlord gives you an N1 Form for a 10% increase, the notice is invalid. Why? Because the N1 form explicitly states the increase cannot exceed the guideline unless approved by the Board. By using the wrong form, they have technically issued an unenforceable notice.

3. The "Vacancy Decontrol" Reset

If you are moving into a new place in 2026, the 2.1% guideline does not exist for you yet.

- The Rule: In Ontario, we have "Vacancy Decontrol." This means a landlord can set the starting rent to whatever they want.

- The Strategy: Use our guide on the 10 Cheapest Cities to Live in Ontario 2026 to find a lower starting point. Once you sign that lease and move in, the 12-month rule and the 2.1% cap (if applicable) "lock in" and protect you moving forward.

4. Illegal Retaliatory Increases

If you ask for a repair (like fixing a leaking sink) and the landlord immediately responds with a rent increase notice, this may be considered a "retaliatory increase."

- The Defense: You can challenge this at the LTB. The Board has the power to void an increase if they believe it was issued because the tenant attempted to enforce their legal rights. This is a crucial strategy when fighting "Renovictions" and N13 Notices.

Ontario Rent Increase 2026

The official Ontario rent increase guideline for 2026 is 2.1%. This cap applies to most residential rental units first occupied for residential use on or before November 15, 2018. Landlords must provide at least 90 days' written notice using the official N1 Form and can only increase rent once every 12 months. Units first occupied after November 15, 2018, are exempt from this cap and can be increased by any amount with an N2 Form.

Frequently Asked Questions (FAQ)

Q: Can my landlord raise the rent if I am in a fixed-term lease?

A: Yes, but only once 12 months have passed. If your one-year lease started in June 2025, they can raise it in June 2026, even if you sign another year-long lease.

Q: My landlord says the 2.1% doesn't cover their mortgage interest. Can they raise it more?

A: No. Higher mortgage interest is not a legal reason for an Above Guideline Increase (AGI). They are stuck with the 2.1% cap unless they did major capital work or had a massive property tax hike.

Q: What if I already paid an illegal increase?

A: You have one year to file a T1 Application with the LTB to get that money back. After 12 months, the illegal rent technically becomes the "new legal rent" by default, so act fast.

Q: Does the 2.1% apply to my parking spot?

A: Yes. If your parking or utilities are part of your lease, the 2.1% increase applies to the total amount you pay each month.

About the Author

Jeff Calixte (MC Yow-Z) is a Canadian labour market researcher and digital entrepreneur specializing in government benefit data and cost-of-living support. As the founder of CanadaPaymentDates.ca and BetterPayJobs.ca, Jeff helps newcomers, students, and workers navigate the Canadian social safety net—from tracking CRA payment schedules to finding entry-level work.

Sources

- Ontario Newsroom: Ontario Capping Rent Increases at the Rate of Inflation for 2026

- Landlord and Tenant Board: 2026 Rent Increase Guideline and Procedures

- Residential Tenancies Act, 2006: Section 120 - Rent Increase Guideline

Note

Official 2026 payment dates and benefit amounts are determined by the Canada Revenue Agency (CRA) and provincial governments. While we strive to keep this information current, government policies and schedules are subject to change without notice. All data in this guide is verified against official CRA circulars at the time of publication and should be treated as an estimate. We recommend confirming the status of your personal file directly via CRA My Account or by calling the CRA benefit line at 1-800-387-1193.